Voyager Digital Preliminary Revenue Drops 40% from Previous Quarter

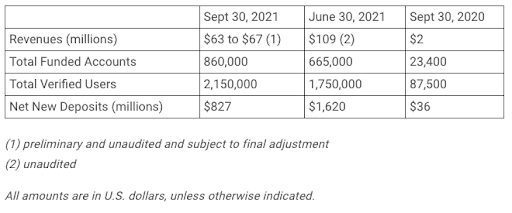

Voyager projects its revenue for its fiscal 2022 first quarter ending on September 30 to be between $63 million to $67 million, down from $109 million in the previous quarter ending on June 30.

Voyager Digital CEO Steve Ehrlich | Source: Voyager Digital

- Voyager’s total verified users on its platform increased to more than 2.15 million, up about 23% from 1.75 million in the previous quarter

- The cryptocurrency trading platform is anticipating international expansion beyond its US homebase and plans to expand its product offerings in the future, Stephen Ehrlich, CEO and co-founder of Voyager said in a statement

Cryptocurrency trading platform Voyager Digital preliminary revenue fell about 40% from the previous quarter, the company reported on Wednesday.

Voyager projects its revenue for its fiscal 2022 first quarter ending on September 30 to be between $63 million to $67 million, down from $109 million in the previous quarter ending on June 30.

The crypto company declined to comment further when requested by Blockworks, but referenced the statement in the press release that “Voyager’s transactional volume is contingent on market volume and the overall market volume decreased substantially in July and August.”

The company operates on a non-standard fiscal quarter, a spokesperson told Blockworks. Voyager’s F1Q is September, F2Q is December, F3Q March and F4Q June, the spokesperson said. So, its Fiscal Year for 2022 is July 2021 to June 2022.

The three-year-old company provides users over 60 digital assets with the ability to earn rewards up to 12% on more than 30 cryptocurrencies. Although revenue is projected lower, Voyager’s total verified users on its platform increased to more than 2.15 million, up about 23% from 1.75 million in the previous quarter, according to the data.

Preliminary data from Voyager Digital

Preliminary data from Voyager Digital“Our marketing efforts are contributing to consistent user growth, and we’ve seen trading volume rebound following the general industry-wide downtrend witnessed in July,” Stephen Ehrlich, CEO and co-founder of Voyager said in a statement.

The company is anticipating international expansion beyond its US homebase and plans to expand its product offerings in the future, Ehrlich said.

“We have begun to diversify our revenue model to generate long term staking rewards providing recurring revenue,” Ehrlich said. “As we continue to develop staking capabilities, we expect that reward and yield revenue will generate a minimum of $40-50 million of reward and yield revenue for the December quarter, in addition to the standard transactional revenue,” he added.

In early August, Voyager announced its plans to acquire crypto payment platform Coinify to accelerate its international expansion and enhance its capabilities in the payment world. The buy gave the company’s customers a new way to make purchases and payments from their accounts on the platform.

Separately in June, Blockworks reported that Voyager was better positioned than some of its larger competitors to attract users into the cryptocurrency market, according to a note by Compass Point Research and Trading.

The note found that Voyager’s commission-free trading model, array of crypto trading pairs and big coin offerings gave it a stronger value proposition over similar companies like Coinbase, Square and Paypal, Compass Point senior analysts Michael Del Grosso and Chris Allen wrote in a June 20 research note.