QCP Capital Wary of Ether Downside as China Mining Pools Shut

In a recent note, QCP Capital highlighted aggressive contract buying in Asia for ether pricing at $2,500 to $2,800 by early October.

Source: Shutterstock

- The market might be preparing for negative price movements as Ethereum gears up for a challenge amidst mining pool shut downs and aggressive competition from Layer-1s

- Has the ‘magic’ left the platform as Layer-1s begin to eclipse Ethereum in active users?

The price of ether might be heading for a drop come mid-month, QCP Capital wrote in a recent note on their Telegram channel.

QCP, based in Singapore, noted during the Tuesday trading day in Asia the market aggressively paid for over 13,000x contracts of puts on ether pricing with an expiry date of October 8. The majority of pricing for these options is clustered around the $2,500 to $2,800 mark. Ether is currently priced at $2,873, down 3% on-week, according to CoinGecko.

Miners leaving China without a destination

Even though use cases for Ethereum, the protocol, like DeFi and NFTs, continue to reach all-time highs, a cloud seems to be looming over ether pricing given the structural challenges surrounding the network.

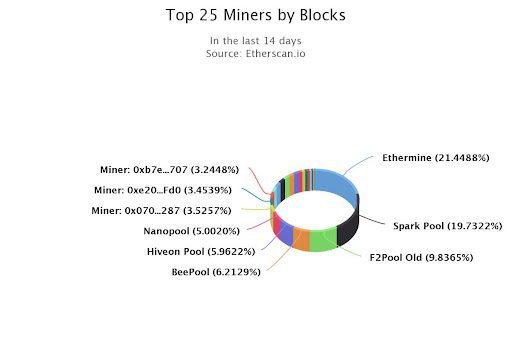

With China’s recent crackdown on mining, some of the largest ether mining pools have announced that they are shutting their doors. Sparkpool, which contributes around 15% of the network’s hashrate, according to Poolwatch.io, will be shutting down at the end of the month according to a post on its WeChat page. BeePool, the fourth-largest miner in China, also is shutting its doors, announcing on Twitter that it was ceasing operations in “compliance with local laws.”

At the same time, some Ethereum mining pools, like their counterparts in the Bitcoin space, are packing up and moving to North America.

However, there’s not the same rapid evacuation from China of Ethereum miners as there are Bitcoin miners, given the finite utility of the industry. With the coming shift to ETH 2 and its proof-of-stake structure, miners as stakeholders have declining relevance. Even before the London Hard Fork was rolled out via EIP-1559 in the summer, some stakeholders were already anticipating mining being made irrelevant by the end of the year.

“If I was a miner, I would plan to break even by end of year 2021,” wrote Tim Beiko, a Community Manager and developer at the Ethereum Foundation on a mining Discord channel in April. Beiko couldn’t give an exact date when the main Ethereum chain would merge with the ETH 2 “beacon” chain and transition to proof-of-stake, but Beiko believes that this would be a safe guess.

Where did the magic go? Blame the layer-1s

Given Ethereum’s high gas fees, many retail traders have moved on to other layer-1 protocols.

Digital assets research house Santiment posted a note earlier this week wondering where the “magic” of Ethereum had gone, noting the influx of ether on exchanges indicating a sell-off was in process.

“Network growth has been stagnant for the past few months even after the price bottomed out. Price continued to grow but Network Participants continue to just range, this deviation is generally not a healthy sign,” Santiment wrote. “Much of this behavior is likely attributed to the growth in L-1s (AVAX, FTM, ATOM) during this period and the gradual decline in NFT speculation.”

Indeed, according to on-chain data, the Polygon network, with its zero fee structure, has surpassed Ethereum in daily active users.

“Ethereum continues to struggle as most speculators have moved on to other L-1s for better ROI, eventually leaving it with stagnant Network Growth,” Santiment concluded. The real rally is unlikely until we get closer to the next major speculative event: the transition to Proof-of-Stake (PoS) in 2022.”

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.