New crypto ETFs could come to market by Halloween

The SEC’s approval of the generic listing standards opens the door for Litecoin and Solana ETPs

Bloomberg Intelligence analyst James Seyffart | Permissionless IV by Ben Solomon for Blockworks

A new slew of crypto ETFs could be just around the corner.

“I could be wrong, but my guess is you can talk to your family about multiple crypto ETPs at Thanksgiving. Maybe at Halloween. I don’t think you’re gonna have to wait till Christmas,” Bitwise Chief Investment Officer Matt Hougan told Blockworks.

Bloomberg Intelligence research analyst James Seyffart said he expects that “dozens of products” will be launched “probably within the next month or two,” and definitely by the end of the year.

However, the approval process could take longer if there’s a government shutdown, as Hougan noted that “things won’t be approved if the government shuts down.”

In September, when the Securities and Exchange Commission approved the generic listing standards, it became clear that it was merely a matter of time before more crypto ETPs hit the market, and, at this point, “everything is moving extremely fast,” Seyffart said.

Read more: Crypto ETF swell approaching after Grayscale’s latest launch

The move, while expected, showed that the SEC had fully entered a new era of crypto regulation. One where it would go back to its roots — as Seyffart put it — as a disclosure regulator. While both the ETH and bitcoin ETFs were launched under previous SEC Commissioner Gary Gensler’s tenure, both approvals took years of close scrutiny to get across the finish line.

That won’t be the case for potential ETPs such as Solana, which saw its first filing just last year.

The proposed crypto products will give both crypto natives and folks who are interested in crypto exposure to new assets.

“I think we’re going to get Litecoin launched, get Solana launched. We’re gonna get some of these other coins launched, including XRP down the line,” Seyffart added.

Read more: Here are the 8 firms vying to list Solana ETFs

“ETF issuers will launch everything they can,” Hougan told Blockworks, noting that he wasn’t talking about Bitwise specifically.

And while there may be an abundance of crypto ETPs potentially launching in the US, Seyffart doesn’t seem too worried.

“Honestly, the market will decide what has value. If there’s trading volume…AUM that are attracting these products, they’re going to stick around for the foreseeable future. It’s up to nobody else, but where the money goes really.”

The assumption, though, is that the new listing standards from the SEC cover 12 assets, including SOL and XRP.

Assessing appetite

While issuers will continue to launch single-asset ETPs, Hougan said he’ll be carefully watching for a “large number of index and theme ETPs.”

He expects that there’ll be more appetite for the exchange-traded products that offer a broader exposure to crypto instead of just, say, a bitcoin ETF.

“As the average buyer of a crypto ETP moves from someone who’s more crypto native to the general population, which I think is like a multi-year transition, but it’s happening, right? It’s moving from crypto Twitter to my uncle. The tendency is going to be to want to get thematic exposure and not individual asset exposure,” Hougan added, likening it to Invesco’s QQQ ETF.

He thinks that single-asset versus index-based ETFs is a bit like a horse race where the single-asset ETPs will look strong out of the gate, but index-based ETPs will finish in first in the end.

Seyffart echoed Hougan, noting that he’s “most bullish on these index-type products. I think they’re going to get the most interest, but you’re going to see a lot of interest in, namely, Solana and XRP ETFs, based on what we’ve seen in the ETF market elsewhere.”

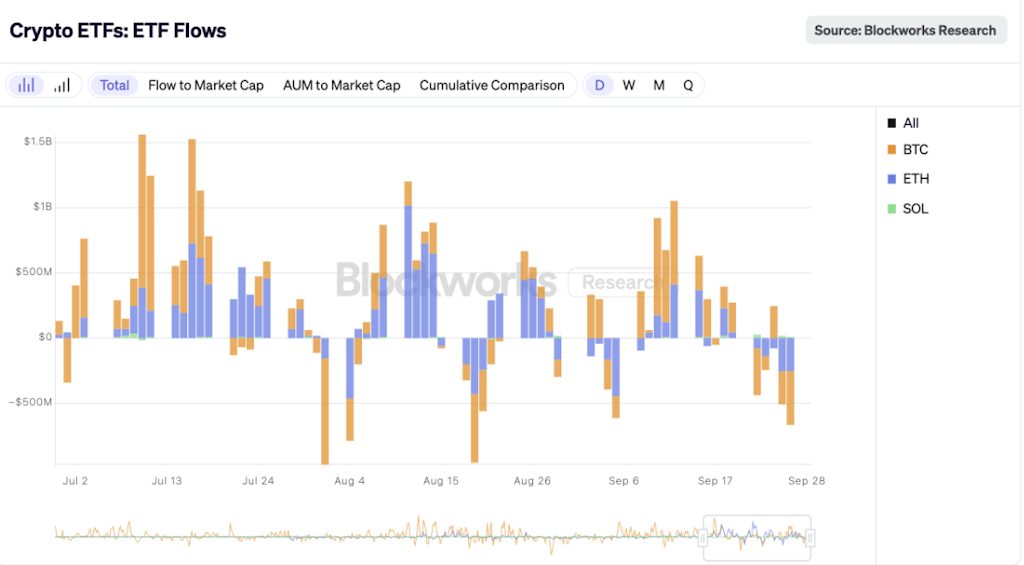

Source: Blockworks Research

Source: Blockworks Research

A lot at stake

The SOL ETFs are “most likely” going to launch with staking, Seyffart said, though nothing’s guaranteed until the products are officially approved for launch.

“It’s been a long time coming,” Hougan noted. “Most people will want staked exposure the same way most people want dividends.”

The inclusion of staking is something that’s been on the table for a while, with the SEC asking potential issuers to update language around staking specifically in the SOL ETF filings back in July, Blockworks previously reported.

“We’ve had [staking in ETPs] in Europe for a while, and European investors have benefited from it. It’d be nice for US investors to have benefited from it too, particularly as we go from ETH, where the staking yield is a few percent, to things like Solana, where you’re talking about like 7%, right?” Hougan said.

“No one cared about their savings account rate when we were in the zero-interest mode, but once savings accounts were paying 5%, people really cared. I think there’s an element here too, where, like ETH, yeah, nice. Solana, boy, I’m not leaving [almost] 7% on the table. That’s crazy.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.