Emmer reintroduces anti-CBDC bill alongside 49 Republicans

The law would block the Fed from issuing a retail CBDC and seeks to protect consumer privacy, Emmer said

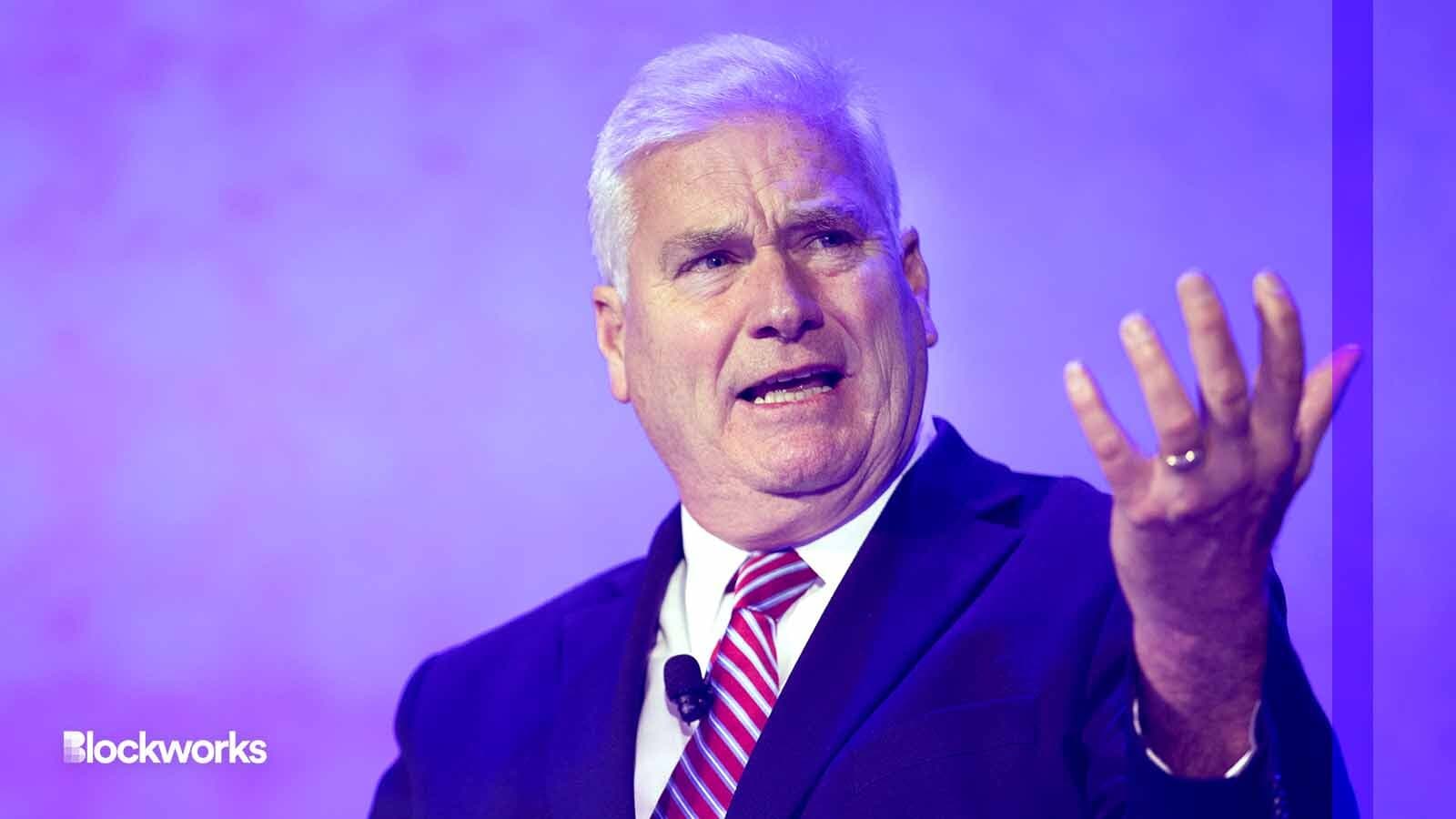

US Rep. Tom Emmer | Permissionless II by Blockworks

Tom Emmer, the House majority whip from Minnesota, on Tuesday announced the reintroduction of his anti-CBDC bill, joined by 49 fellow Republicans.

The Central Bank Digital Currency Anti-Surveillance State Act aims to block the Federal Reserve from directly offering a CBDC to individuals and using it to implement monetary policy.

Emmer first brought the bill to the House floor in February.

“Any digital version of the dollar must uphold our American values of privacy, individual sovereignty and free market competitiveness,” Emmer said in a statement at the time. “Anything less opens the door to the development of a dangerous surveillance tool.”

The legislation targets the potential for CBDCs to impact Americans’ privacy and rights, Emmer added.

“This bill puts a check on unelected bureaucrats and ensures the US digital currency policy upholds our American values of privacy, individual sovereignty, and free-market competitiveness,” Emmer wrote on X, formerly Twitter, Tuesday.

The bill comes as congressional leaders continue to spar with each other and federal agencies over how to regulate the crypto industry.

Five crypto-related bills in the House are slated to go to a full-floor vote after passing through Committee markups this session. The Financial Innovation and Technology (FIT) for the 21st Century Act, co-sponsored by French Hill, R-Ark., Glenn Thompson , R-Penn., and Dusty Johnson, R-S.D., and the Clarity for Payment Stablecoins Act, introduced by Patrick McHenry, R-N.C., received fairly promising bipartisan support during their markup stages.

SEC Chair Gary Gensler appeared before senators Tuesday morning to discuss how the agency enforces its rules. In his opening remarks, Gensler maintained that the agency is acting in investors’ best interest by taking an aggressive stance against crypto firms he says are not following appropriate and long-established securities laws.

“Given this industry’s wide-ranging noncompliance with the securities laws, it’s not surprising that we’ve seen many problems in these markets,” Gensler said during the hearing. “Thus, we have brought a number of enforcement actions — some settled, and some in litigation — to hold wrongdoers accountable and promote investor protection.”

Gensler is scheduled to testify before the House Financial Services Committee on Sept. 27.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.