Crypto-friendly Emmer snags GOP Speaker nomination, at least for now

After an internal vote, Republicans just barely agreed on Tom Emmer, the House majority whip from Minnesota, as their top pick for Speaker of the House, but insiders say his support is dwindling

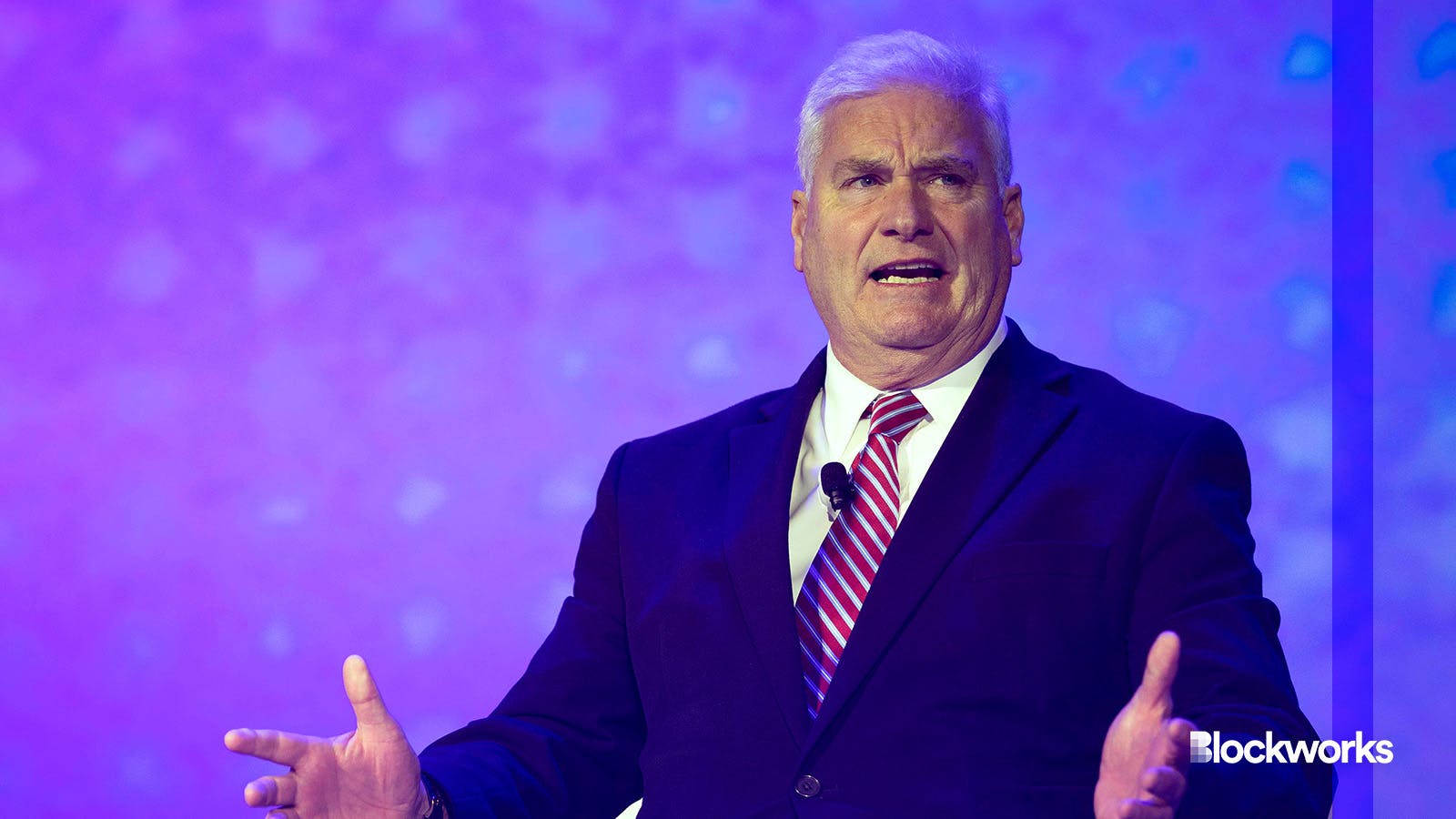

Rep. Tom Emmer | Permissionles II by Blockworks

Congressional crypto advocate Rep. Tom Emmer, R-Minn, has emerged as the GOP’s latest pick for Speaker of the House, but he still has an uphill battle ahead.

Republicans landed on Emmer, who currently serves as the majority whip, after considering nine other party members Tuesday in an internal election. There could be a House floor vote as soon as this afternoon, but people familiar with the matter said that Emmer is losing support by the minute.

Emmer will need 217 votes to get the gig, meaning a maximum of only four Republicans can go against him. In the internal vote, Emmer was down 26 Republicans.

Former President Donald Trump seems to be leading the charge against Emmer via social media platform Truth Social. He wrote that Emmer is not on the list of Republicans he would endorse as Speaker.

The Speaker position has remained vacant for three weeks since Kevin McCarthy, R-Cali, was ousted in early October.

Emmer last month unveiled a new version of his anti-central bank digital currency (CBDC) bill, which aims to block any efforts from the Federal Reserve to issue a retail digital dollar.

“Any digital version of the dollar must uphold our American values of privacy, individual sovereignty and free market competitiveness,” Emmer said in a statement in February, when he first brought the bill to the floor. “Anything less opens the door to the development of a dangerous surveillance tool.”

Emmer’s nomination comes as congressional leaders continue to spar with each other and federal agencies over how to regulate the crypto industry.

Five crypto-related bills in the House are slated to go to a full-floor vote after passing through Committee markups this session. The Financial Innovation and Technology (FIT) for the 21st Century Act, co-sponsored by French Hill, R-Ark., Glenn Thompson, R-Penn., and Dusty Johnson, R-S.D., and the Clarity for Payment Stablecoins Act, introduced by Patrick McHenry, R-N.C., received fairly promising bipartisan support during their markup stages.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.