Helium partners with DAWN to create ‘last-mile internet solution’

Two Solana DePIN projects are teaming up to take on big telecom

Akif CUBUK/Shutterstock modified by Blockworks

This is a segment from the Empire newsletter. To read full editions, subscribe.

Crypto is a creature of extremes. Look no further than the major narratives right now.

AI agents and memecoins are almost completely virtual. DePIN, meanwhile, derives practically its entire value proposition from very physical networks of hardware. In the real world.

So, you can’t fault Helium — the decentralized wireless carrier powered by Solana — for teaming up with DAWN to expand both their networks, together.

The pair have struck a partnership to allow Helium hotspot operators to serve DAWN broadband internet, and vice versa, to create “the world’s first fully decentralized last-mile internet solution.”

Like how Helium is shooting to disrupt centralized telecoms, DAWN is pushing to change our relationship with traditional ISPs, allowing regular users to both own the infrastructure and be rewarded in crypto for providing wireless broadband to anyone in range.

“The conversation started with a strong alignment on the mission of decentralizing internet access,” a Helium spokesperson told me. “We’re moving toward making connectivity owned by the many and accessible to everyone.”

It means that the Helium Network will automatically grow by 8,000 nodes that already serve the DAWN ecosystem, according to a press release.

A Helium Foundation dashboard meanwhile points to more than 25,000 mobile hotspots onboarded since last April, which hypothetically could serve DAWN broadband once the functionality is rolled out, although it’s not immediately clear how many are currently active.

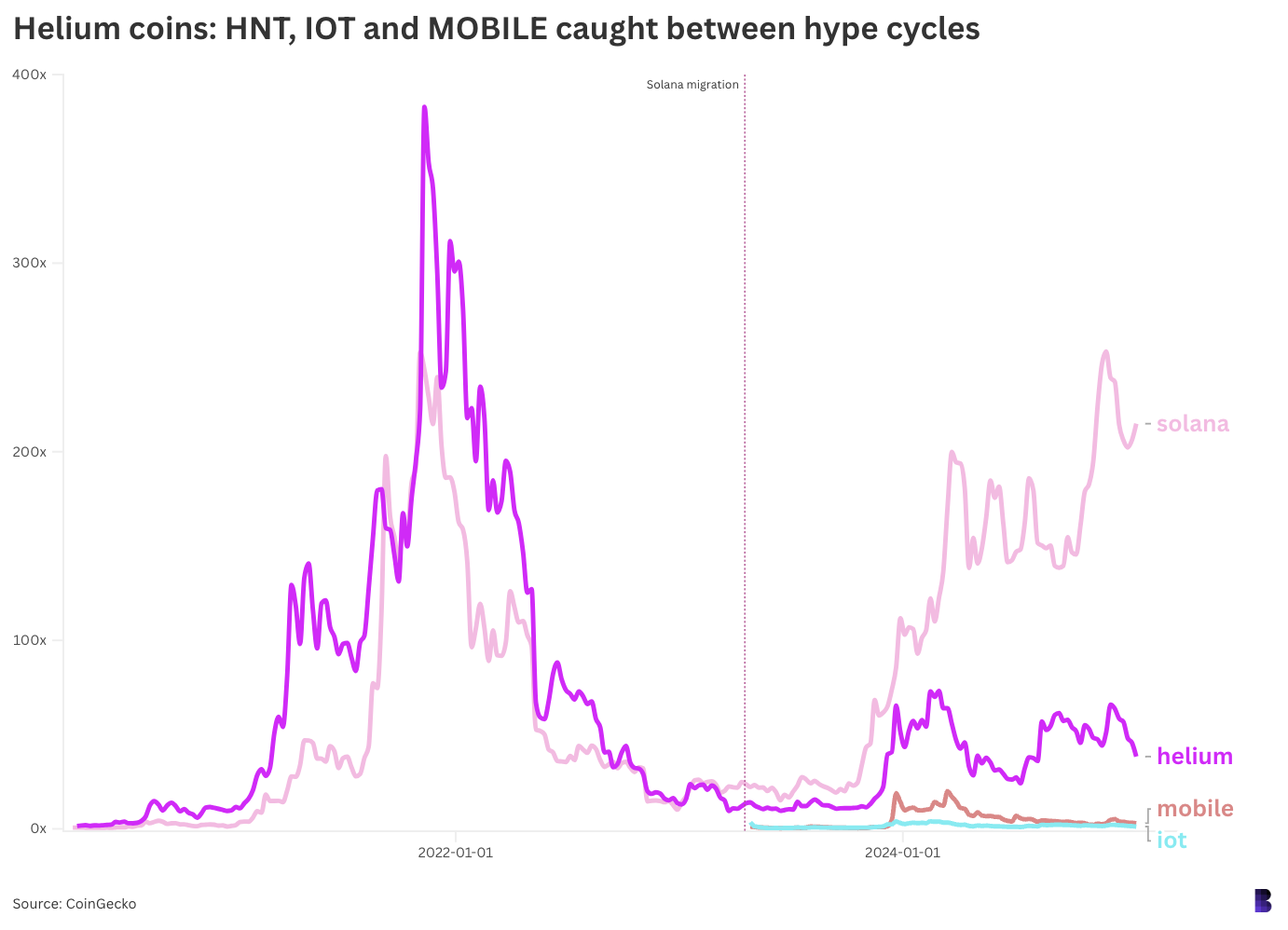

Helium’s HNT is still working on reclaiming highs from the last cycle. DAWN, which has an active points program, is yet to confirm a token launch

Helium’s HNT is still working on reclaiming highs from the last cycle. DAWN, which has an active points program, is yet to confirm a token launch

The spokesperson said that there’s no equity or investment deal as part of the partnership. Still, it all suggests a certain coalescence in the DePIN space.

Like how GPUs and ASIC mining rigs can be used to mine a number of different cryptocurrencies — switching between them based on profitability — we could be headed for a world where DePIN devices in our homes can be pointed to all sorts of different use cases depending on demand.

It might mean additional income for the household without the often extreme overheads related to proof-of-work mining, although how much would be largely dependent on token prices and whatnot.

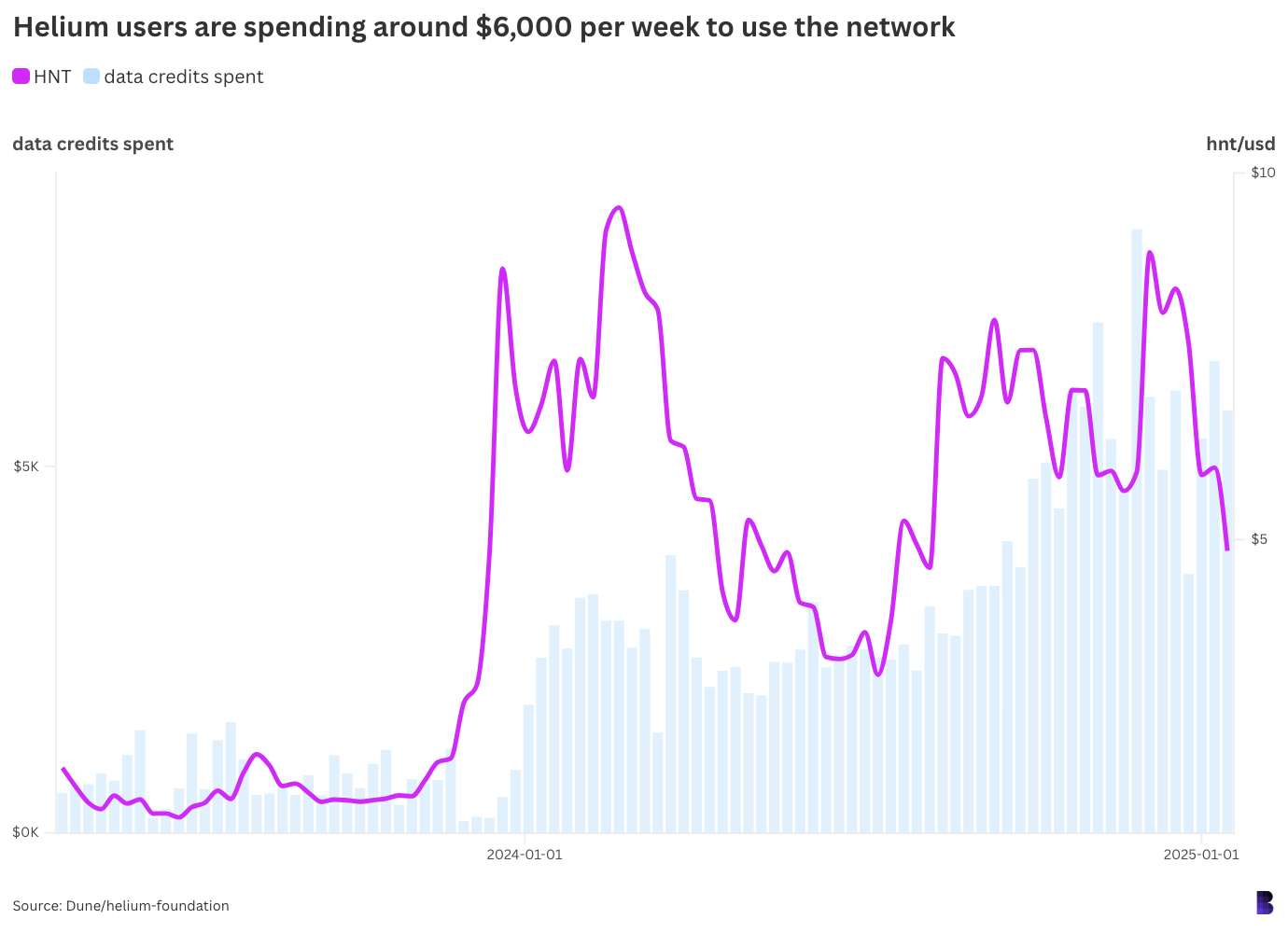

Helium users are spending ~$6,000 HNT per week right now, up from under $3,000 in January 2024

Helium users are spending ~$6,000 HNT per week right now, up from under $3,000 in January 2024

What’s interesting is that had this partnership not been made, eventually Helium and DAWN would’ve been considered competitors. But not really anymore.

Wouldn’t that make Elon Musk’s Starlink the biggest rival to the Helium-DAWN partnership, outside of the traditional carriers?

“Starlink is disrupting the connectivity industry in ways that were unimaginable just a few years ago,” the Helium spokesperson said. “Several Helium deployments use Starlink as an internet backhaul in the US and Mexico.”

The team has also developed a connectivity kit that combines Starlink with Helium Hotspots, to better serve phones in areas without cell coverage.

In any case, the Helium-DAWN partnership makes total sense, especially considering the latter is expected to airdrop a token to early adopters at some point.

After all, when it comes to incentivizing people to set up physical devices in their homes, two token flywheels must be better than one.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.