Matching Crypto Wallets to Twitter Accounts: Web3 Marketing Takes Off

Bancor and Immutable are among the users of a startup tool that matches millions of crypto wallet holders to social media profiles

Login/Shutterstock.com modified by Blockworks

The anonymity of crypto wallets has historically left Web3-focused marketing executives in the dark about their audience’s age, country or purchasing history, stifling efforts to reactivate existing users and acquire new ones.

A new tool seeks to change that.

Addressable, founded last June, scans various wallet data points, such as tokens purchased, balance, and overall transaction activity levels.

“Generally what we’re trying to understand is what is the wallet owner interested in and what are they doing on the blockchain,” Addressable co-founder Asaf Nadler said. “And on social media, we’re trying to understand the same thing.”

CTO Tomer Shlomo, CEO Tomer Sharoni, and Chief Scientist Dr. Asaf Nadler | Source: Addressable

CTO Tomer Shlomo, CEO Tomer Sharoni, and Chief Scientist Dr. Asaf Nadler | Source: Addressable

Addressable’s app parses through data from roughly 500 million crypto wallets, the company said, which is stored in one of its databases. Its matching algorithms seek to link those to a separate grouping of more than 100 million social media profiles.

Read more: The Definitive Guide on Crypto Wallets

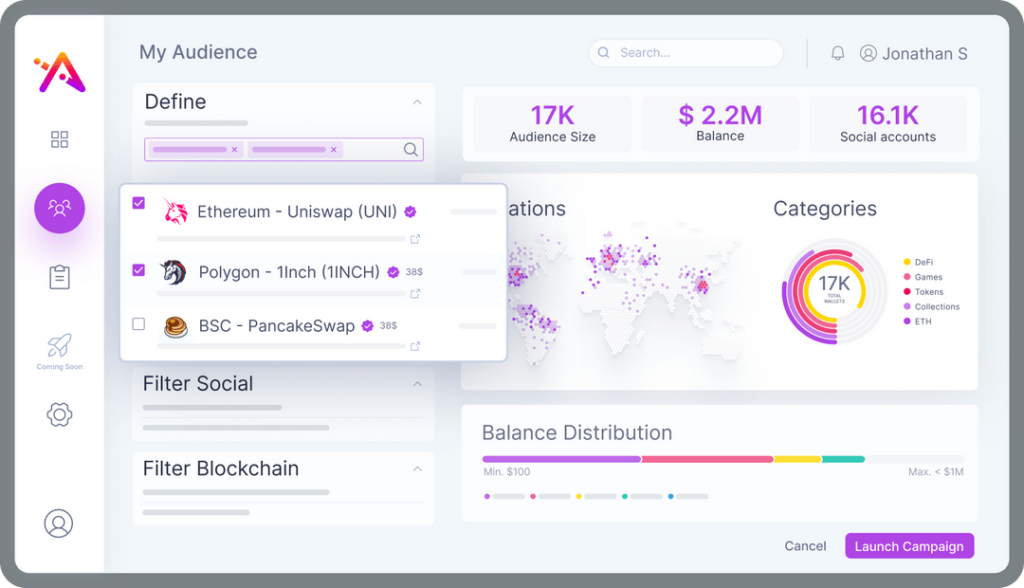

The app is currently matching 17 million crypto wallet holders to Twitter accounts — via analyzing various social media engagements — to help marketing pros in the crypto segment better understand, and reach, specific audiences.

“A marketer can say I want to target whoever bought tokens from me, or bought tokens from my competitors, or is playing blockchain games in the bear market,” Nadler added.

The Addressable app in action | Source: Addressable

The Addressable app in action | Source: AddressableBut the marketer will not see sensitive data, Nadler said, as the app maintains the privacy of crypto wallet holders and Twitter accounts by aggregating the data when it leaves its database.

Addressable is looking to match wallets to social media accounts on Instagram and TikTok in the future.

Targeting an audience

In a demo with Blockworks, Nadler showed what a marketer would do to target those holding a Bored Ape NFT, for example, in their crypto wallet. Such holders make up a community some view as especially valuable to reach when launching a new NFT collection, he said.

“They will not respond to any [direct message] you make to them directly; they get lots of DMs,” he said of Bored Ape Yacht Club (BAYC) NFT holders. “But if you get on their radar and they become followers of you, you have a better chance.”

While the BAYC collection, released in 2021, totals 10,000 NFTs, the Bored Ape Yacht Club’s Twitter page has about a million followers.

As Nadler navigated the app, 5,900 such wallets came up in Addressable’s database as holding a Bored Ape NFT. Those were matched to 5,100 Twitter accounts — to which a marketer could send out a promoted tweet.

By whittling down the massive follower base of the Bored Ape Yacht Club to a contingent representing less than 1% of that, Web3 marketers can avoid “shouting to the void,” Nadler said.

“How do you avoid spending the huge amount of money…and get directly to these people?” he explained. “You need the blockchain information to do that.”

Marketers also get a full view of the conversion rate from both social media and the blockchain, Addressable executives said. In addition to seeing the number of social media engagements, the app helps marketers see how many people bought its token, for example.

Users weigh in on the tool

Addressable users include DeFi protocol Bancor and Web3 games developer platform Immutable.

Nate Hindman, Bancor’s head of growth, said the company is getting set to launch an automated trading protocol built for custom on-chain limit orders.

“There is currently no way to perform oracle-free limit orders on decentralized exchanges…so we are specifically looking to attract DeFi users who might be interested in setting automated entry/exit strategies in their positions and performing automated buy low, sell high strategies on-chain,” he said.

Addressable has allowed Bancor to promote educational initiatives on the protocol to specific entities based on their level of on-chain trading and usage.

“We are able to see the users that come from Addressable-sourced audiences, and they are particularly well aligned with our target audiences,” Hindman added.

Russell Tan, marketing lead for Gods Unchained, a digital trading card game developed by Immutable, said he has used Addressable to target holders of other Web3 trading card games, which he called “a niche space.”

The executive added the results were “impressive” when compared to Immutable’s existing database, as the company saw a lower cost per click across the different segments it tested.

“Understanding the nature of on-chain activity, I believe they are able to accurately provide the right audiences, and have been able to build out specific audiences based on our requirements,” Tan said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.