Funds are Bullish on DOT; BTC Continues to Struggle: Markets Wrap

Digital asset funds are bullish on Polkadot (DOT) while BTC continues to consolidate below $60,000 despite inflation running hot

Shutterstock

- Polkdaot (DOT) and Terra (LUNA) are among the most commonly held assets in professional funds’ portfolios.

- BTC price stays below $60,000 as inflation runs hot

Many of the top crypto venture capital firms hold Polkadot (DOT), Terra (LUNA), Near (NEAR) and Oasis Network’s ROSE coins, according to a Messari report.

Bitcoin (BTC) continues to tread water in the midst of inflation and decoupling from the NASDAQ.

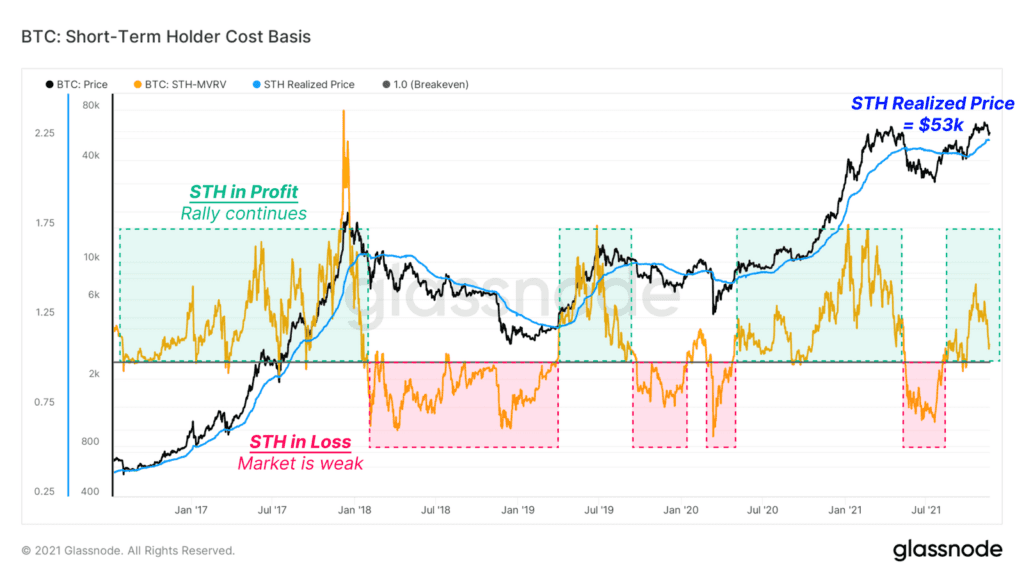

Short-term BTC holders could prove to be a headwind over the coming weeks if they look to close positions on any rallies.

The short-term holder realized price now sits near $53,000, according to Glassnode. A loss of this price level would signal further downside.

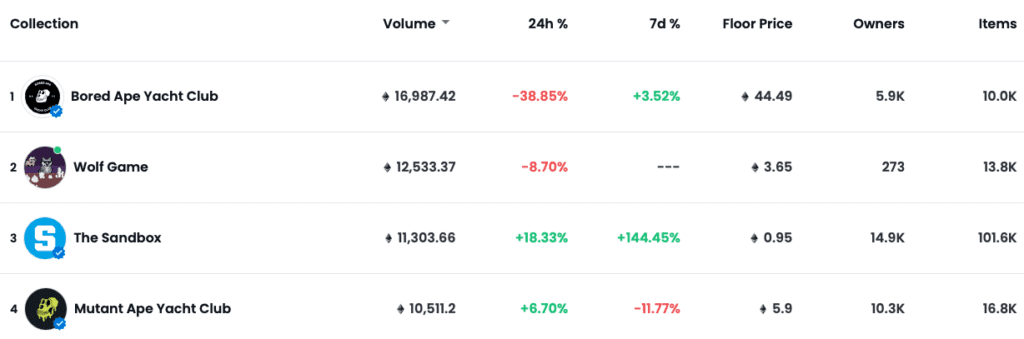

Bored Ape Yacht Club has seen its floor price drop after last week’s strong rally.

Latest in Macro:

- S&P 500: 4,682, -0.32%

- NASDAQ: 15,854, -1.26%

- Gold: $1,805, -2.14%

- WTI Crude Oil: $76.36, +0.55%

- 10-Year Treasury: 1.63%, +0.094%

Latest in Crypto:

- BTC: $56,924, -5.54%

- ETH: $4,071, -6.84%

- ETH/BTC: 0.0724, -0.28%

- BTC.D: 42.71%, -0.51%

DOT a favorite for crypto funds

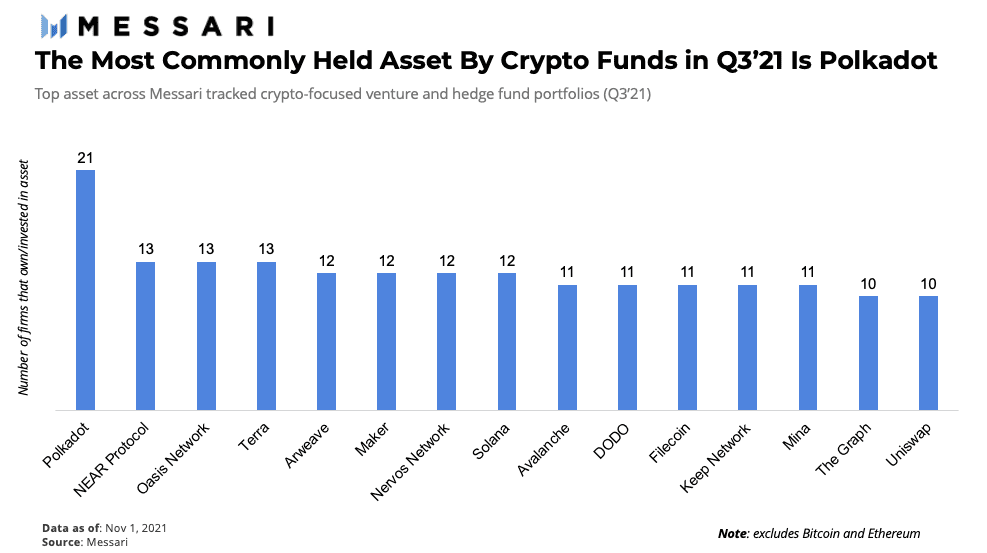

Messari conducted its Q3 analysis of top holdings among leading digital asset investment firms. The analysis tracked 53 firms and their holdings, which included 228 different assets.

Due to the public nature of blockchains, the holdings of prominent investors are accessible to anyone.

“Investing like a crypto fund – venture or hedge – has never been easier,” the Messari report states. “An average investor can quite literally copy-trade these portfolios and mirror any of their favorite funds.”

It is important to note, however, that many funds are given the chance to invest in projects during their early stages in exchange for tokens at lower valuations with a vesting period. This means that the tokens are not liquid outright, but instead unlocked over a predetermined amount of time.

“Most of these funds typically receive private placements at far cheaper valuations, and the short-term focused funds are waiting to liquidate a portion of their tokens once vested to record profits for their investors,” the report adds.

Twenty-one of the 53 funds in the report, or 39%, are invested in DOT, making it the most commonly held digital asset among the portfolios tracked. This means that large investors will likely determine which projects win Polkadot’s parachain auction slots.

BTC and ETH were excluded from the study.

ROSE, NEAR and LUNA tied for the second-most commonly held asset in the portfolios.

Source: Messari

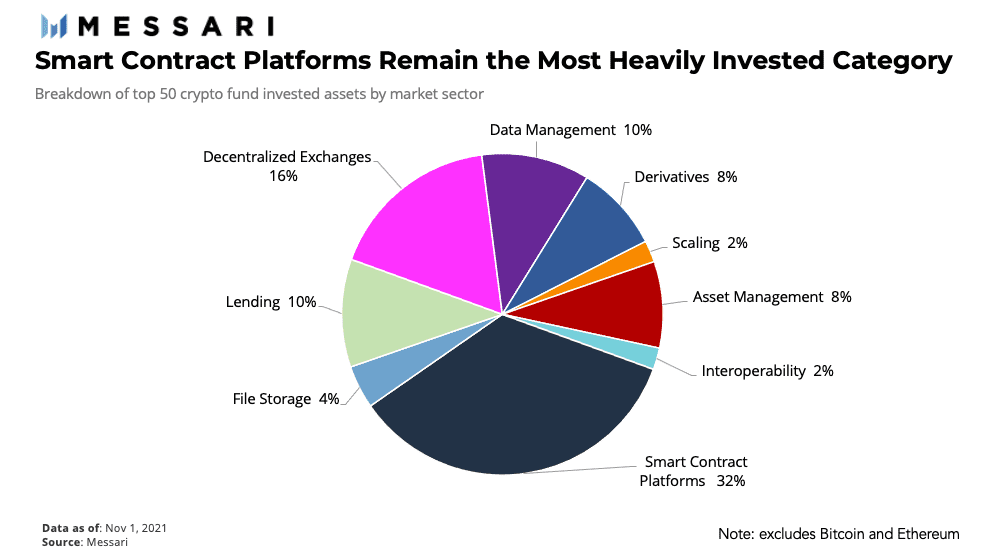

Source: MessariThe most popular digital asset category was smart contract platforms, Messari found, followed by decentralized exchanges (DEXs).

Source: Messari

Source: Messari

BTC struggles continue

BTC surged to nearly $59,000 this morning on news that President Biden would elect Jerome Powell for a second term as chairman of the Federal Reserve. BTC was unable to hold onto any gains, as price was hovering between $56,000 and $57,000 later in the afternoon.

With inflation running hot, BTC investors who were seeking a hedge against inflation are likely stifled by the recent BTC pullback.

“As long-term money enters the pool, it brings some very specific implications that anyone hedging with bitcoin should remain cognizant of,” Kay Khemani, managing director at Spectre.ai, told Blockworks. “The violent gyrations that bitcoin has historically seen will become less frequent, while the asset will become more susceptible to classical schools of thought. This could ultimately result in bitcoin as a mainstream asset at the mercy of institutionalist buy-or-sell ideologies, which are dictated by the very elite 1% that BTC was intended to disrupt.”

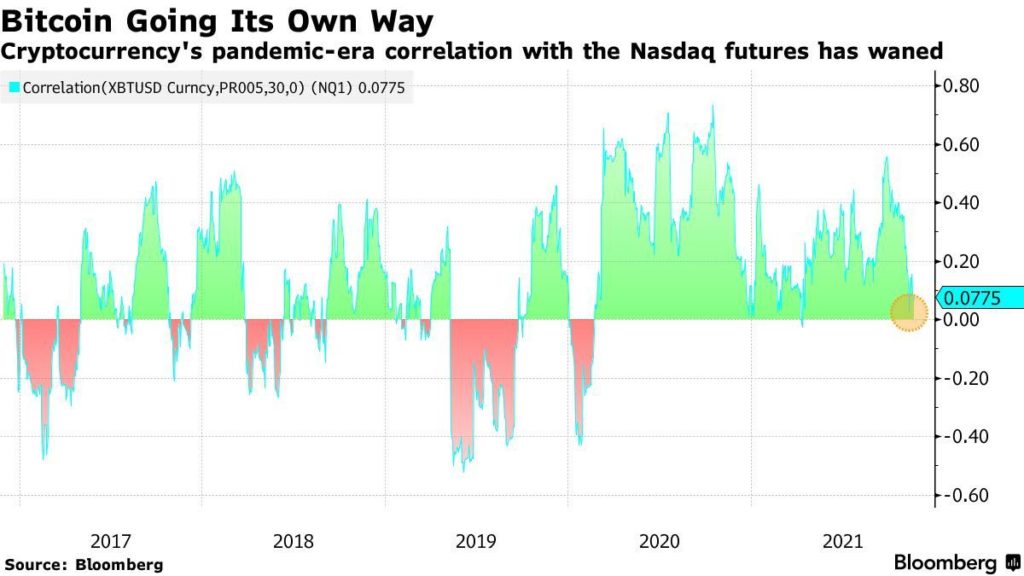

The correlation between BTC and the NASDAQ has been strong since the markets crashed in early 2020. The correlation has abated in recent weeks, as the NASDAQ continues to notch record highs and BTC consolidates below $60,000.

Source: Bloomberg

Source: BloombergOn-chain metrics

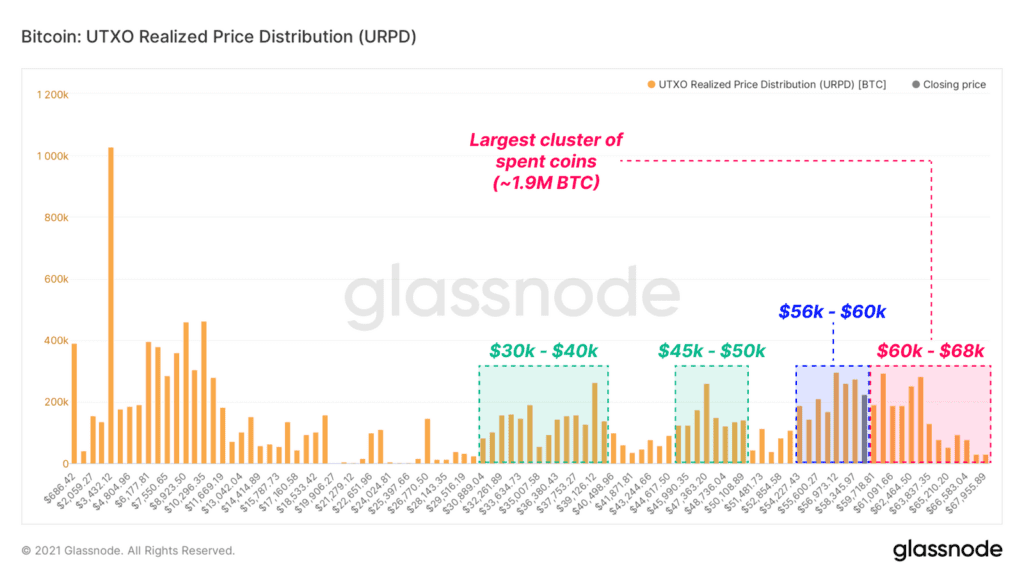

According to data from Glassnode, 15% of the BTC supply is currently being held at a loss. Roughly 10% of the supply last changed hands at $60,000 or higher, which could prove to be a challenge in the coming weeks as new market entrants may look to cut their losses on any rallies.

Source: Glassnode

Source: Glassnode

Short-term holders, normally consisting of traders and new market entrants, are sitting at an average cost basis of $53,000. If this level is lost, it would signal the potential for increased sell pressure prior to an eventual capitulation.

Source: Glassnode

Source: Glassnode

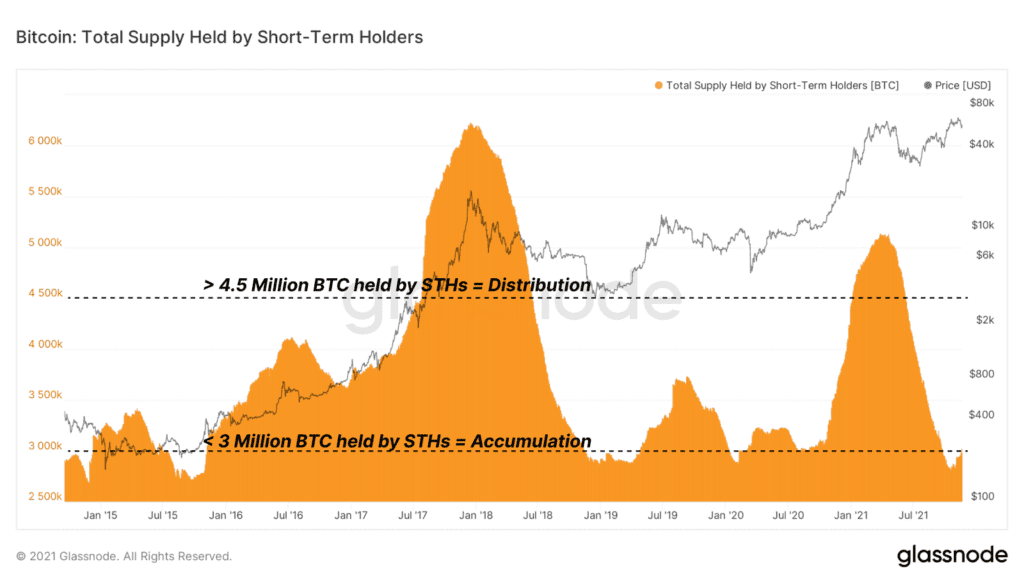

Short-term holders (STHs) hold roughly 3 million of the BTC supply. Glassnode data indicates that this figure is smaller than normal while bitcoin is hovering close to all-time highs.

A potential reason for this anomaly is the parabolic rise in BTC’s price. Today, investors aren’t sitting on 10x to 100x gains like in previous market cycles, and the amount of capital inflows required to move more than 6 million BTC is drastically higher than in 2017 and 2018.

Non-Fungible Tokens (NFTs)

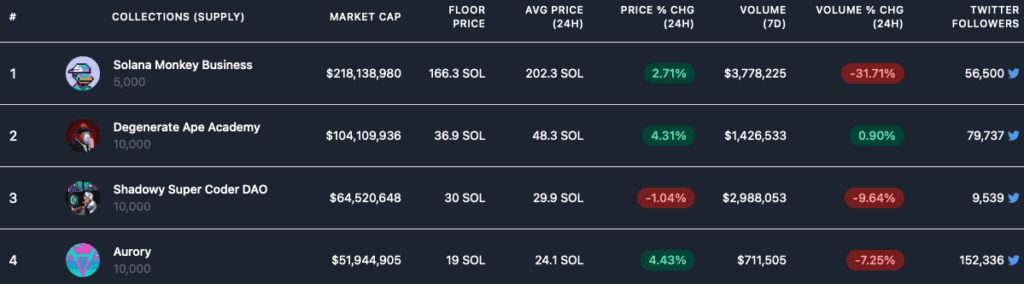

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up on Tuesday.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.