Funding Wrap: Bitcoin miners bag cash ahead of ETF decisions

Plus, a Web3 fan engagement platform found backing from Warner Music Group and Winklevoss Capital

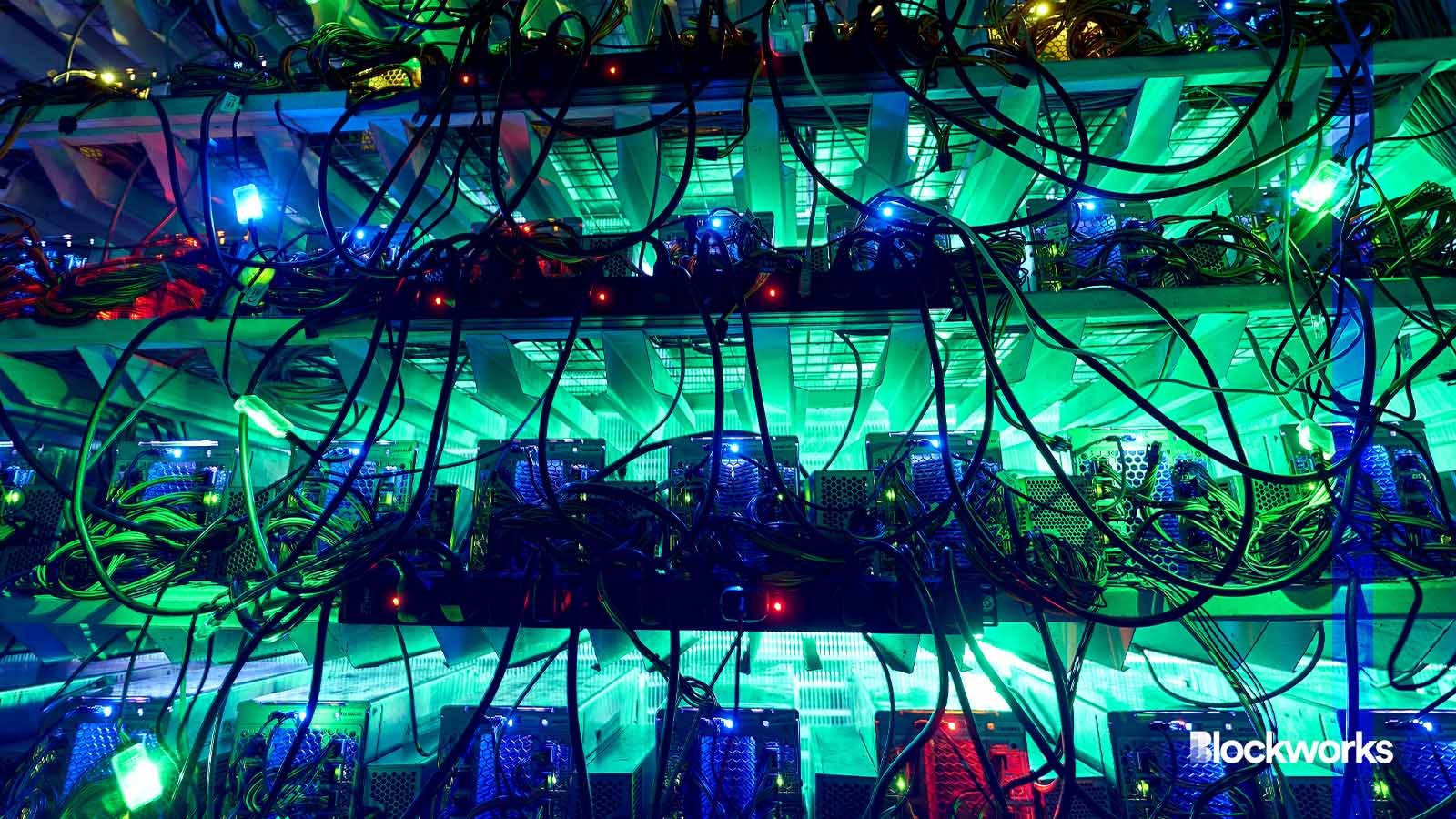

Artie Medvedev/Shutterstock modified by Blockworks

Bitcoin mining firms are deepening their financial war chests as speculation arises around potential spot bitcoin ETF decisions early next year.

Twitter co-founder and longtime bitcoin bull Jack Dorsey led a $6.2 million seed round in Mummolin, the company supporting the launch of a decentralized bitcoin mining pool called OCEAN.

Meanwhile, the Canadian mining company Bitfarms closed a private $60 million share sale with US institutional investors.

OCEAN is a non-custodial mining pool, meaning miners can lend computing power with ASIC interfaces and receive rewards directly from the bitcoin network without the company taking custody of the mined bitcoins.

“It went back to the principle of protecting bitcoin,” Dorsey said at a live event this week promoting OCEAN. “We need the people to have more independent, sovereign options [to mine bitcoin].”

It is Dorsey’s second round of 2023, joining his seed investment in bitcoin “voucher” provider Azteco in May.

Read more: Twitter co-founder Dorsey leads $6M investment in bitcoin voucher service

Bitfarms operates mining facilities in Quebec, the US state of Washington, Argentina, and Paraguay. The day before the private placement closed, the company announced the purchase of 35,888 T21 bitcoin miners and said the high-energy miners come at the most attractive price point the company has seen since 2020.

November was a busy month for bitcoin miners on the funding side. Abu Dhabi-based Phoenix Group raised $370 million via an initial public offering ahead of its listing on the emirate’s ADX stock exchange. Northern Data Group secured a $623 million debt financing facility from Tether Group, the company behind USDT, partly to scale its bitcoin mining operations.

Warner Music Group invests in Web3 fan engagement platform

Warner Music Group joined a group of investors including CMT Digital, Winklevoss Capital, and the NEAR Foundation to raise $3.5 million for a startup blockchain fan engagement platform named MITH, as Axios reported.

MITH allows creators to make tiered membership platforms for fans. MITH members can store collections and rewards on their profiles. The rapper Jack Harlow’s “Private Garden” membership platform launched earlier this month on the Polygon blockchain, according to Axios.

MITH’s raise is the latest funding round for a platform using Web3 monetization tools to connect celebrities with their fans. Modhaus, a platform for K-pop fan engagement, raised $8 million in November.

Other notable fundraises

- The cross-chain protocol Wormhole raised $225 million at a $2.5 billion valuation. Tier-1 investors in the round were Coinbase Ventures, Multicoin Capital and Arrington XRP Capital, per CryptoRank.

- Coinchange raised $10 million for its platform that simplifies DeFi yield and compliance for financial businesses.

- Decentralized physical infrastructure (DePIN) provider Grove raised $7.9 million with participation from Placeholder VC, Avon Ventures, and Druid Capital. DePIN refers to computing infrastructure, like wireless networks or file storage, that isn’t controlled by a centralized entity.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.