BUIDL as collateral? Another step in the tokenization story

Deribit, Crypto[dot]com to allow institutions to post BlackRock’s tokenized money market fund as collateral

Securitize CEO Carlos Domingo | DAS 2022 New York by Blockworks

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

As you’ve probably heard a thousand times: Tokenization is in its early stages.

But a new tidbit seems to confirm that the utility of onchain assets will continue to evolve.

As it stands now, stablecoins are “really the only [RWA]” that have gained substantial product-market fit, Ondo Finance CEO Nathan Allman recently told me. (My fuller Q&A with Allman will hit Blockworks.co a bit later).

Circle had its IPO earlier this month and the Senate passed the GENIUS Act last night, both of which brought stablecoins further into the public eye.

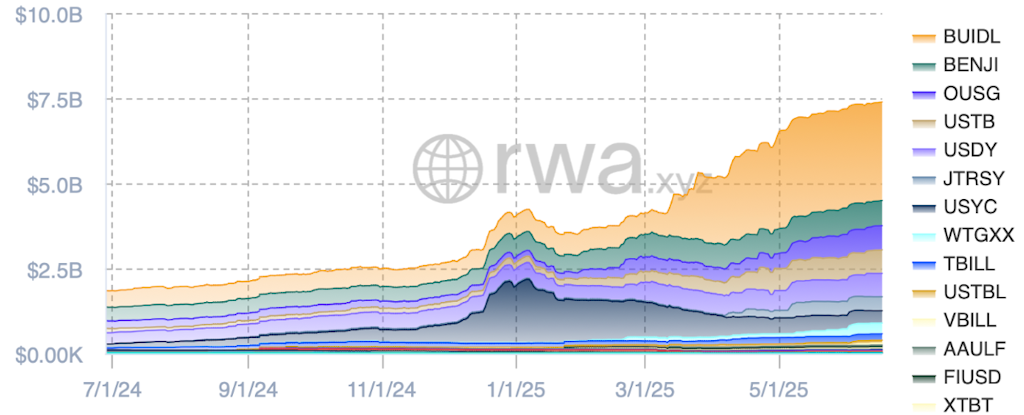

While the promise of more widespread access to tokenized stocks, bonds and other assets has not yet been fully realized, another tokenized RWA with growing traction is money market funds.

BlackRock got into that game with Securitize via the USD Institutional Digital Liquidity Fund (BUIDL) launch in March 2024. Its assets under management stand at roughly $2.9 billion.

Now, certain institutional clients using Crypto.com and Deribit can post BUIDL as collateral. The thought is enabling capital allocation flexibility while getting the relative price stability of tokenized Treasurys.

And the yield.

As Securitize CEO Carlos Domingo put it in a statement: “The fund is evolving from a yield-bearing token into a core component of crypto market infrastructure.”

Tokenized money market funds are not here to replace the ~$240 billion stablecoin market, industry watchers have noted.

Standard Chartered’s Waqar Chaudry told me in March that the two are “definitely complementary,” adding: “Many might prefer tokenized funds for collateral management.”

But while BlackRock’s Robbie Mitchnick sees tokenized yield funds as the predominant cash savings vehicle, he believes stablecoins “will retain their dominance” for payments and transactions. Deribit’s nearly $1.2 trillion in trading volume was one reason Coinbase agreed to buy the company last month.

We’ll see if and how today’s development contributes to accelerated tokenized yield fund adoption. And, of course, we’ll get back to you.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.