FTX Run by ‘Inexperienced, Unsophisticated’ Traders, Court Hears

Spurned FTX users are settling in for a lengthy bankruptcy case, with the first court hearing just kicking off

Blockworks Exclusive art by axel rangel

Lawyers managing the FTX bankruptcy likened the firm to a “personal fiefdom” of former CEO Sam Bankman-Fried in Delaware court on Tuesday.

In the first hearing of what’s set to be a sprawling case, lawyers James Bromley and Sullivan Cromwell ultimately described FTX — previously one of the world’s largest global crypto exchanges by trade volume — as a “different sort of animal.”

They told the court that a “substantial amount of assets” held by FTX have either been stolen or are otherwise missing. FTX in total has a cash balance of $1.24 billion, and its restructuring experts are now working with financial investigators to locate the remaining assets.

A court document from Saturday shows FTX owes $3.1 billion to its 50 largest creditors, and the biggest creditor alone is out-of-pocket for $226.2 million. Each claimant is listed as a customer, not as a company insider. Ten have claims of more than $100 million each.

Bankman-Fried has reportedly sought up to $8 billion to cover the company’s shortfall.

“We realize that there are many people that are looking to get their money back immediately. And we sympathize with that… and we are working towards being able to do that,” Bromley said.

After initial disagreement, Bahamas-appointed lawyers for FTX Digital Markets agreed to move their chapter 11 to Delaware, bringing all FTX petitions together in one case.

Veteran restructuring expert John J. Ray III, who sorted out Enron following its own demise, is spearheading FTX efforts as the firm’s new CEO.

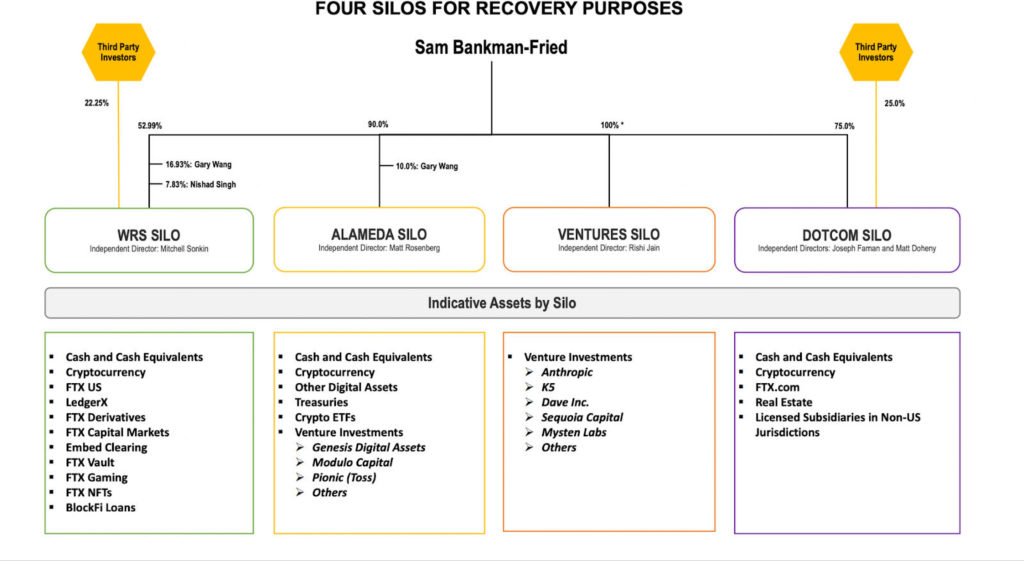

FTX lawyers shared a map of Bankman-Fried’s business, with the former billionaire at the top (source: FTX counsel).

FTX lawyers shared a map of Bankman-Fried’s business, with the former billionaire at the top (source: FTX counsel).

Matters of alleged malfeasance are already apparent. Bromley detailed substantial purchases unrelated to the business. One of the US debtors purchased almost $300 million worth of real estate in the Bahamas, according to the attorney.

Those houses were said to be mostly used as homes and vacation properties by senior FTX executives.

Bankman-Fried effectively controlled FTX ‘at all times,’ lawyer says

FTX’s mysterious hack shortly after it filed for bankruptcy was also covered. Around $477 million in various cryptocurrencies (valued at the time) was apparently drained from FTX hot wallets — including FTX US.

The Bahamas security regulator quickly moved to place some of FTX assets in cold storage via direct-custody startup Fireblocks. The decision, lawyers say, was directly actioned by Bankman-Fried and FTX chief technology officer Gary Wang.

The hacker recently swapped much of the siphoned ether for bitcoin via the RenBridge service — a platform Bankman-Fried’s Alameda Research acquired in 2021.

Bromley said FTX continues to suffer cyberattacks beyond that initial one. FTX’s new management has engaged “sophisticated expertise” to protect against incidents moving forward.

The team is now “working to bring order to disorder” by implementing controls, investigating core issues and providing transparency, Bromley said. Investigators are coordinating with debtors to collect all related business information.

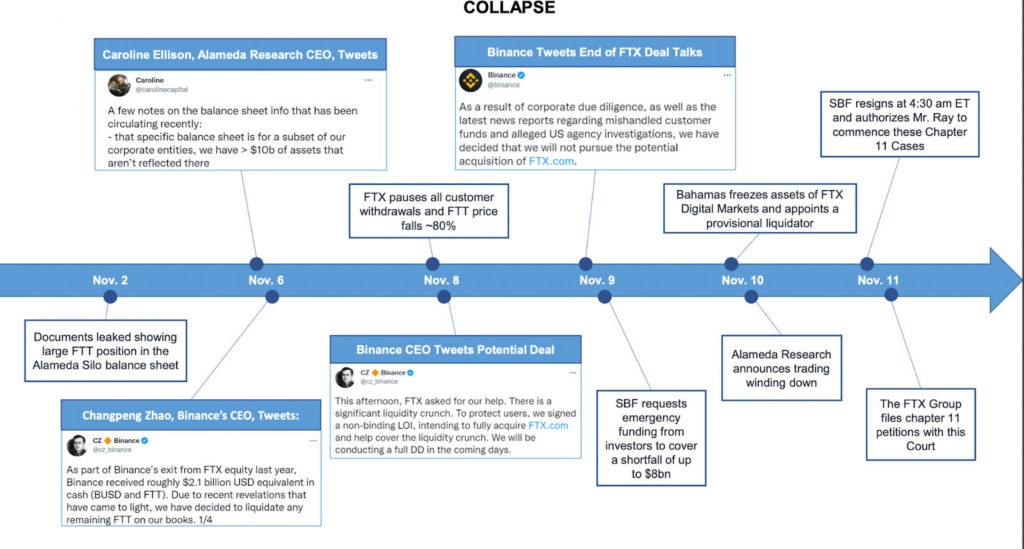

The apparent hacking incident isn’t labelled here. It happened after FTX Group filed for chapter 11s (source: FTX counsel).

The apparent hacking incident isn’t labelled here. It happened after FTX Group filed for chapter 11s (source: FTX counsel).

As that plays out, Bankman-Fried’s exact role in FTX’s alleged mismanagement no doubt will be front-of-mind for its creditors. It’s estimated up to one million users lost money with FTX, ranging from regular investors to blockchain startups and funds.

Lawyers presented a timeline of Bankman-Fried’s business activity. His trading outfit Alameda was founded in Nov. 2017 at the University of California, Berkeley, with FTX’s launch following in 2019 in Hong Kong.

“In effect, the company during that period of time, wandered the world. Started in Berkeley and went to Hong Kong… it went to Chicago, to Miami, went to the Bahamas, but at all times it was effectively under the control of Mr. Bankman,” Bromley said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.