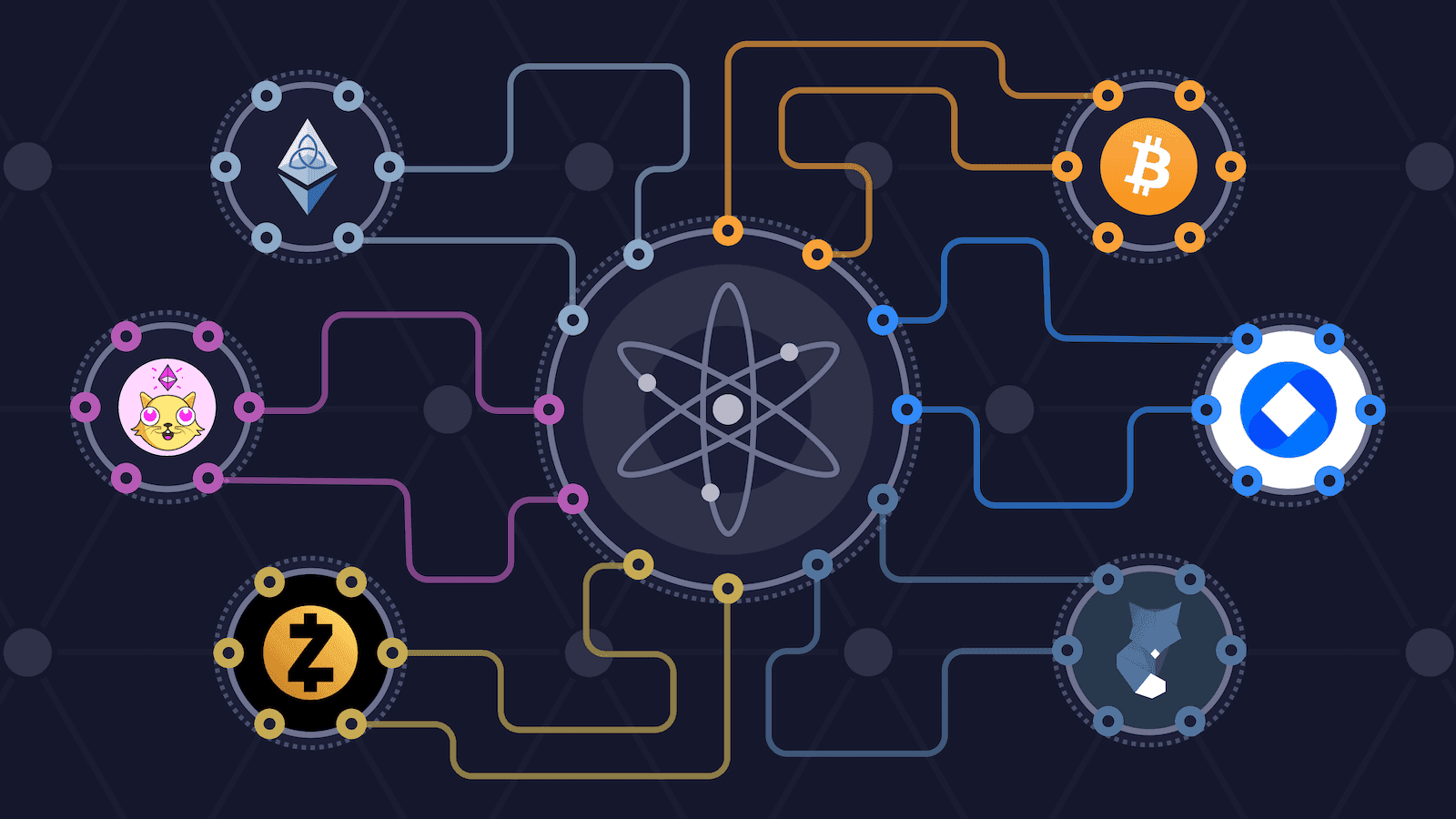

Cosmos HUB and the Future of Shared Security

The Cosmos Hub allows developers to not only create and connect their own blockchains but also rent the security they need for building bigger and better applications

Source: Cosmos

- The launch of the Inter-Blockchain Communication protocol (IBC) in early 2021 shifted attention to implementing shared security, which began testing in the fourth quarter of 2021

- This allows newer, smaller blockchains to “rent” security from more established networks

Proof-of-stake (PoS) networks are secured by validators who stake tokens on the network to validate transactions and produce blocks. The overall security of a PoS network, then, will roughly be in proportion to the total market cap of the token, because the more tokens being staked, the higher the cost of attacking the network.

The market cap of a PoS network is somewhat analogous to the hash rate in a proof-of-work (PoW) network. The higher the hash rate, the more difficulty an attacker would have in trying to take over the network by controlling the majority of its mining power. Similarly, the higher the market cap of tokens on a proof-of-stake network, the more resources it would take for an attacker to control enough tokens for a successful attack.

Ways to attack a PoS network

While a 51% attack requires controlling 51% of the hash rate of a proof-of-work network, proof-of-stake networks can be attacked even if a bad actor controls less than a majority of the network’s resources.

“If you control one-third of a network, you can do censorship attacks, meaning you can prevent certain transactions from being executed… if I control two-thirds of the network, I can control governance and pass a proposal for a malicious upgrade or drain the community pool with a spend proposal. There are various ways that can be leveraged for nefarious means,” says Billy Rennekamp, Cosmos Hub Lead at the Interchain Foundation and member of the Board of Management.

This makes shared security even more important. Part of what makes PoS networks difficult to attack is the cost of acquiring all those tokens. To buy one-third of the Cosmos’ ATOM token would cost about $2.3 billion, let alone the price impact it would have if suddenly someone started buying up that many tokens.

But if your network is just starting out and only has $1 million or $10 million in market cap, a lone whale wouldn’t have much trouble conducting an attack. And it’s not always feasible to wait for wider adoption of a token before building decentralized applications that could necessitate large transactions on a regular basis. That’s where shared security comes in.

ShareInterchain security: Cosmos’ take on Shared Security

What does shared security look like in Cosmos?

“The Cosmos network, Interchain Foundation, Tendermint Inc, the different contributors for the last 4 to 7 years — depending on how you see the start of the project — have always been working on the most valuable use of our time,” says Rennekamp. “So again with PoS, it began just building Tendermint. Then it moved to the Cosmos SDK, making it easy to build application-specific blockchains, and then it shifted to IBC, making it possible to connect these blockchains.”

After the successful launch of the Inter-Blockchain Communication protocol (IBC) in early 2021, attention has shifted to the implementation of interchain security which began testing in the fourth quarter of 2021.

“Interchain security is the ability to use one staking token across multiple networks to secure those networks,” says Rennekamp.

This allows newer, smaller blockchains to “rent” security from more established networks. The ability to do this can be helpful when expecting large transactions to occur on a PoS blockchain that doesn’t have much market cap behind it.

For example, if someone wants to send $20 million of tokens through a blockchain secured by just $10 million in value of tokens staked, then the operators of that chain “would be incentivized to steal the tokens if they’re being logical game-theory participants,” explains Joe Dirtay of Cosmos.

ATOM, which CoinGecko tracks as the 18th largest cryptocurrency with a market cap of around $11.5 billion, is in a good position to provide this kind of security to other networks. “Building a highly secure network means getting a high-value token, in the most straightforward way, although the problem is actually much more nuanced than that,” says Rennekamp.

Thanks to the Cosmos Hub, developers can not only create and connect their own blockchains but also rent the security they need for building bigger and better applications.

This content is sponsored by Cosmos. To read more Cosmos content, check out How the Interchain Sustainability Mission Plans to Change the World with IBC.