SEC Hands Over Key Documents in Case Against Ripple

In a small victory for Ripple Labs, the SEC has complied with an order to hand over internal emails

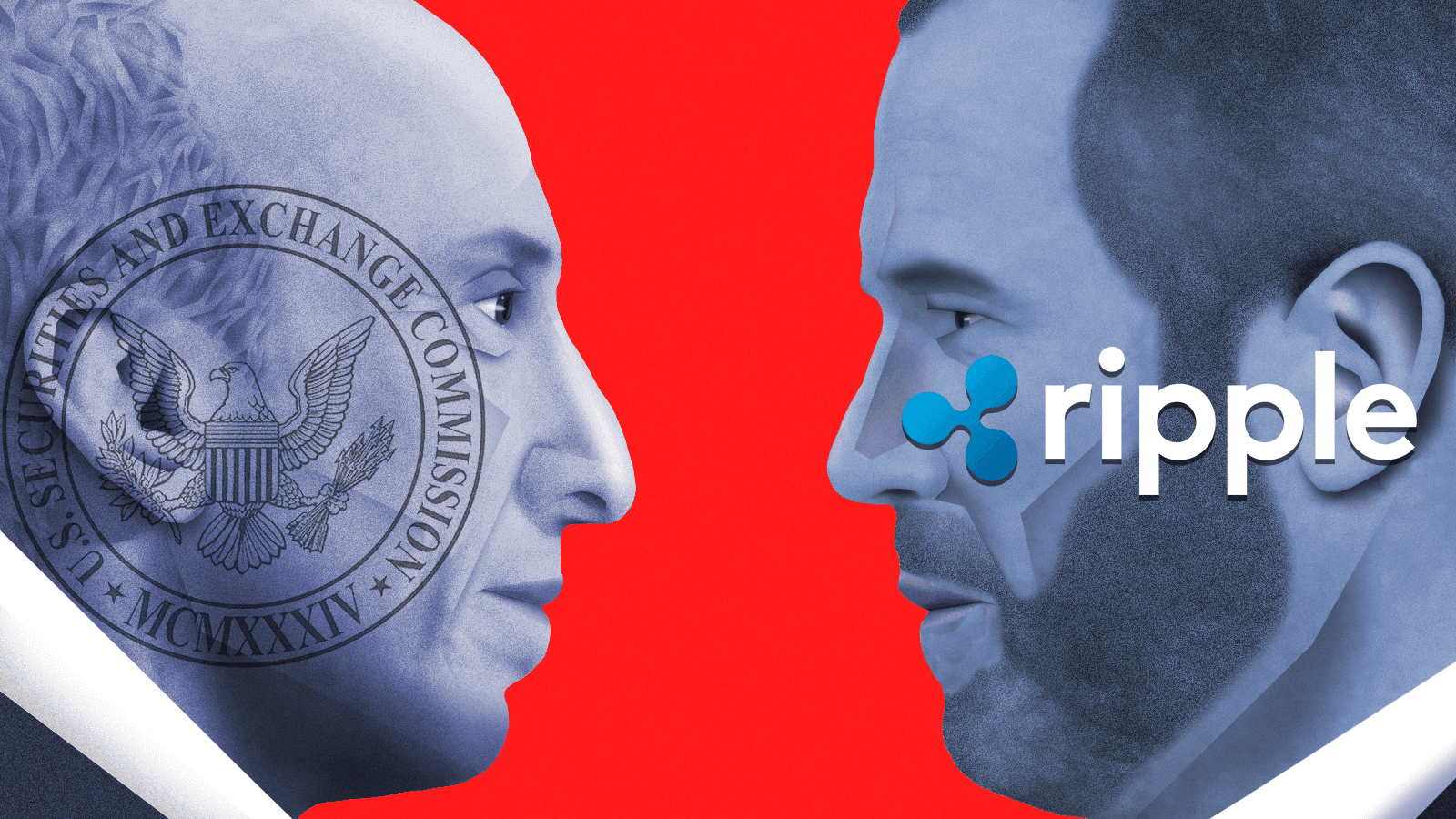

Blockworks exclusive art by axel rangel

- The documents — internal SEC drafts and emails — relate to a speech given by a former agency director in 2018

- The SEC fought hard to resist turning over the files, though their contents remain under wraps for now

Ripple Labs, stewards of the XRP token, has had a small win in its long-running case with the SEC, obtaining key documents that may help in its fight against the regulator.

After 18 months and six court orders, Ripple has its hands on what has become known as the Hinman documents — internal SEC drafts and emails relating to a former director’s speech more than four years ago.

The speech, given by William Hinman, who at the time was Director of the SEC’s Division of Corporation Finance, was notable as it seemed to declare ether was not considered a security by the agency.

Ripple’s general counsel, Stuart Alderoty, tweeted Thursday that while the documents relating to the 2018 Yahoo Finance All Markets Summit speech remain confidential for now, at the request of the regulator, “it was well worth the fight to get them.”

Ripple’s defense is based on the argument that if ether was not considered a security back then, why should XRP — which is arguably more like a currency — be subject to US securities law?

Ripple has repeatedly sought the documents through discovery, while the SEC attempted to withhold them on at least three occasions. The SEC’s viewpoint were overruled, first in February and then in April by Magistrate Judge Sarah Netburn in the Southern District Court of New York.

Judge Analisa Torres once again ruled against the SEC’s attempts to withhold the documents for the third time late last month. The price of XRP lept by more than 9% on the news. XRP was last seen trading at $0.44, down 1.8% over a 24-hour period.

“I’ve always felt good about our legal arguments and I feel even better now, Alderoty said in his tweets. “I always felt bad about the SEC’s tactics and I feel even worse about them now.”

Crypto’s watershed moment

While the case continues, the outcome of the legal sparring between the two could have wider ramifications for the industry as it may establish precedence over how crypto is regulated and treated as either a security or a commodity.

The SEC, meanwhile, has been arguing — ever since it filed suit in 2020 — that Ripple and two of its executives, former and present CEOs Brad Garlinghouse and Chris Larsen, violated securities laws in 2013 when they sought to raise funds without first registering with the agency.

Blockworks attempted to contact the US securities regulator to ask it to comment on the development but did not receive a response by press time.

Ripple has repeatedly denied the allegations, which the regulator argues raised more than $1.3 billion in an XRP token sale more than nine years ago.

“Ripple denies it engaged in any offering of securities; denies the inaccurate characterization of the legal advice Ripple received regarding XRP; and denies that it engaged in a single ‘offering’ of XRP,” Ripple said in a filed court document back in 2020.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.