Bank for Central Banks Floats Ways to Contain Crypto, Including Ban

BIS economists reckon crypto isn’t quite big enough to threaten global financial stability, but one day it might

BIS general manager Agustin Carstens | Source: IMF modified by Blockworks (CC BY-NC-ND 2.0)

After a series of blowups in the crypto industry, the Bank of International Settlements is exploring de-risking policies for central banks, with a ban on crypto activity one potential option.

Economists Matteo Aquilina, Jon Frost and Andreas Schrimpf disparagingly wrote in a Thursday bulletin that despite inefficiencies recently seen in the space, crypto proponents still believe decentralization and blockchains are solutions rather than problems.

“Recent developments underscore that the decentralization in crypto and DeFi markets is illusory,” they said, reiterating the bank’s stance from last year.

“The vision of crypto proponents is to do away with financial intermediaries, yet to function and achieve a meaningful scale, crypto markets rely heavily on centralized entities for several reasons.”

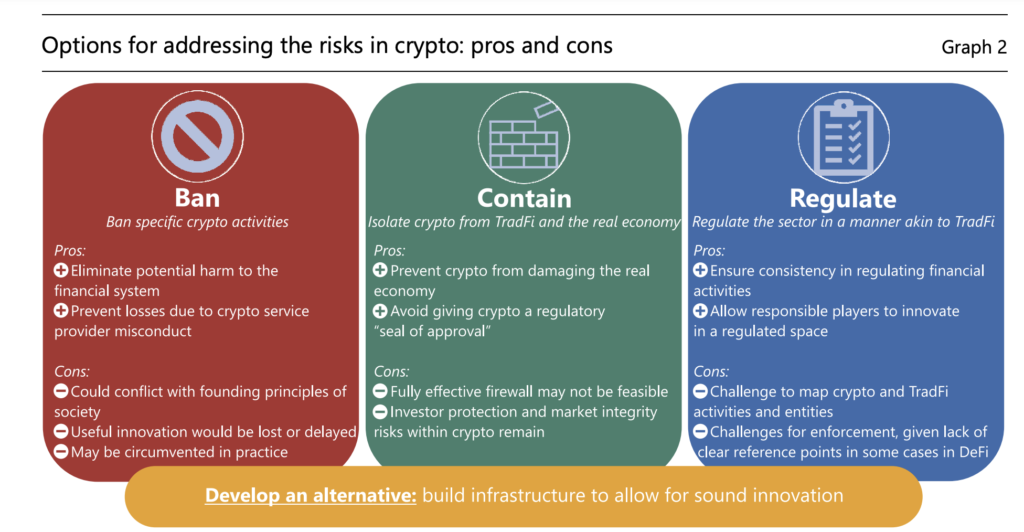

The economists pitched three potential options to tackle crypto risk in the wild. “A crucial element to be considered when selecting which options to pursue is the ability to enforce any rule that is introduced, including ensuring that the resources needed to do so are on hand,” the report states.

Ban specific crypto activities

This is the “extreme option,” per the authors, involving either an entire ban or a targeted one that eliminates potential harm to the financial system. This would mean investors wouldn’t be exposed to the misconduct of crypto service providers, the economists said.

They admitted that implementing a ban would be difficult in terms of enforcement. Decentralized crypto activities are borderless, so the ban would work better if focused on centralized intermediaries (an apparent reference to exchanges or payment providers).

“But the activity could move to jurisdictions that do not impose the ban and investors may find ways to evade it,” BIS researchers wrote. “The main downside is that any useful innovation from crypto would be lost or delayed.”

Isolate crypto from TradFi and the real economy

This course of action would see crypto become more of a niche activity — a good thing as it wouldn’t be interconnected with TradFi (traditional finance), according to the economists.

How would that work?

“By limiting the flow of funds into and out of it and by limiting other connections with TradFi.” The authors then acknowledged this firewall-like approach wouldn’t be effective, again due to the borderless world of crypto.

Regulate the sector just like TradFi

The third option would seek to fit digital assets into existing regulations at all costs.

Authorities would be encouraged to map activities in the crypto industry to their counterparts in TradFi, then apply variants of existing regulations for those sectors to regulate crypto.

“This approach would ensure consistency in regulating financial activities — whether performed by crypto players or TradFi — and help to promote the policy goals at the core of existing regulatory frameworks,” the report states.

At least BIS admits a ban on crypto “could conflict with founding principles of society”

At least BIS admits a ban on crypto “could conflict with founding principles of society”

The authors reasoned that the crypto sector hasn’t yet “grown large enough or sufficiently interconnected with TradFi to threaten financial stability,” but all that could purportedly change if retail or institutional interest in the sector doesn’t stop growing.

“Interconnections with the real economy and TradFi could also increase should crypto become less self-referential, in particular if asset tokenisation makes inroads. Discussions on the appropriate policy response to crypto are therefore timely,” they said.

Analysis by David Canellis

We’ve already seen some of the latter approach: the SEC forcing digital assets through the 77-year-old Howey Test to determine securities status, and the FATF’s strict (and controversial) recommendations on a “travel rule” for crypto.

The authors do suggest a potential fourth alternative: increase quality and reduce costs of payments through “sound innovation in TradFi,” harnessing crypto transformation and applying it to existing financial rails.

As for the sweeping ban: totally outlandish, bordering on trolling. Not to mention, practically unrealistic due to the decentralized resiliency of blockchains such as Bitcoin and Ethereum (which the authors do appear to realize).

The BIS’ crypto stance shouldn’t surprise, considering it serves as a bank for central banks. This positions it as a natural-borne antagonist for crypto-cypherpunks.

After all, Bitcoin was born sporting a middle finger to all things central bank. The BIS is simply blowing raspberries right back.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.