BTC Slumps as Kazakhstan Miners Power Down: Markets Wrap

BTC trades sub $44,000 as miners in Kazakhstan power down due to a forced internet outage by the nation’s government

The businessman is touch bitcoins as part of a business network on blue background. bitcoin cryptocurrency ideas concept and virtual financial chart diagram, Digital symbol of a new virtual currency

- BTC briefly trades below $44,000 as global hashrate declined earlier today

- This BTC sell-off has not been driven by forced long liquidations

Authorities of Kazakhstan declared a nationwide state of emergency today and shut down the country’s internet.

As a result of the internet outage, the global hashrate took a dive earlier before later recovering.

This BTC sell-off is not the result of forced liquidations.

Serena Williams purchased a CryptoPunk.

Latest in Macro:

- S&P 500: 4,700, -1.94%

- NASDAQ: 15,100, -3.34%

- Gold: $1,809, -0.22%

- WTI Crude Oil: $77.05, +0.08%

- 10-Year Treasury: 1.702%, +0.036%

Latest in Crypto:

- BTC: $44,155, -4.60%

- ETH: $3,612, -5.40%

- ETH/BTC: 0.0820, -0.73%

- BTC.D: 39.59%, +0.27%

Kazakhstan

Authorities of Kazakhstan declared a nationwide state of emergency today as citizens against the rise of fuel prices.

“Protests spread across the nation of 19 million this week in outrage over a New Year increase in prices for liquid petroleum gas (LPG), which is widely used to fuel cars in the west of the country,” read an article from The Moscow Times. “Thousands took to the streets in the country’s biggest city Almaty and in the western province of Mangystau, saying the price rise was unfair given oil and gas exporter Kazakhstan’s vast energy reserves.”

Hashrate drops

Due to the protests, Kazakhstan’s government shut down the nation’s access to the internet, according to The New York Times, which led to many bitcoin miners going off-line earlier today.

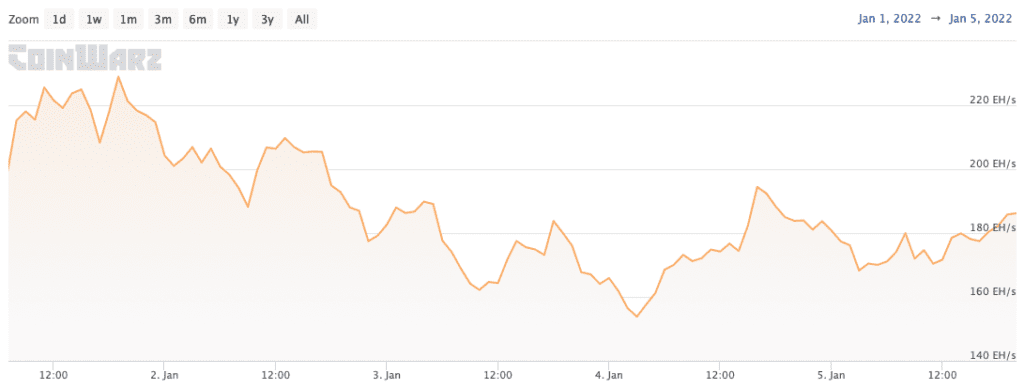

The hashrate dropped from a high of 194 EH/s on Jan. 4, to a low of 168 EH/s during the internet outage in Kazakhstan today, according to data from Coinwarz. (It is worth noting that hashrate is calculated differently by various sources.)

Bitcoin hashrate drop. Source: coinwarz.com

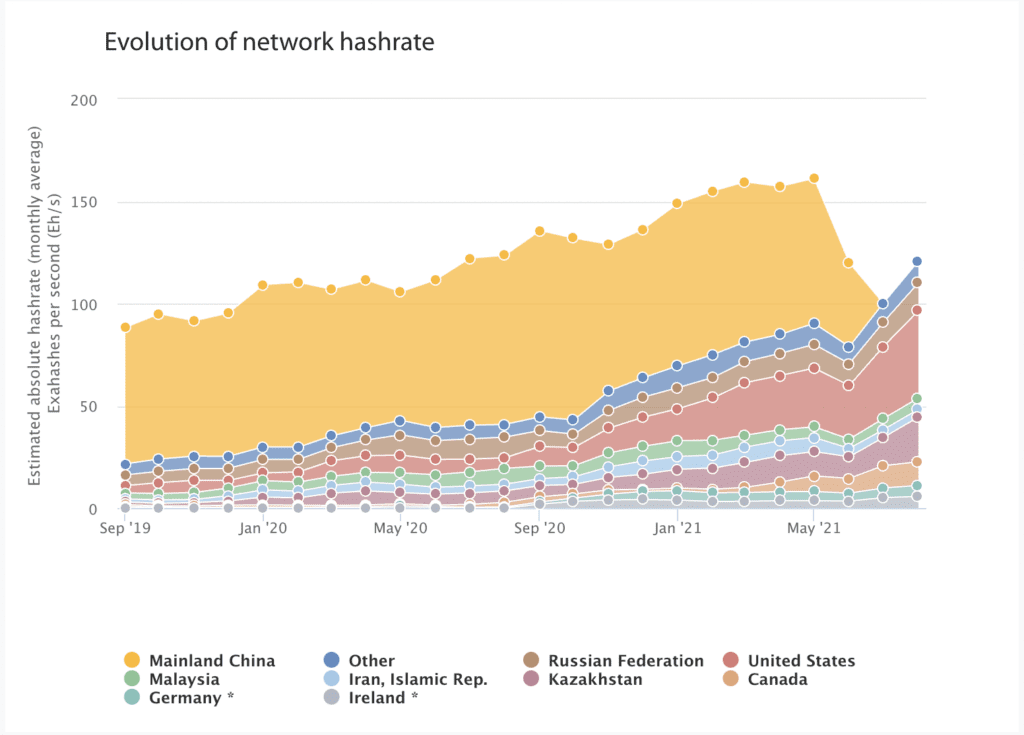

Bitcoin hashrate drop. Source: coinwarz.comKazakhstan accounts for roughly 21.9% of the global hash rate, according to the University of Cambridge. The internet outage is likely the reason behind the drop in global hash power online.

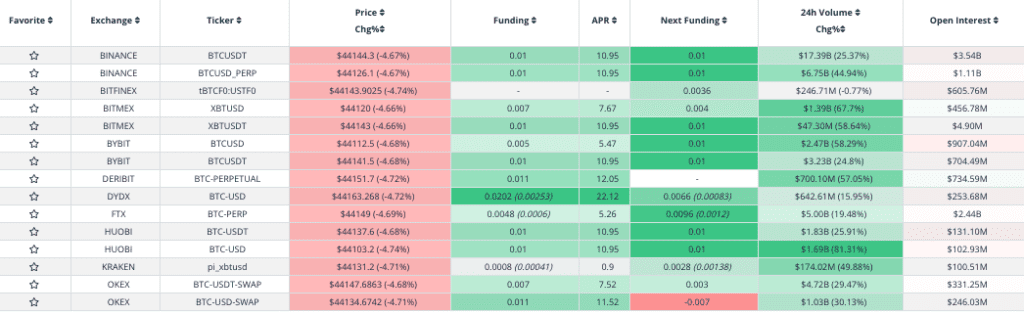

BTC derivatives

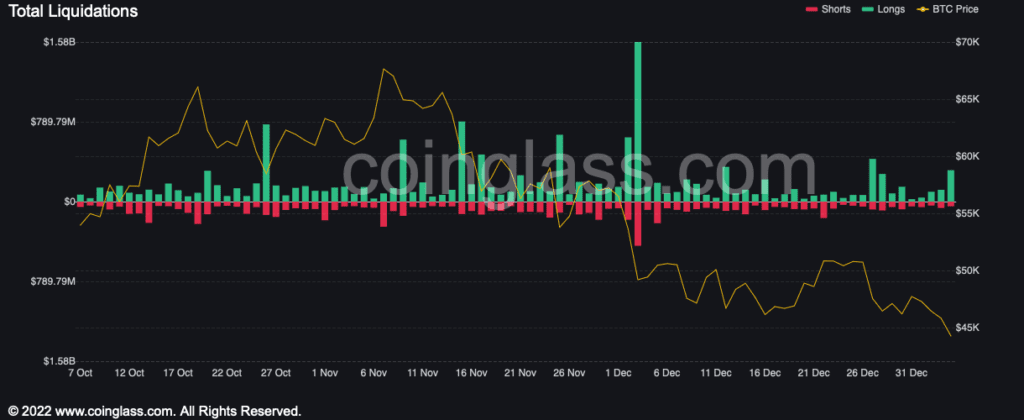

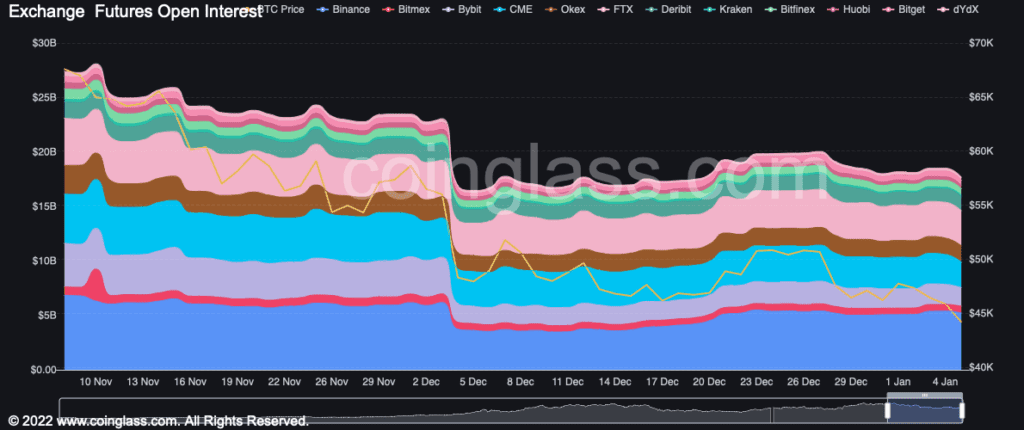

Unfortunately for BTC bulls, this move lower can’t be attributed to forced liquidations. $310 million worth of long positions have been closed, but futures open interest dropped just $840 million according to data from Coinglass.

Source: Coinglass

Source: Coinglass Source: Coinglass

Source: Coinglass

Perpetual funding rates show a slightly positive bias across most exchanges, so long side traders are still paying shorts to keep their positions open, according to Laevitas.

Source: Laevitas.ch

Source: Laevitas.ch

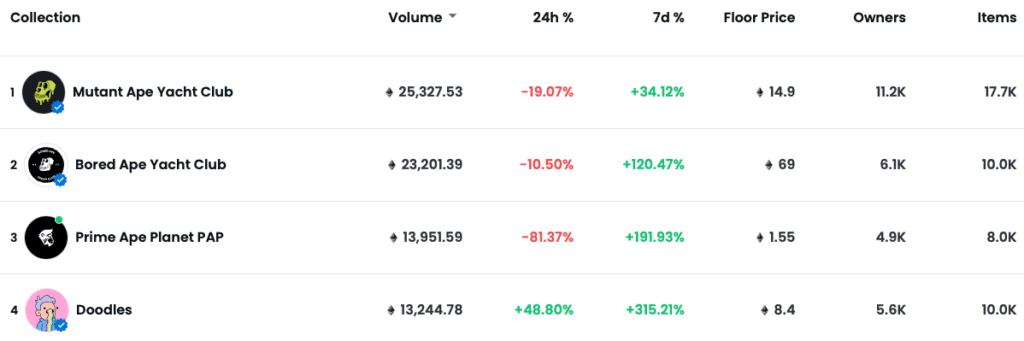

NFTs

Famous professional tennis player, Serena Williams, purchased a CryptoPunk and made it her profile picture on Twitter.

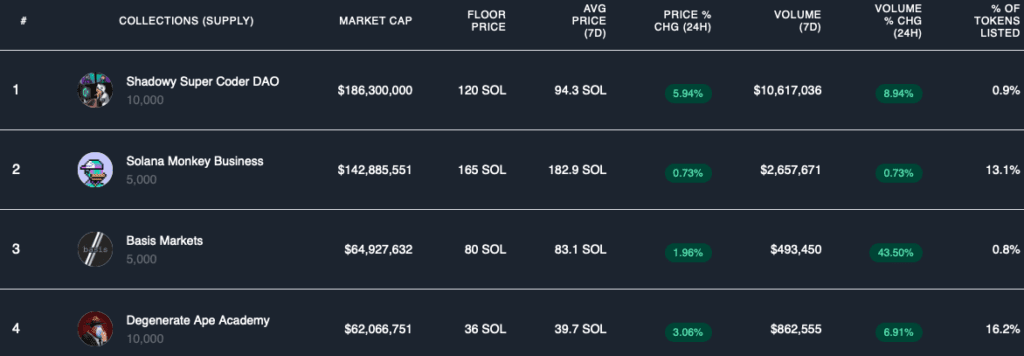

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.