DCG Silent as Winklevoss Demands Commitment From CEO Silbert

Now that Genesis is considering bankruptcy, hopes of returning $900 million to lending partner Gemini are shrinking

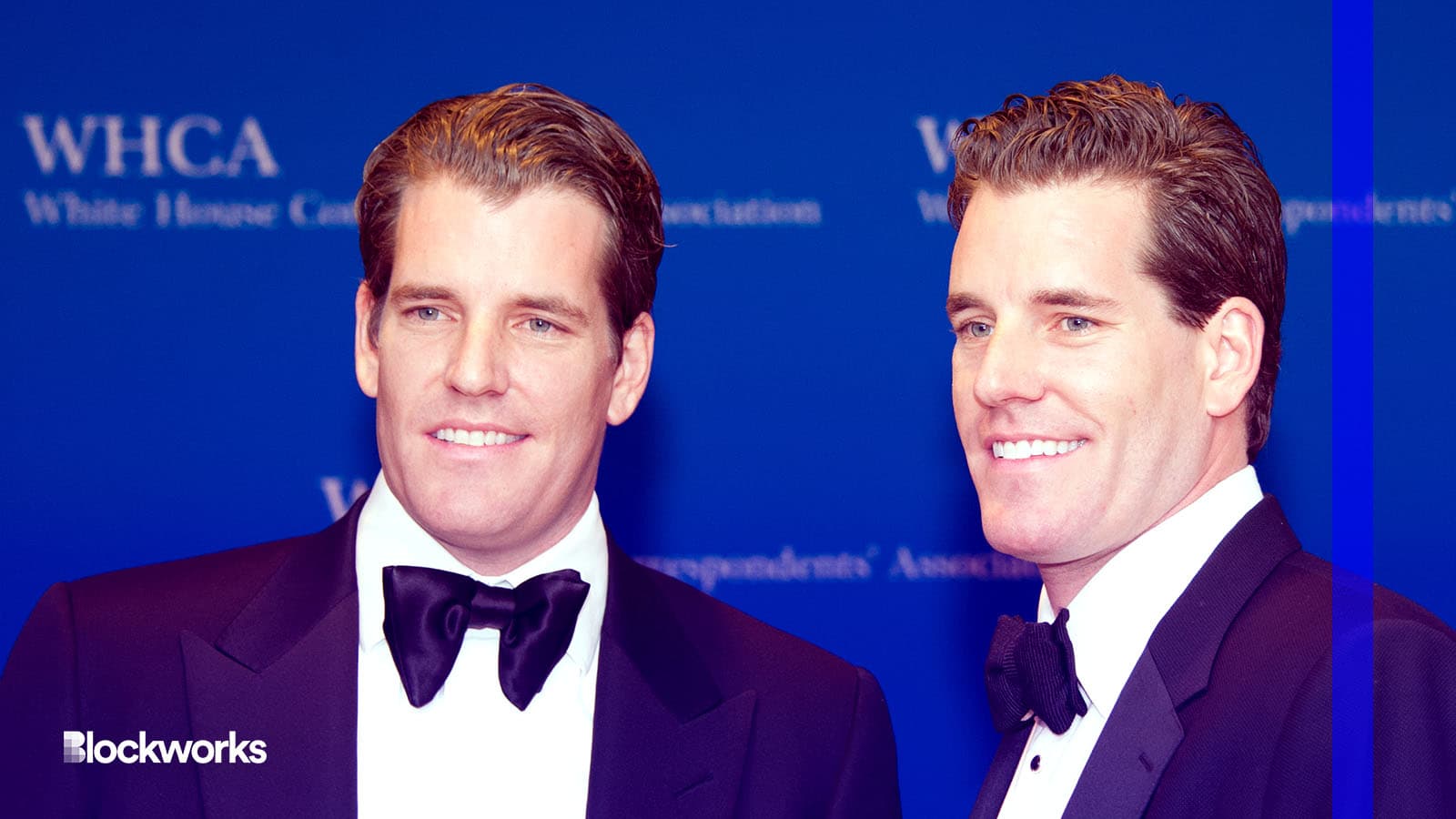

Rena Schild/Shutterstock.com modified by Blockworks

More than 340,000 users of Gemini’s crypto lending program Earn have been kept away from their funds ever since Genesis suspended redemptions and new loans in November.

The situation boiled over onto Twitter earlier this week, with Gemini co-founder Cameron Winklevoss pointing the finger at Barry Silbert, CEO at Genesis parent Digital Currency Group (DCG).

Genesis handled backend business for Gemini Earn, with as much as 8% interest offered under their partnership.

But trouble surfaced once Genesis faced a rush of withdrawals from its lending arm after FTX’s implosion. Gemini’s customers have now been unable to redeem more than $900 million for nearly two months.

“Every time we ask you [Silbert] for a tangible engagement, you hide behind lawyers, investment bankers, and process. After six weeks, your behavior is not only completely unacceptable, it is unconscionable,” Winklevoss said in an open letter posted to Twitter on Monday.

Silbert founded DCG in 2015 and quickly grew to be a major player in the crypto space. It has made hundreds of investments over the past few years, but it’s mostly known for its five main pillars: mining firm Foundry, asset manager Grayscale, crypto lender Genesis, trading platform Luno and media outlet CoinDesk.

Trouble at Genesis — and by extension DCG — looms over the crypto space coming off a terrible 2022. Winklevoss said DCG owes Genesis some $1.675 billion in total, which is the money Genesis needs to fulfill Gemini’s Earn product “and other creditors.”

Rather than meet Winklevoss’ call directly, Silbert denied the purported loan from Genesis to DCG and fired back, claiming Gemini is the one dragging its feet towards a potential deal.

“DCG has never missed an interest payment to Genesis and is current on all loans outstanding; next loan maturity is May 2023,” Silbert tweeted. “DCG delivered to Genesis and your advisors a proposal on December 29th and has not received any response.”

Silbert wrote in a November letter to investors that DCG owes Genesis around $575 million due in May 2023, on top of a $1.1 billion promissory note due in June 2032, the Wall Street Journal reported.

Just crypto things: cascading bankruptcies

“The rift between Gemini and DCG has caused investors to remain fearful in the short term,” Marcus Sotiriou, market analyst at GlobalBlock, told Blockworks.

Earn users also might have seen a Wednesday Bloomberg report that Gemini Chief Operating Officer Noah Perlman had left the firm this month amid the turbulence, having worked there since 2019.

The next day, Genesis slashed nearly 30% of its staff and is reportedly weighing bankruptcy, flagging further potential disruption. DCG is also closing down its wealth management arm.

Genesis’ interim CEO, Derar Islim, in a blog post said the firm is “committed to moving as quickly as possible, this is a very complex process that will take some additional time.”

The post wasn’t exactly what Winklevoss had in mind — a public declaration of moving forward for the betterment of Earn users. Winklevoss’ “final” deadline of Jan. 8 marks the last date Gemini expects Silbert to openly commit to finding a resolution.

Winklevoss may again air his grievances with Silbert on Twitter if that doesn’t happen before Monday. Blockworks reached out to DCG to see if Silbert plans on doing so, but the firm declined to comment beyond what its CEO had tweeted.

But in any case, the matter may well be settled behind closed doors — or in bankruptcy court. The firm hired venerable investment bank and restructuring advisor Moelis & Co. to chart a way out of its troubles days after it paused withdrawals in November, with potential bankruptcy already on the table.

Last month, Genesis was reportedly seeking an emergency loan of $1 billion before itself halted withdrawals — not just to Earn — and approached Binance and Apollo Global to raise capital.

“If Genesis goes into bankruptcy, this means DCG assets will have to be liquidated due to Genesis’ callable loans, resulting in DCG bankruptcy,” Sotiriou said. “Therefore, Grayscale Trust assets would be at risk of being sold, but if [Chapter 11] is invoked the sale of Grayscale assets will be stopped until the court process plays out.”

Crypto participants will be waiting to see what eventually plays out on Jan. 8 — but should strap themselves in for the long haul, just to be safe.

David Canellis contributed reporting.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.