Major takeaways from this week’s BTC ETF options launch

Crypto’s calls are equally as juiced as puts, creating a “smile” in the volatility surface

Hansel Gonzalez/Shutterstock modified by Blockworks

This week I had the pleasure of interviewing Jeff Park, head of alpha strategies at Bitwise Asset Management, to unpack the BTC ETF options launch this week.

Here are the main takeaways from our interview that I learned:

Volatility Smile

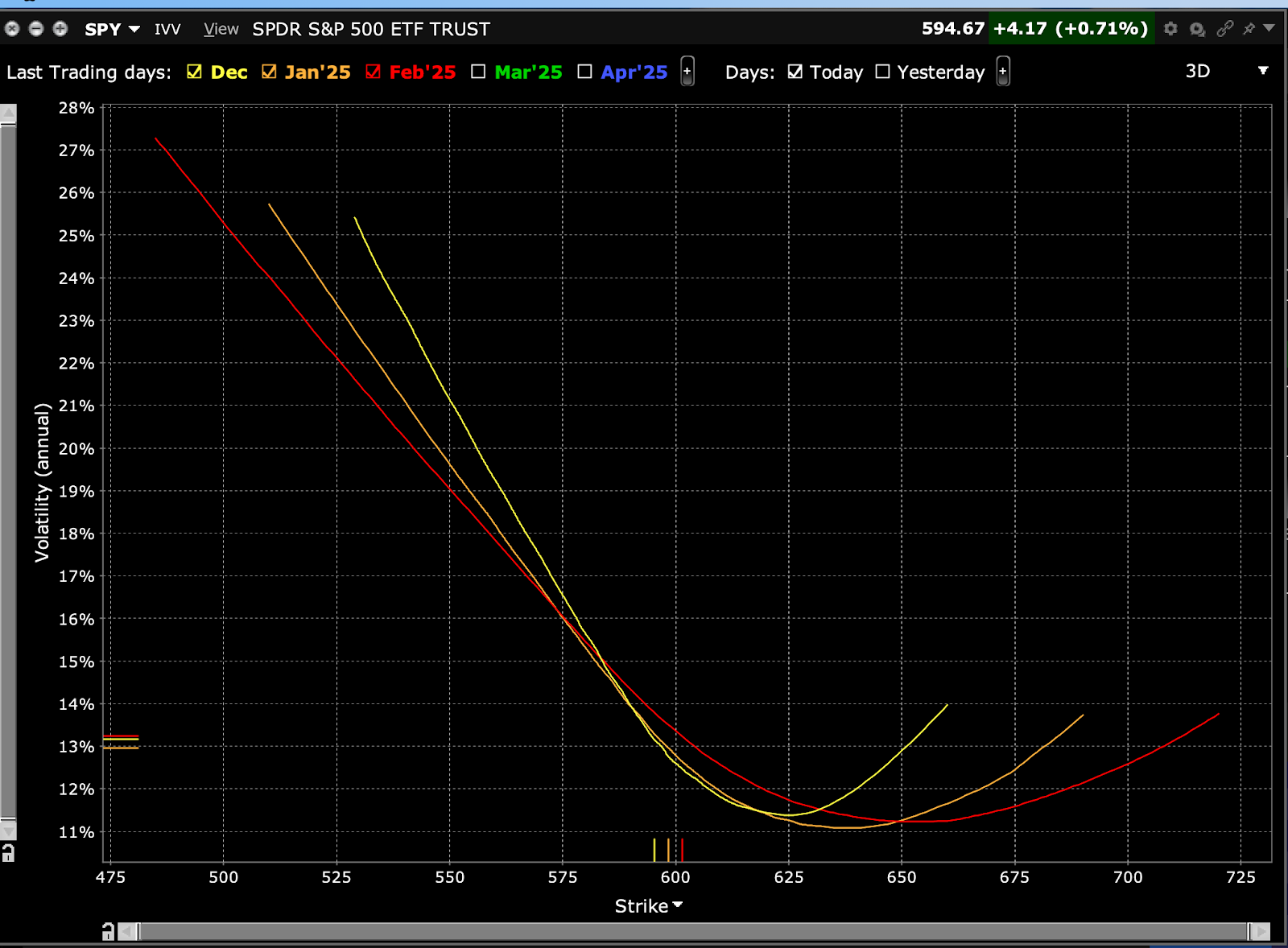

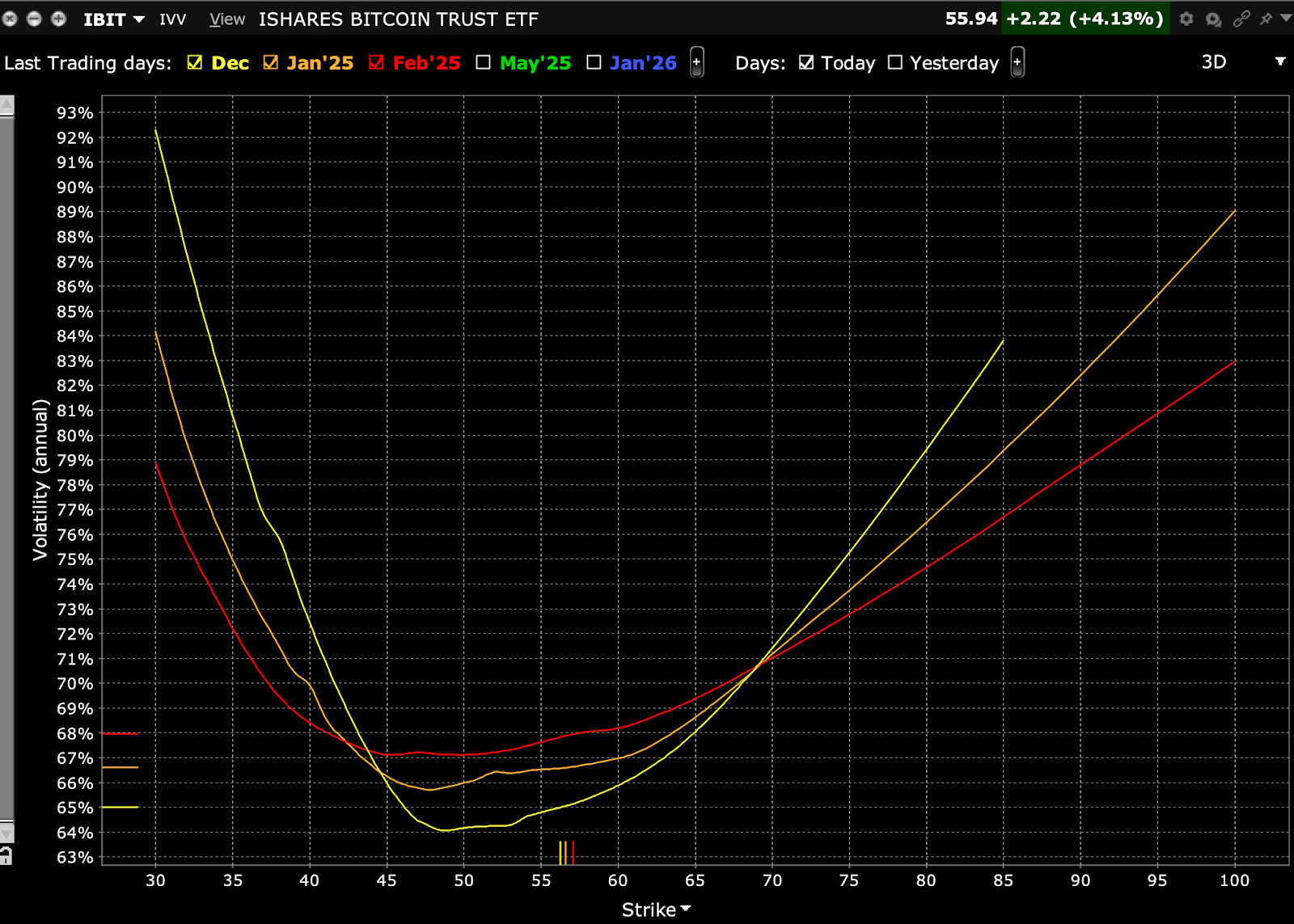

Typically with risk assets, puts demand a higher premium than calls. This is because most people use options to hedge their longs, creating skewed demand for puts over calls. This typically creates a half smile in the volatility structure as seen below:

Something very unique about crypto, however, is that it has a persistent smile to its volatility surface — where calls are equally as juiced as puts, creating a “smile” in the volatility surface:

Often this smile only occurs in commodity assets during supply shocks, where demand outpaces available supply and prices surge. However, since supply can then increase to a new equilibrium with demand, the price will then revert and the volatility smile ends. What is unique about Bitcoin, however, is due to the difficulty adjustment that makes that supply adjustment like you see in traditional commodities impossible, the smile remains persistent and permanent. This is extremely unique.

Call Heavy Flow

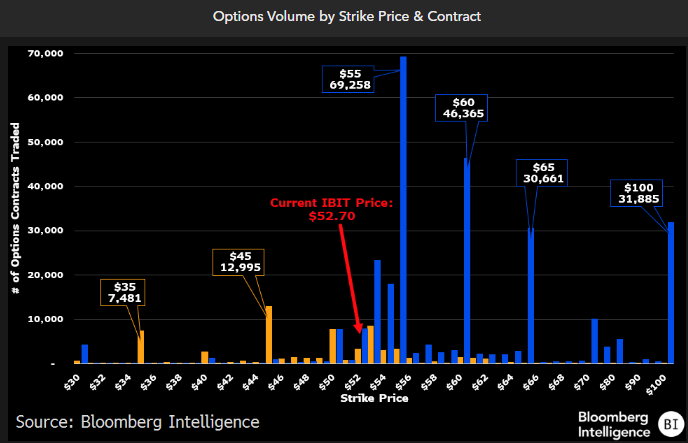

The vast majority of the options activity has been in out-of-the-money calls. As we can see in the chart below from Bloomberg Intelligence’s Eric Balchunas, most of the activity has been in either marginally OTM calls or as far out as the strikes are currently available:

Further, we can see that 82% of the first day options volume on IBIT was from calls:

Deribit vs TradFi options

One interesting takeaway I learned from Jeff is that Deribit, a crypto options exchange that is open 24/7, should have BTC options that are priced differently from the ETF options. The key reason for this is that because of theta, otherwise known as the time to expiry. Since Deribit options are constantly live for trading, the theta — and therefore the volatility — should sit at a premium to the ETF options, which only trade during standard market hours.

Most on IBIT

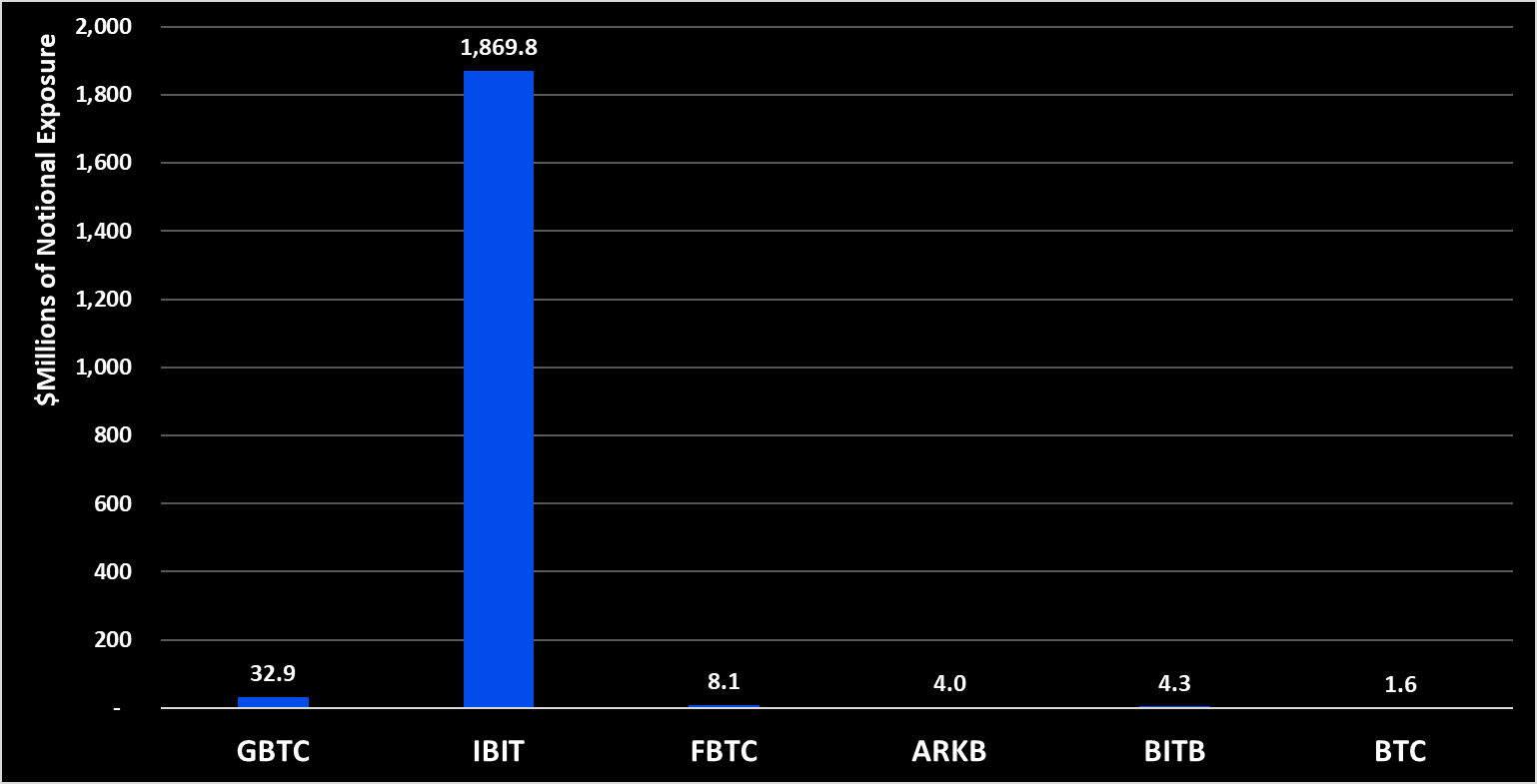

Finally, despite yesterday being the launch day for all the other ETF’s options, we’ve seen the vast majority of the notional exposure reside within BlackRock’s iShares Bitcoin Trust (IBIT):

This makes for much wider spreads on the other ETFs given there’s much less liquidity available.

Overall, the market structure has changed significantly this week with the launch of ETF options. Whereas traditionally short-term market structure was largely a function of perpetual futures, options flow dynamics will increasingly play a larger role in the price action.

For a deeper dive into other implications of this major market regime change, check out my interview with Jeff Park.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.