Crypto Spreading Among the Wealthy in Singapore, Hong Kong: KPMG

A KPMG survey of 30 family offices and wealthy individuals found the majority have already invested in crypto in one way or another

Hong Kong skyline | Source: Shutterstock

- KPMG reported a clear appetite for digital assets among some of Singapore and Hong Kong’s wealthiest investors

- All respondents already invested in crypto held bitcoin but less than half disclosed DeFi tokens

Big Four accounting firm KPMG has indicated big interest in the crypto market from the wealthy elite of Singapore and Hong Kong.

KPMG surveyed 30 family offices and high net worth individuals across both regions for its inaugural Investing in Digital Assets report.

Of survey respondents, 58% reported skin in the crypto game while a further 34% intend to allocate funds to bitcoin, stablecoins and ether, as well as DeFi opportunities.

KPMG only gathered responses from investors whose assets under management ranged between $10 million to $500 million. Of the 58% already invested in crypto:

- 100% held bitcoin,

- 87% disclosed ether,

- 60% bought NFTs and other metaverse tokens, and

- 47% had DeFi tokens.

Beyond the actual assets, 58% of respondents also said they were investing in crypto service providers, including exchanges and software developers.

The study was conducted jointly between KPMG China and financial services company Aspen Digital. Results were taken during the second quarter of this year. At the time, markets across the board were in turmoil with macroeconomic conditions, such as rising inflation, taking center stage.

KPMG found interest in crypto has mainly been driven by prospects of high returns, portfolio diversification and increased confidence in the market following institutional uptake.

It wasn’t all bullish, though, with respondents stating the industry needs more mature methodologies for valuing crypto, the lack of which has given some investors pause.

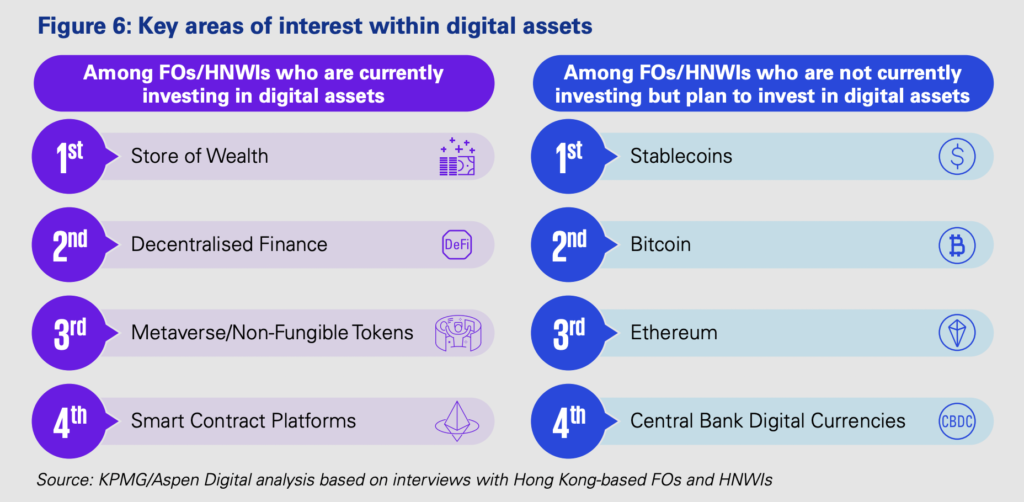

Wealthy investors are keen on crypto’s “store of wealth” proposition alongside decentralized finance | Source: KPMG

Wealthy investors are keen on crypto’s “store of wealth” proposition alongside decentralized finance | Source: KPMG

Not to mention, most already invested only allocated 5% of their portfolio to the digital asset class, a figure dampened by uncertainty around regulations and accounting standards.

The findings echo crypto exchange Bitstamp’s April Crypto Pulse survey which found that 80% of institutional investors believe crypto stood poised to overtake traditional investment vehicles within a decade.

KPMG overall found regulatory uncertainty continues to be a roadblock for major players across Singapore and Hong Kong, with investors hungry for a clear regulatory framework that balances both investor protections and industry growth.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.