Bitcoin Infrastructure Firm Blockstream Reaches Unicorn Status With $3.2B Valuation

The company has raised a total of $299 million to date with the latest $210 million, Blockstream’s chief strategy officer told Blockworks.

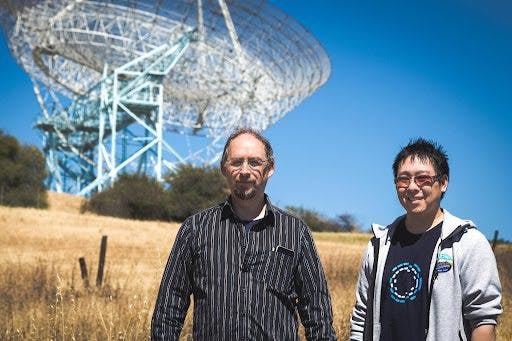

Blockstream CEO Adam Back (left) and chief strategy officer Samson Mow

- The funding comes in tandem with Blockstream’s acquisition of the intellectual property of a bitcoin mining manufacturer called Spondoolies

- The new capital will help expand the company’s mission to build additional infrastructure in the future with a focus on the Liquid Network and bitcoin financial products

Bitcoin infrastructure firm Blockstream announced it has raised $210 million in a Series B funding round, bringing the company’s valuation to $3.2 billion and officially making it a unicorn.

The funding was raised by two investors; an investment management company, Baillie Gifford, and iFinex, the parent company of the Hong Kong-based cryptocurrency exchange Bitfinex.

“In some ways this valuation is an affirmation of our focus to build on top of Bitcoin and our vision of rearchitecting finance with Bitcoin as the base layer. We still have a long way to go in achieving our goals and now we’re able to accelerate on multiple fronts,” the company’s Chief Strategy Officer Samson Mow said in an interview with Blockworks.

The company has raised a total of $299 million to date, including the latest $210 million, Mow said. “We raised a seed round in 2014 for $21 million, a Series A in 2016 for $57 million, and then added a $11 million convertible note,” he added.

Unicorns abound

Blockstream joins multiple other crypto-based companies that reached unicorn status during the month of August. CoinDCX became India’s first crypto-related unicorn with a valuation of $1.1 billion and FalconX raised $210 million in Series C funding, which brought its valuation to $3.75 billion, Blockworks previously reported.

Earlier this month, Singapore-based crypto financial service platform Matrixport announced it closed its $100 million Series C funding round also with a valuation over $1 billion. Bitpanda also shared a new, higher valuation of $4.1 billion after closing a funding round of $263 million, just five months after its last valuation of $1.2 billion.

The funding comes in tandem with Blockstream’s acquisition of the intellectual property of a bitcoin mining manufacturer called Spondoolies. This buyout will include rights to Spondoolies’ five different mining products, which the company says delivers energy-efficient mining equipment and the core team joining the company to build out Blockstream’s application-specific integrated circuit (ASIC) arm.

“We see a great deal of demand for both our enterprise-grade hosting of miners, as well as our financial products like the BMN (Blockstream Mining Note). With the new round of funding we should be able to expand in both financial products and mining, but the new ASIC we plan to bring to market will likely be our most disruptive endeavor to date,” Mow said. He also said they’re working with security token exchanges to list the BMN for trading.

The raise and acquisition will be used to add staff and advance Blockstream’s other mining products and services. The new mining infrastructure will be used for global partnerships, including a collaboration with Square to develop an open-sourced, solar-powered mining facility in the US, the company said.

Expanding its mission

Blockstream said the new capital will help expand the company’s mission to build additional infrastructure in the future with a focus on the Liquid Network and bitcoin financial products. The Liquid Network is a sidechain-based settlement network that enables faster, confidential bitcoin transactions and the issuance of digital assets for traders and exchanges, the company said. Since its launch, the Liquid Network has amassed more than $1.1 billion in network value and has seen growth with a number of platforms being built on the sidechain, it added.

In the future, Mow said the company will focus on launching additional products through Blockstream Finance like a Bitcoin Alpha Fund, as well as work with the Liquid Network’s ecosystem to expand use of its assets.

“In the next few years, bitcoin adoption around the world will increase rapidly and our goal is to make all our bitcoin products and services more intuitive and easily accessible to those new users,” Mow said.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.