2021 Crypto VC Funding Tops $30B, Market is ‘Superheated’

Crypto capital investments have increased 445.5% year-over-year and 2021 isn’t over, yet

Blockworks exclusive art by Axel Rangel

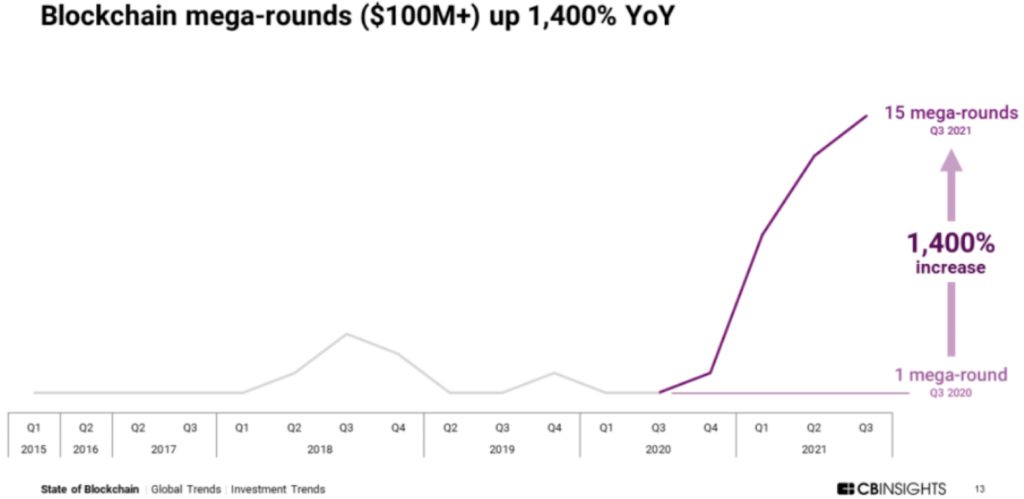

- In the third quarter of 2021, there were 15 “mega-rounds” of deals for $100 million or more, up 1,400% from one mega-round in the year-ago quarter, according to CB Insights

- “It’s no longer just smaller checks of $1 million to $5 million,” David Nage, portfolio manager at Arca, told Blockworks

Digital asset companies have seen a near-450% increase in venture capital funding this year, and VC firms expect it to grow even more next year.

During all of 2020, $5.5 billion of VC funding was put in crypto businesses, but in 2021, there has been about $30 billion of funding in crypto year-to-date, according to data by PitchBook. Crypto capital investments have increased 445.5% year-over-year and 2021 isn’t over, yet.

There were many VC funding rounds worth $100 million or more in the crypto space during 2021, including Celsius Network’s $750 million round and Forte’s $725 million capital raise in November. At the top of the list recently was NYDIG’s $1 billion growth equity funding round led by WestCap, which increased its valuation to $7 billion.

“It’s no longer just smaller checks of $1 million to $5 million,” David Nage, portfolio manager at Arca, told Blockworks. “Large pensions and endowments are willing to go in for $100 million, $200 million to $500 million in funds. It’s a maturing asset class that’s no longer just about bitcoin,” he said.

In the third quarter of 2021, there were 15 “mega-rounds” of blockchain-based deals for $100 million or more, up from just one mega-round in the year-ago quarter, CB Insights shows.

While digital asset companies were completing large funding rounds this year, firms such as Paradigm and Andreessen Horowitz (a16z) launched crypto funds at $2.5 billion and $2.2 billion, respectively.

“The crypto industry is seeing funding levels beyond what 2020 totaled, within half or two-thirds of the time,” Imran Khan, venture partner at Volt Capital and pilot at DeFi Alliance told Blockworks.

In total, crypto deals rack up anywhere from low millions to over $1 billion a week, both Khan and Nage said.

Compared to the first half of 2021, the third and fourth quarters have been “superheated and busy” with deals, Paul Veradittakit, partner at Pantera Capital, told Blockworks. Veradittakit helps manage over $7 billion for Pantera’s funds and has closed over 200 deals during his eight years at the company.

At the same time, new investors are leaning into the space, including traditional and institutional investors, Veradittakit said.

Over the past four weeks alone, Nage has seen an average of 30 to 35 deals announced every week. Nage manages Arca’s Endeavor Fund, which launched in October and focuses on early-stage to closed-end investments across gaming, decentralized finance and Web3.

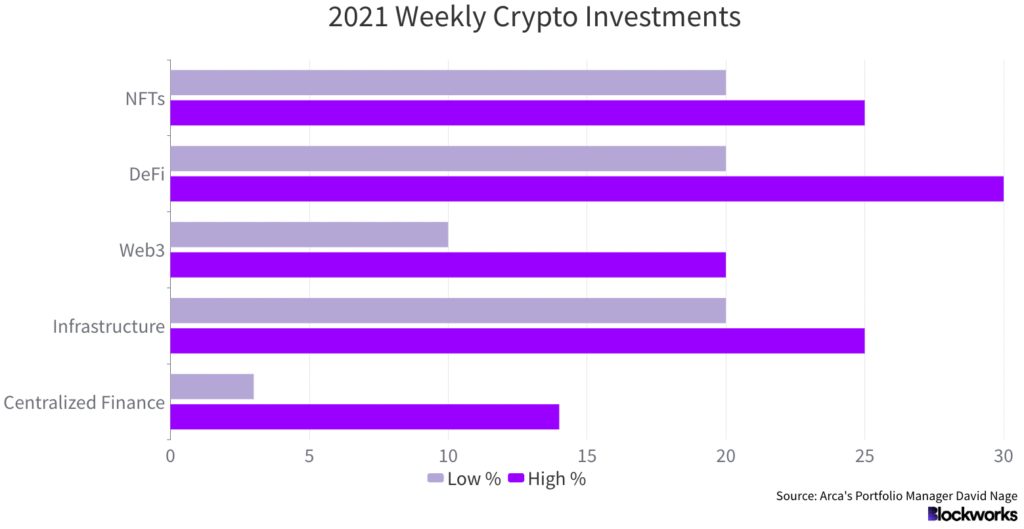

Companies focusing on NFTs, DeFi or infrastructure development received the most funding, followed by Web3 and centralized finance, Nage said (see chart below).

Deals are oversubscribed

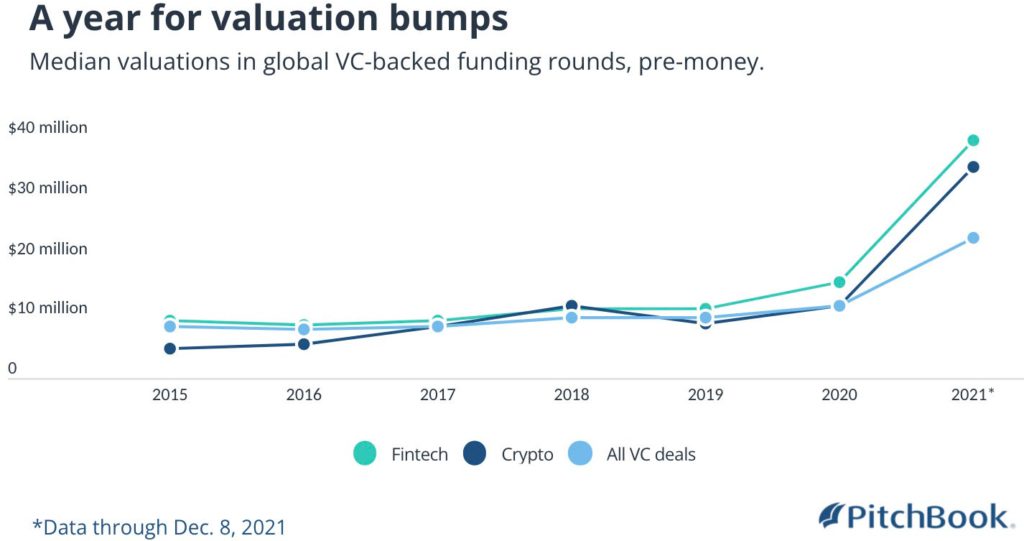

Every deal is oversubscribed two to three times, Nage said. Veradittakit agrees. “It’s just the sheer volume and amount of capital that wants to come in, therefore every round seems to be super-oversubscribed, which pushes the valuation up,” he said.

Global median valuations for crypto deals hit record highs this year and are up 191.6% from $12 million in 2020 to $35 million in 2021, according to data up to Dec. 8 by PitchBook.

Overall, Binance tops the list for the highest valuation of a crypto company at $300 billion, followed by Coinbase at $85.7 billion and Robinhood at $39 billion, according to research by Crypto Head. Robinhood has received over $5.57 billion in funding throughout its existence, the most capital raised by any crypto-related company, with FTX following it at $1.33 billion total funding received.

Khan warned valuations might not maintain these levels. “I think that there will be a point where valuations and teams will get higher to the point that there may be a cool-off period,” he added.

2022: Year of the metaverse

That cool-off period might not last long because of the growing enthusiasm around the metaverse and Web3.

“The flow of entrepreneurs coming into the landscape is not going to stop. The valuations will hopefully cool down to a place that makes more sense…but founders will not stop coming to crypto,” Khan added.

Veradittakit expects the market to remain heated for the first half of 2022, but anticipates a “bit of a pullback.” However, a lot of institutional capital will still be around as well as retail investors.

“Some VCs got into [crypto in] 2017, but ran away when the bear market came,” Veradittakit said. “We are going to have more traditional VCs stay this time around and see that this is the best time to invest as valuations cool off,” he added.

Nage predicts that interest in non-fungible tokens (NFTs), gaming and the metaverse will remain strong in 2022 and as a result, more money will flow into those spaces.

“We’re starting to see some real big hitters looking at NFTs, the metaverse and gaming going forward, so we’re going to see specialization and funding there,” Nage said.

The metaverse has seen an influx of market players fighting for a place in the space. From centralized companies such as Meta, formerly Facebook, or Microsoft, to DeFi companies like play-to-earn video game Axie Infinity or virtual real estate developer, Republic Realm. Wall Street giant Morgan Stanley has said the metaverse will be “the next big investment theme.”

“It’s no longer theoretical. It’s actually real,” Nage said. “It’s real users and real growth. It’s a confluence of money that’s been pent up over the past two to three years and is now this cluster ball of activity,” he added.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.