Lightspeed Newsletter: MetaDAO is making markets into its government

Plus, Andrew Tate has announced he wants to crash Solana

Akif CUBUK/Shutterstock modified by Blockworks

Howdy!

If you’re reading this, I’m somewhere in New Hampshire, hopefully not getting eaten by a bear.

In honor of New Hampshire’s (awesome) state motto of “Live Free or Die,” let’s dive into an entirely market-based governance system that’s currently being tried on Solana. It’s fun Friday!

MetaDAO pioneers “futarchy” governance on Solana

Solana has been the land of native token airdrops for the past several months, and with these airdrops often comes governance processes for which to use these new tokens. But even at its best, DAO-based governance can suffer from low turnout and misaligned incentives.

On Solana, MetaDAO is testing out a new paradigm for crypto governance — so-called futarchy.

Under futarchy, instead of voting on governance proposals, people trade on them. This means that a market decides how protocols ought to be governed. MetaDAO, Future DAO, and Drift Protocol all have pages live on Futarchy’s governance page.

MetaDAO’s pseudonymous founder, Proph3t, told me that they were formerly a developer working in Ethereum DeFi but grew aggravated with often-misaligned incentives muddling decision making processes.

Proph3t said they discovered futarchy through a YouTube video and decided to build futarchic governance in crypto. Futarchy was introduced by the economics professor Robin Hanson. When I asked Proph3t if all of Solana could someday be governed by futarchy, they replied that they see a future where “everything is governed by futarchy.”

Proph3t began coding MetaDAO in January 2023 on Solana, a blockchain they felt was in a much better position than people understood at the time. The platform launched in November 2023 and is now raising a funding round. In February, Pantera Capital made a proposal to acquire some of MetaDAO’s native tokens, but traders voted the measure down.

A futarchic proposal sets a price for what the market thinks the DAO’s native token will cost if the proposal passes or fails. Traders can take options-like bets on these prices, and the proposal passes or fails based on whether passing or failing is expected to be better for the token’s price. If the proposal passes, traders on the “pass” side will have their trades go through, while those on the “fail” side will have their trade canceled, and vice versa.

For example, say I propose to the fictional Lightspeed DAO for everyone to share the Lightspeed newsletter with a friend. If this proposal were to pass, the market determines the fictional LIGHTSPEED token would increase from $1 to $10. If the proposal were to fail, the market says LIGHTSPEED would only increase to $8. The proposal would pass because the market sees everyone sharing the newsletter as better for the LIGHTSPEED token price. Everyone who traded on the fail side would get their money back, and those who traded on the pass side would see unrealized gains or losses based on whether they took the correct bet on the token’s price following the proposal passing.

I brought up the question of how a market can be built to only capture the effect of a governance proposal. Proph3t suggested making proposal times as short as possible to try limiting the factors affecting the market.

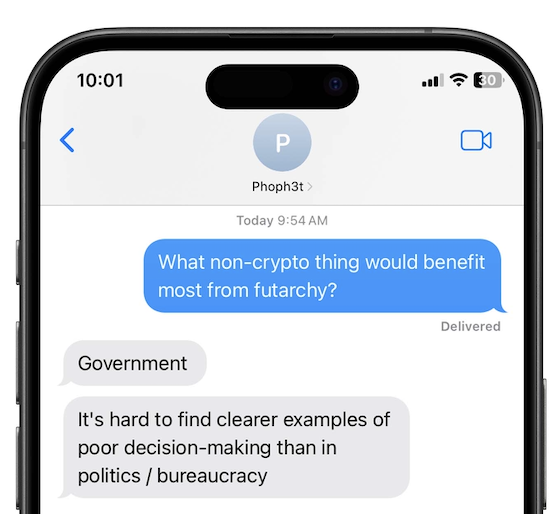

This all sounds a bit like nerd sniping, and I asked Proph3t if there was a way to make futarchy more digestible for normies.

“Well, I would push back on the idea that it needs to necessarily be very digestible. The goal of any decision making process would be to make good decisions, not necessarily to incorporate the most people in that decision making process,” Proph3t said.

— Jack Kubinec

Zero In

A cursory glance at rapper Iggy Azalea’s X account reveals a near-constant drumbeat of promotion for Azalea’s memecoin, $MOTHER:

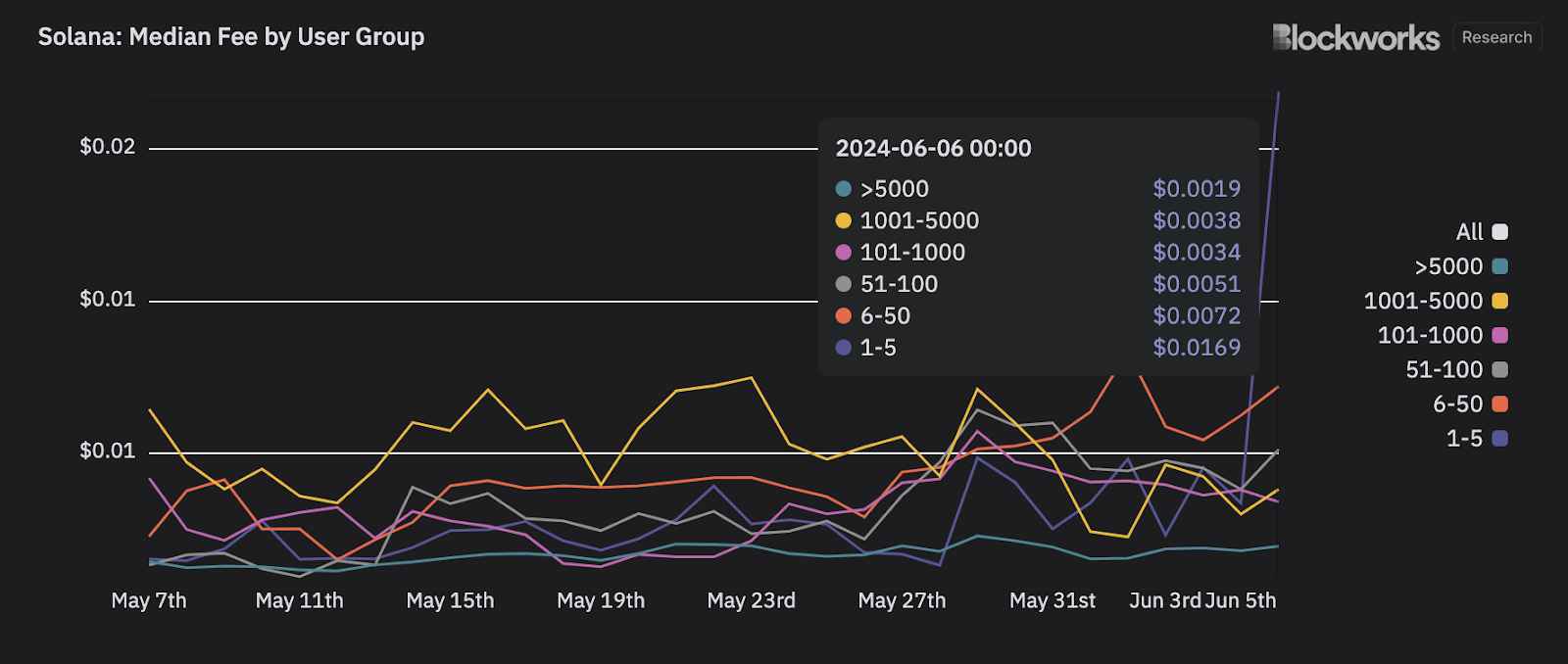

(Source: Blockworks Research/Solana Dashboard)

(Source: Blockworks Research/Solana Dashboard)

Sure, the memecoin’s market cap has grown since launch, but is the token actually bringing people into the market vs providing a shiny new toy for the space’s existing degens?

Data from Blockworks Research shows a sharp spike in the median transaction fee paid within the group of users who’ve transacted between 1 and 5 times in the period. The day-to-day jump was from $0.003 to $0.016 — a more than 430% increase.

Does this represent a wave of Solana newbies trying to gain transaction priority, or those trying to pay higher fees in the wake of failed transactions? It’s tough to say, and inquiring minds wish to know.

Either way, something is going on, and a celebrity memecoin may have something to do with it.

— Michael McSweeney

The Pulse

It isn’t even 10 am, and Andrew Tate has announced he wants to crash Solana.

How or why he plans to do that is unclear. A deeper reading of his tweets seems to indicate that what he actually means is that he’s going to buy and hold a couple of memecoins as an engagement farming exercise.

Early on Friday, Tate took to X to declare (always in all caps) that, “I WILL CRASH THE SOLANA NETWORK,” and “I AM DIAMOND HANDS ALL DAY. WATCH ME.” He boasted about investing over 1 million USD into random cryptocurrencies, stating that he has no intention to ever sell them. His followers perceive this as good because, by committing to never sell the coins, Tate is effectively offering to reduce the circulating supply. This increased scarcity could potentially drive up demand, and therefore the price. Or it might do nothing at all.

Intermixed with his Solana tweets, Tate worked hard to stay on-brand — that brand comprising a hyper-machismo mix of racism, anti-semitism, sexism, and homophobia. Most followers were unfazed, seemingly thrilled instead at the prospect of a market pump for their bags.

Tate is just the latest in the current cycle’s trend of celebrity involvement in memecoins, joining the ranks of Hulk Hogan, Caitlyn Jenner, Iggy Azalea and more. Response has been positive for the most part. Many people don’t seem to care about the quality of the person shilling their coins, so long as they can buy into the speculative promise of personal upside. I guess that’s why we call them degens.

— Jeffrey Albus

One Good DM

A message from Proph3t, founder of MetaDAO:

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.