Barry Silbert

DCG and Silbert said the suit was an attempt to find a “headline-worthy scapegoat”

The “root lesson to be learned,” Ahluwalia says, is “not to borrow from Genesis to go levered long on your own product”

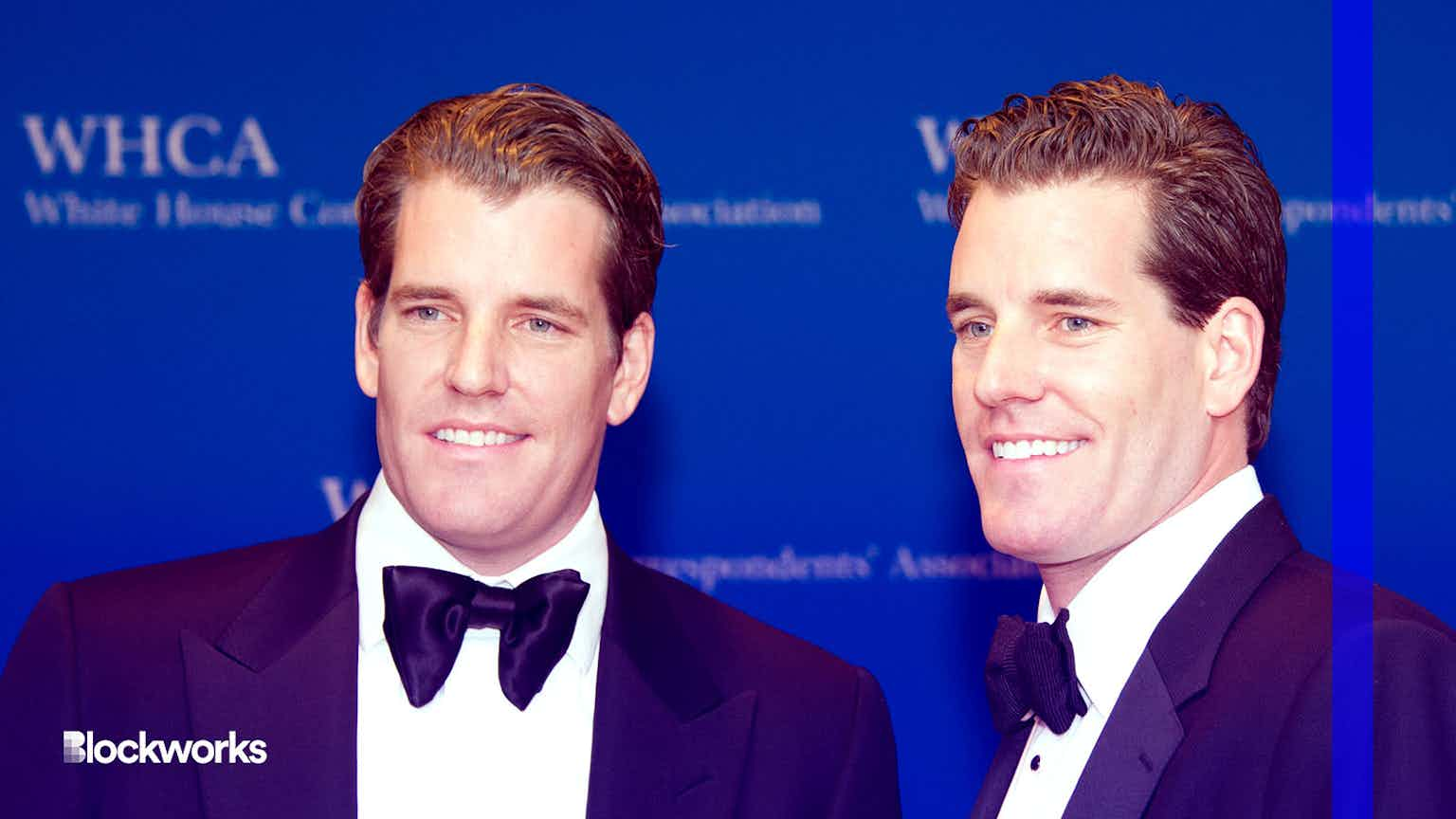

In its lawsuit, Gemini cited a number of other prolonged measures it took before resorting to legal action against DCG

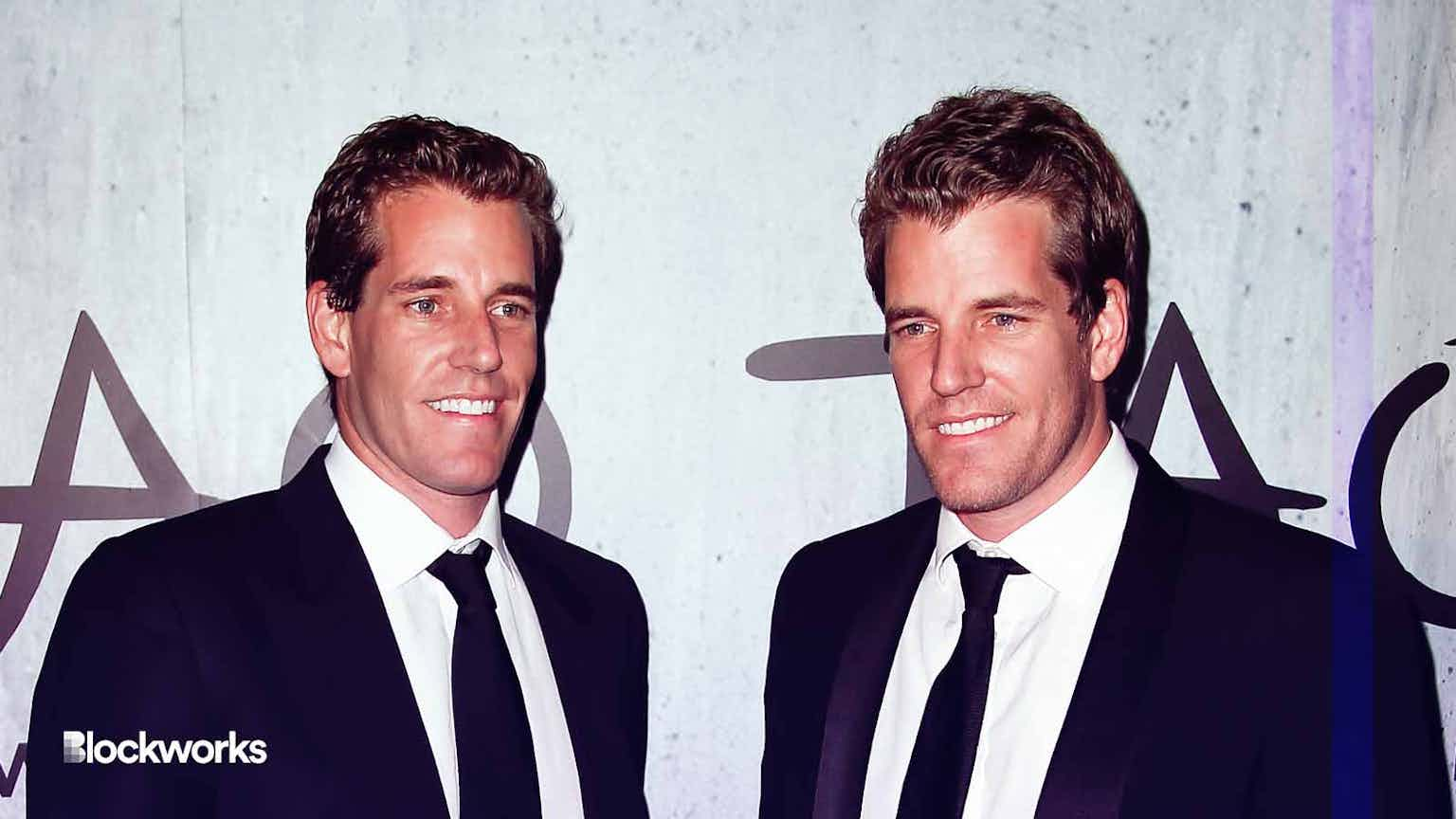

Gemini co-founder Cameron Winklevoss wants DCG to pay up in US dollars, bitcoin and ether — or else face a lawsuit

Genesis, Gemini and other stakeholders are weighing whether to allow DCG more time to stave off a potential default

Luno has asked Singapore-based users to withdraw their crypto and fiat currencies from the platform before June 19

Alameda claims Grayscale’s fee structure and lack of redemption options has lowered the value of Alameda’s shares by 90%

Genesis could be up for sale under a new restructuring agreement with creditors

Cameron Wiklevoss threatens to sue Barry Silbert, DCG and others, following Genesis bankruptcy

The crypto lender reportedly warned investors about filing for bankruptcy if it couldn’t line up sufficient financing

Several sources have told Blockworks DCG’s head, Barry Silbert, isn’t telling the full story relating to his company’s relationship with crypto lender Genesis

The cryptocurrency industry has a “lot of hard work to do” on the heels of a brutal 2022, Silbert said Tuesday in a letter to DCG shareholders

Now that Genesis is considering bankruptcy, hopes of returning $900 million to lending partner Gemini are shrinking

Cameron Winklevoss has given Barry Silbert until Jan. 8th to commit to publicly working together

This new debt capital raise comes shortly after DCG raised $700 million in the beginning of November, at a $10 billion valuation.

Along with the milestone for Grayscale funds AUM, the firm passes SPDR Gold Shares (GLD), the world’s largest gold ETF.

The parent company of Grayscale has raised a massive round from heavy-hitters like SoftBank Group and Alphabet Inc’s independent growth fund CapitalG.