Cracking Ethereum’s networking bottleneck

Optimum’s faster relay, tested by Everstake, could boost validator rewards today and help Ethereum move toward 6-second slots tomorrow

Soponpotsit/Shutterstock and Adobe modified by Blockworks

Optimum’s new propagation layer promises to reshape Ethereum’s validator economics, starting with better performance and higher staking yield, but pointing toward future protocol upgrades like shorter slot times.

Powered by Random Linear Network Coding (RLNC), the system — called mumP2P — is already showing major gains on Ethereum’s Hoodi testnet. Early tests by validator giant Everstake confirm a 5–6x speedup over today’s standard Gossipsub relay.

Running mumP2P, “right now an average block propagation time is like 150 milliseconds,” Everstake COO Bohdan “Bo” Opryshko told Blockworks. For large validator sets, Opryshko emphasized, those speed gains aren’t cosmetic:

“If somebody can transfer data faster, if you can sign block faster…you can mitigate the risk around missing blocks. That means less missing block, more rewards for users, and more rewards for [validators],” Opryshko said.

Boosted yields compound at scale. “It could be small [1 bip], for example,” he said, but on large amounts of ether staked, it nevertheless can be a substantial nominal sum.

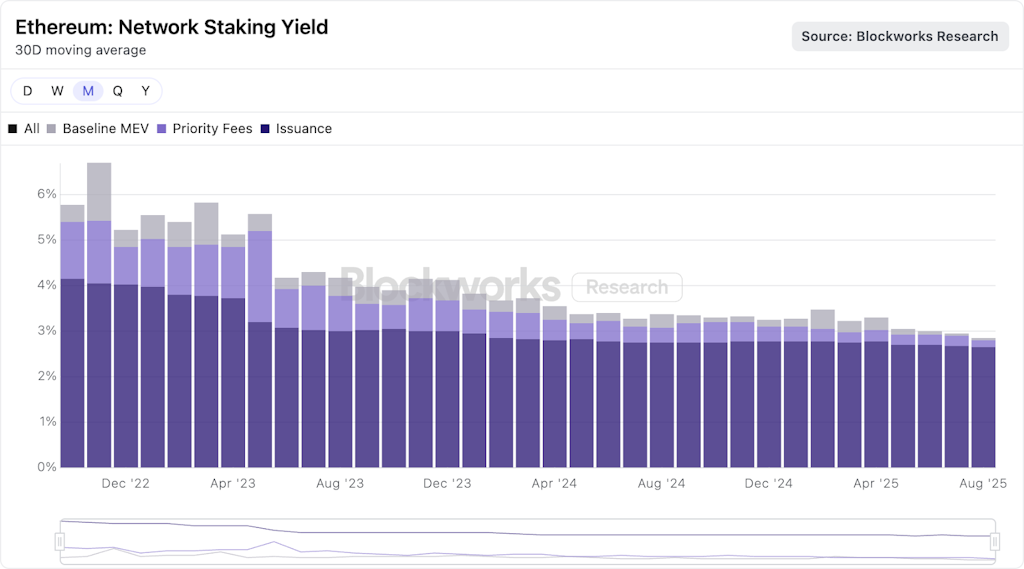

Ethereum’s staking yields have seen steady compression since The Merge, Blockworks Research data shows.

Source: Blockworks Research

Source: Blockworks Research

Optimum co-founder Muriel Médard, the MIT professor behind RLNC, is enthusiastic about improving Ethereum’s current networking stack. “[Gossipsub] has a lot of redundancy [but] it’s very, very bandwidth hungry, and it really slows down under stress,” Médard told Blockworks.

Optimum’s solution aims to replace it with a smarter relay that looks like Gossipsub on the outside, but codes data under the hood to streamline transmission. Médard explained that unlike traditional peer-to-peer relays, which resend the same data repeatedly, mumP2P uses coded packets — mathematical equations that are almost always new — allowing nodes to transmit information more efficiently and with less duplication.

Importantly, Everstake’s Opryshko said his team hasn’t encountered any meaningful overhead costs from running mumP2P. “It’s not significant compared with the normal setup.”

Everstake is rolling out in stages on testnet, then moving on to mainnet. Opryshko suggested that once one client team proves mumP2P delivers better results, others will likely follow to stay competitive: “If one shows it works well, others will want the same.”

This isn’t just an incremental gain for validators. Ethereum leaders have their sights on shorter slot times. In May, EF co-executive director Tomasz K. Stańczak posted about the network’s technical roadmap: “Where are the shorter slot times? 6 seconds to start with and how we plan for 1s?”

An ETH Research report earlier this month suggests median/95th-percentile block relay may already fit a 6-second slot budget; the problem is outlier validators and attestation timing. With Optimum, Ethereum gains the headroom to shrink slot times without starving Ethereum’s fork choice rules of timely data.

Médard puts the point in roadway traffic terms: When there are lots of cars on the road, Gossip gets stuck in a traffic jam, while coded propagation doesn’t, so its delay stays low rather than skyrocket under stress.

The end users would feel the difference as faster transaction confirmations and fewer gas spikes, like the one Ethereum suffered on Sept. 1.

Opryshko expects the earliest benefits will accrue to larger validators managing thousands of keys, and their staking clients. But it won’t just be big shops that notice: The latency-obsessed solo crowd — operators who “fight in the milliseconds” — stands to cut missed attestations and occasionally win more when their turn to propose arrives, he said.

Everstake estimates moving the technology to mainnet within three months. If the 6x gains hold across various real-world conditions, and the validator economics start to shift, better propagation becomes table stakes rather than a nice-to-have— and Ethereum’s roadmap gains the slack it needs to seriously size up 6-second slots.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.