Solana finalists: Ignition Demo Day at Singapore Token2049

Stablecoin, DePIN and robo-advisor teams made the finals

Harshit Srivastava S3/Shutterstock modified by Blockworks

This is a segment from the Lightspeed newsletter. To read full editions, subscribe.

It’s Token2049 week in Singapore.

The week kicked off yesterday with demo day of Ignition, a Y-Combinator-like initiative by Superteam Singapore.

This marks the fourth iteration of Superteam Singapore’s Ignition. Alumni from previous Ignition programs have collectively raised $24 million in the past, the team told me.

A total of 223 projects building on Solana sent applications in this cohort, but only six lucky finalist projects were shortlisted by judges to present: Home Harvest, Motif, Azza, Onta, DeCharge and Altify.

“Stablecoin-related projects are very popular now, we’re seeing lots of cross-border FX plays,” Superteam SG lead Nick Tong told me. He also noted a flood of memecoin and AI-themed projects.

The six teams seeking funding demoed their projects in front of a packed auditorium of at least 150 people, with VCs like Dragonfly, Hashed and Spartan in attendance.

Of the six finalists, companies varied in three broad categories: stablecoin networks, AI-enabled wealth advisors and DePIN.

The first was Azza, a “stablecoin neobank” offering cross-border payments to consumers in Africa. Azza’s application is tightly integrated with Whatsapp messenger, which its CEO Toochukwu Okoro pointed to as a decision made to meet where “African consumers are.”

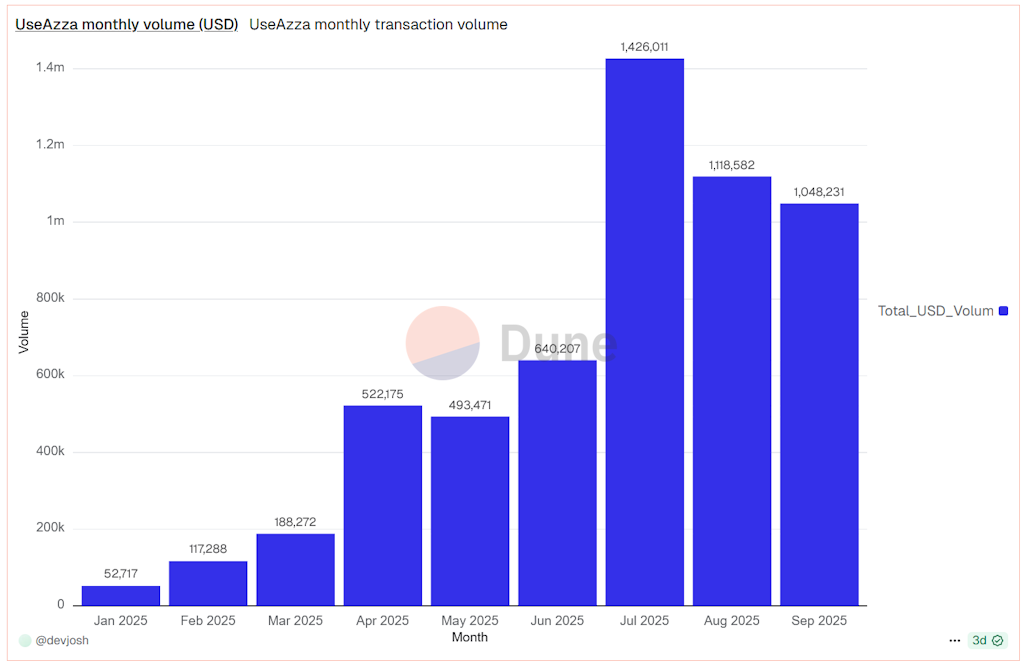

Azza has seen $5.7 million in volumes in the last eight months across ~7000 users, without any marketing spend.

Source: Dune

Source: Dune

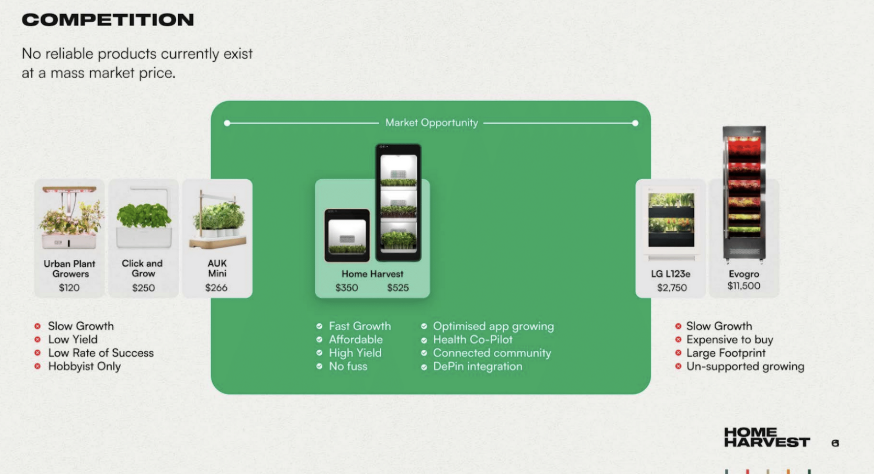

The second was Home Harvest, a DePIN team with the goal of reimagining everyday food production.

Rather than depending on imported fresh produce, Home Harvest hopes to empower consumers to grow their own greens with indoor hydroponic smart appliances.

Source: Home Harvest

Source: Home Harvest

“We’re using the blockchain to verify and transfer the customer harvest data we are capturing from our growers — their harvests, meal plans, diets, recipes and how they are engaging with the product,” Home Harvest’s co-founder Hedley Aylott told me.

“We also plan to use the blockchain to verify the carbon offset created by each unit so that we can aggregate and sell these on the tokenized carbon market and return the income to customers via our tokenized rewards program.”

Home Harvest was a previous winner of Solana’s Colosseum hackathon and is currently raising in a $3 million seed round with $1.5 million pre-seed committed.

The third project to take stage was DeCharge, a DePIN team that touts itself as the “Helium of electric vehicle charging.”

3x more electric vehicles are hitting the road compared to the number of chargers being deployed, according to the framing of DeCharge co-founder Mohan Ponnada.

DeCharge hopes to address what centralized charge point operators like ChargePoint and Electrify America have failed to do, namely by incentivizing property owners with tokens to put idle parking spaces and power to productive use.

Source: DeCharge

Source: DeCharge

DeCharge claims to be generating $2.8 million in annual recurring revenues across 1000+ hosts onboarded.

Finally there is Altify, an investment platform operating at the intersection of crypto and artificial intelligence.

Altify’s thesis is simple: Most money to be made in investing are in private markets, an asset class that is locked out of the retail public. Altify wants to give you access.

Altify’s platform strives to source the best tokenized investments — private credit, structured products, crypto, commodities etc. — and make them available to their users.

The team has generated $1.4 million in annual recurring revenues, with 13,100 monthly active users.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.