Bitcoin Price Hits ‘Greediest’ Point in 4 Months as It Flirts With $19K

The index, a measure of trader sentiment, rose to its highest point on Thursday after hovering near record lows for more than a month last year

Sittipong Phokawattana/Shutterstock.com modified by Blockworks

Digital assets are flashing signs of a potential short-term price recovery following a breakdown in the market last year and more than two months of subsequent sell-side pressure.

Bellwether crypto bitcoin is now at its “greediest” point in four months, according to the Bitcoin & Crypto Fear and Greed Index by research site BTC Tools. Other related indexes place that greed sentiment at two-month highs.

The crypto was last seen changing hands for around $18,830 after briefly reaching an intra-day peak above $19,100 on Thursday, exchange data show. That marked the first time it had traded beyond that point since Nov. 8 — the FTX breakdown. Bullish traders are now hoping for a strong daily close above $19,000 to validate a continuation of bullish price action.

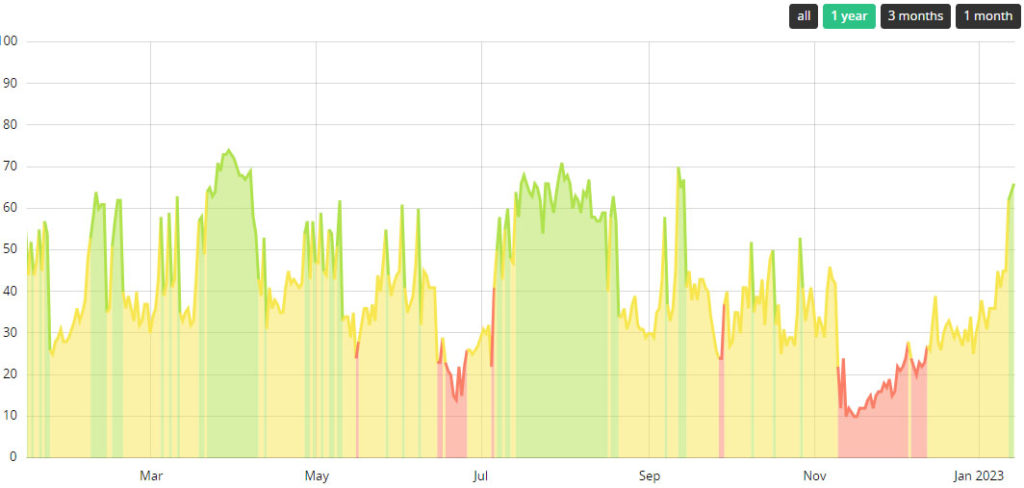

Bitcoin and, by extension, digital assets have hit a peak of 66 out of 100 on BTC Tools’ index — the highest recording since September 13, 2022. The index is a measure of four metrics including trade volume, open interest, social media sentiment and search data via Google and Bing.

Historical Bitcoin & Crypto Fear and Greed Index; Source: btctools.io

Historical Bitcoin & Crypto Fear and Greed Index; Source: btctools.io

A high value, above 50, indicates traders and investors in the market may be getting too greedy and a correction could soon be on the cards. Conversely, a value well below signals fear — by contrarian trading philosophy — may present a reversal to a downward trend.

“The index turned from Fear to Greed in the last few days as anticipation built over a bullish CPI print for December,” Zhong Yang Chan, head of research at CoinGecko told Blockworks.

“The CPI came in within consensus estimates, falling by 0.1% month-on-month, adding to hopes that the US Fed may further moderate rate hikes in the coming FOMC meetings,” he said.

Traditional markets have begun to push for higher gains, beginning Jan. 5, with the S&P 500 closing 0.34% higher to 3,983 on the day, following a shaky intra-day trading session. The Dow Jones Industrial is also up 3.45% to 34,182 after printing a series of higher-highs over a four-day period, beginning Jan. 6.

Though not all remain convinced as looming questions surrounding macroeconomic stability including rising inflation and record household debt have some hesitant to call for an early rebound in digital assets.

“Hopium is a powerful drug, but poor macroeconomic conditions combined with Genesis/Gemini’s SEC-baiting death match will sober up the market in short order,” Jehan Chu, founder of Hong Kong trading firm Kenetic told Blockworks. “Further lows and a final market capitulation seem closer than a recovery.”

Blood was on the streets

Most traders are aware of the statement that an opportune time to buy is “when there’s blood in the streets,” first coined by 19th-century British financier Nathan Rothschild.

The markets certainly had their bloodiest few days in November following revelations FTX allegedly defrauded customers and commingled funds with sister trading firm Alameda Research. It would appear traders are taking advantage of recent rivers of red in the short term.

Following their latest downfall, digital assets had struggled to recover from a brutal sell-off beginning on Nov. 6 at around $21,300 and ending on Nov. 21 with a low of $15,612 — a loss of more than 27% peak to trough.

At that point, the Fear and Greed index had dipped to its lowest point in more than 16 months indicating extreme fear had gripped the market where a recovery closely followed suit.

Recent daily levels of decentralized exchange trade volume have slowly been rising across multiple chains, data provided by DeFiLlama show.

Ethereum has also begun flashing signs of increased activity on-chain. The world’s second-largest crypto by market capitalization achieved a major milestone late Friday, with the number of daily validators exceeding 500,000.

Validators are essential in guaranteeing the integrity and security of the Ethereum network — more is generally a positive sign for the Ethereum ecosystem, as the economic stake securing the network now tops $22 billion.

The ETH-BTC ratio is once again exploring the top side of its long-term range, around 0.075 BTC per ETH. It’s most recent significant peak was just prior to the Merge in September, when ETH briefly hit 0.085. The downstream effects of the Merge on ether inflation have some analysts expecting the ether market cap to “flip” bitcoin’s in 2023.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.