What Is the Future of Crypto Investment Among Family Offices?

London-based firm of billionaire Simon Nixon set to increase allocation to crypto

Source: Shutterstock

- Family office interest in digital assets likely to increase as secure platforms emerge and regulations become more clear, Aite-Novarica senior analyst says

- Seek Capital managing director said digital assets has potential to be “very significant part of the future financial system”

More family offices are considering cryptocurrencies, but widespread adoption among wealth managers with fiduciary obligations could remain stymied in certain regions until regulatory frameworks become more clear.

A Goldman Sachs survey conducted earlier this year found that while about 15% of family offices globally and about 25% in the Americas, have exposure to cryptocurrencies to date, almost half indicated they may be interested in initiating exposure in the future.

The report, released last month, reflects the views of 150 family office decision-makers from all major regions.

“Some family offices are considering cryptocurrencies as a way to position for higher inflation, prolonged low rates, and other macroeconomic developments following a year of unprecedented global monetary and fiscal stimulus,” the report states. “Of the approximately two-thirds of family offices that are actively thinking about an increase in inflation, digital assets emerged as one portfolio solution.”

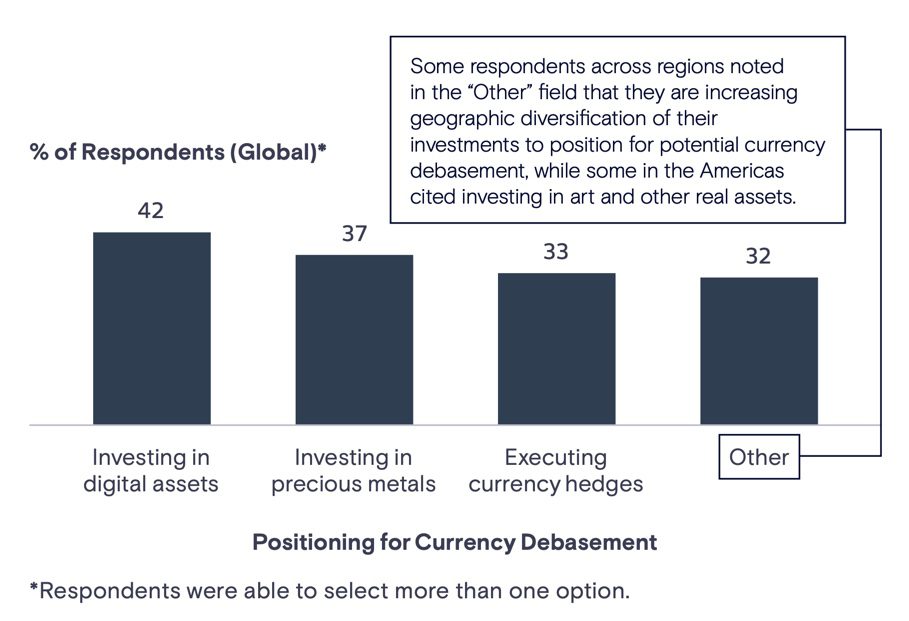

Among those currently prepared for this economic environment, digital assets (42%) and precious metals (37%) are the most popular implementations.

While some family offices in the US and Europe are buying bitcoin and other digital assets as a hedge against cash, interest is mixed among Asia’s financial centers. Just under 10% of Asia and EMEA respondents had existing investments in cryptocurrencies, according to the Goldman Sachs survey.

Source: Widening the Aperture: Family Office Investment Insights; Goldman Sachs, July 2021

Source: Widening the Aperture: Family Office Investment Insights; Goldman Sachs, July 2021Wally Okby, a senior analyst for Aite-Novarica’s wealth management practice, said that in Switzerland, where digital asset regulation is very advanced, private banks have been delving into crypto. Such institutions want to appeal to family offices, for example, who may be allocating 1% or more to the space.

“Those private banks that have built the capability for private clients to trade and custodize certain crypto coins, it’s not just done in a vacuum, it’s done out of market demand,” Okby told Blockworks. “It’s growing fast but still nascent compared to where it’ll probably be or at least where I think it will be in a few years time.”

Okby wrote in a January report that certain global family offices don’t invest in digital assets because they can’t do so within a secure platform that accommodates classic banking and digital assets. As these platforms start to emerge, time will tell whether these clients will invest and develop the asset class to greater scale.

The Goldman Sachs report highlighted that some family offices don’t view cryptocurrencies as a good store of value, while other respondents said they had reservations about the underlying infrastructure or environmental impacts of bitcoin mining.

In the US, it is a “high hurdle” for many wealth managers with a fiduciary obligation to justify crypto investments, he said, especially because the regulatory frameworks around digital assets is not yet clear.

“Once a wealth manager says it’s a fiduciary, it’s very hard or virtually impossible to say … I’m going to suggest or recommend that you invest in a digital asset which is new, doesn’t have much of a track record and is reported to play a part in fraud and market manipulation,” Okby explained.

Wall Street giants like Morgan Stanley have begun to offer clients exposure to crypto through several funds. But Okby noted that limiting these offerings to its wealthiest clients with “an aggressive risk tolerance” gives Morgan Stanley some protection.

“I’m sure there are going to be those firms that are just not going to do it and there are going to be some who will do it,” Okby said. “…Wealth managers are not known to be comfortable with risk. When you talk about crypto, it’s risk, and especially if it’s unregulated, then it’s really risky.”

Increasing allocations

The London-based family office of billionaire Simon Nixon is set to increase its allocation to crypto and build out its staff focused on the sector. Nixon, who co-founded Moneysupermarket.com in 1993, reportedly manages more than $1 billion of personal assets in the tech sector.

“As a family office we are always looking to the future for planning how to deploy capital today,” said Adam Proctor, managing director at Seek Capital. “We feel crypto and blockchain and associated technologies more broadly as having potential to be a very significant part of the future financial system and hence looking to add dedicated talent to this area.”

The firm has invested in areas across crypto for many years, but the sector is becoming a more important focus, Proctor told Blockworks. He noted that Seek Capital is initially looking to hire an individual with detailed technical and industry knowledge of crypto and may add more resources over the coming years.

The executive declined to comment on specifics about the size of Seek Capital’s current or planned future crypto allocation but noted that the firm would be looking to invest broadly in the sector.

“At this stage, [we’re] keeping a very open mind,” he said, “and will then no doubt dive deeper into certain areas once we have more expertise on the team.”

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.