Crypto hiring: Gemini eyeing Singapore as springboard for APAC plans

Gemini plans to have over 100 employees stationed in Singapore a year from now

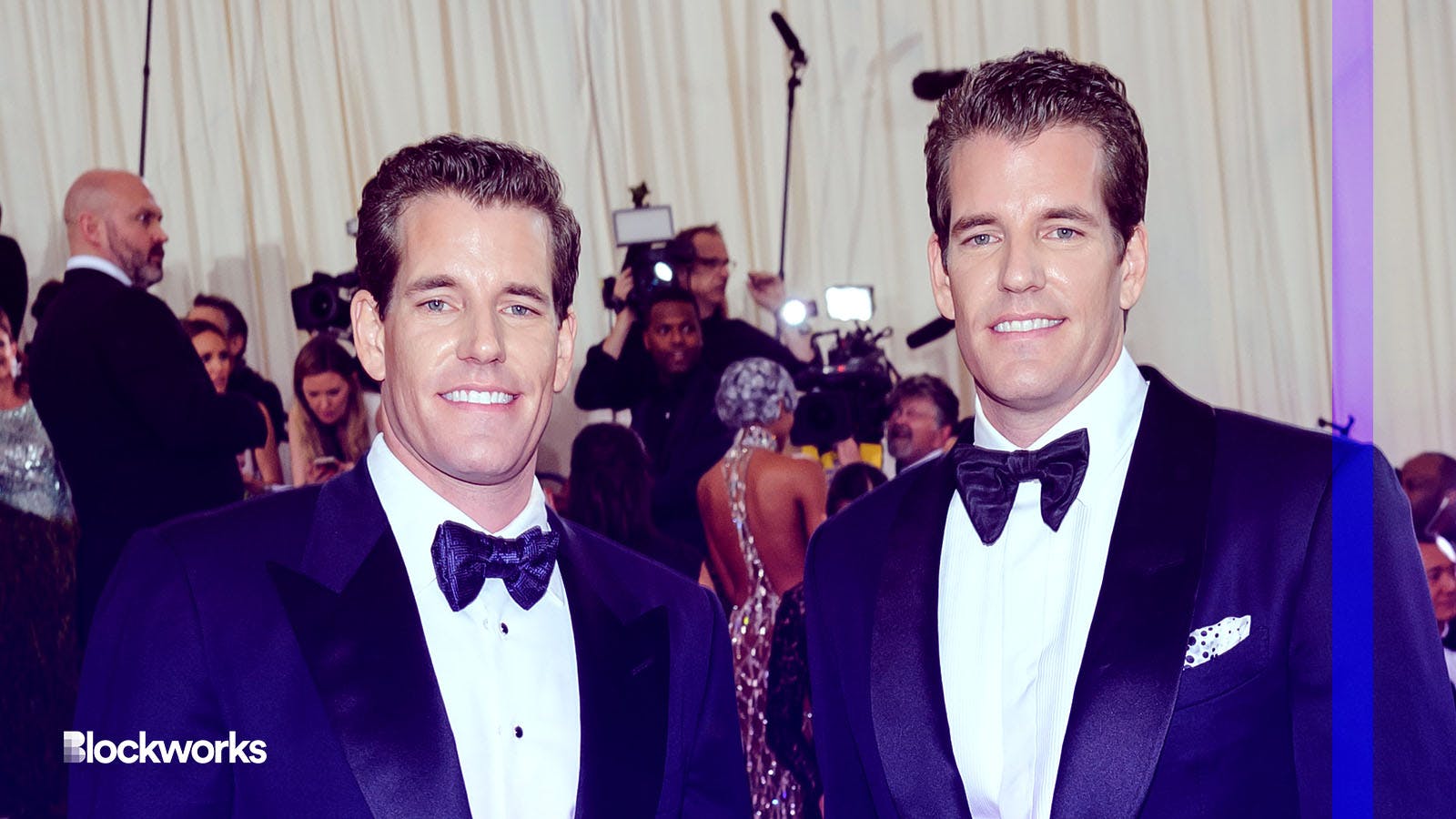

Gemini co-founders Tyler and Cameron Winklevoss | Sky Cinema/Shutterstock modified by Blockworks

Gemini is expanding its Singapore operations, perhaps one indicator that the Asia-Pacific region has continued to demonstrate promise for crypto companies.

Gemini representatives this week said the company plans to increase its headcount in Singapore to more than 100 employees over the next 12 months. The outpost, Gemini said, will form the foundation for “larger APAC operations.”

“We believe that APAC will be a great driver of the next wave of growth for crypto and Gemini,” Gemini wrote.

Gemini hired Pravijt Tiwana as its APAC CEO in April. Tiwana first joined Gemini as the company’s chief technology officer, jumping ship from Amazon Web Services (AWS).

The move, paired with its new engineering center in Gurgaon, India, demonstrates that Gemini is serious about expanding into Asia and ramping up its international business.

Singapore crypto efforts more broadly have continued apace over the past couple of months.

Ripple on Thursday received provisional regulatory approval to offer crypto products and services in the city state. Conversely, DCG-owned Luno wound down its services in Singapore in mid-April.

Starknet Foundation appoints first CEO

Former Meta executive Diego Oliva will head up the Starknet Foundation as its chief executive.

Oliva has been tasked with fostering growth at Starknet, as well as overseeing its decentralization plans.

Starknet is a permissionless validity layer-2 rollup,and uses STARK proofs to power the network.

Oliva, who was born in Mexico, in the statement pointed to how Mexican migrants sent nearly $60 billion in remittances back home in 2022. He said blockchain technology can cut down on “unnecessarily high” wire transfer fees.

“Scalable and user-friendly blockchain solutions, like those being built on Starknet, can be transformative for such people,” Oliva said.

Oliva was Facebook’s regional director for Europe, the Middle East and Africa from 2009 to 2015.

Starkware, Starknet’s parent company, raised $100 million last May and is now valued at $8 billion.

Other notable hires

- Joseph Tsai, a co-founder of Alibaba and an FTX investor, is taking over as chair of the Chinese e-commerce giant. Tsai’s family office Blue Pool Capital invested in the doomed FTX.

- V Pappas is stepping down as chief operating officer of TikTok, citing a desire to focus on their “entrepreneurial passions” and name-dropping “blockchain” as an area with “incredible innovation.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.