Here’s What the Secondary NFT Market Looks Like

Data from NonFungible shows a vibrant secondary market with the number of buyers and volume of dollars traded surpassing the primary market

Blockworks exclusive art by Axel Rangel

- Data from NFT tracker NonFungible shows more buyers, higher dollar volume in secondary market for NFTs

- Experts say that NFTs are largely a diversification play for crypto whales

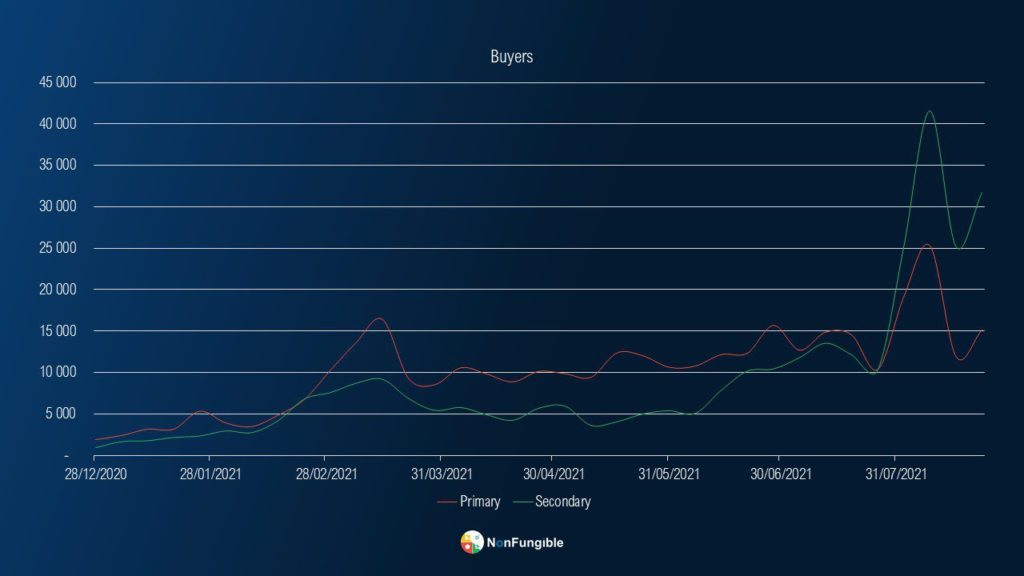

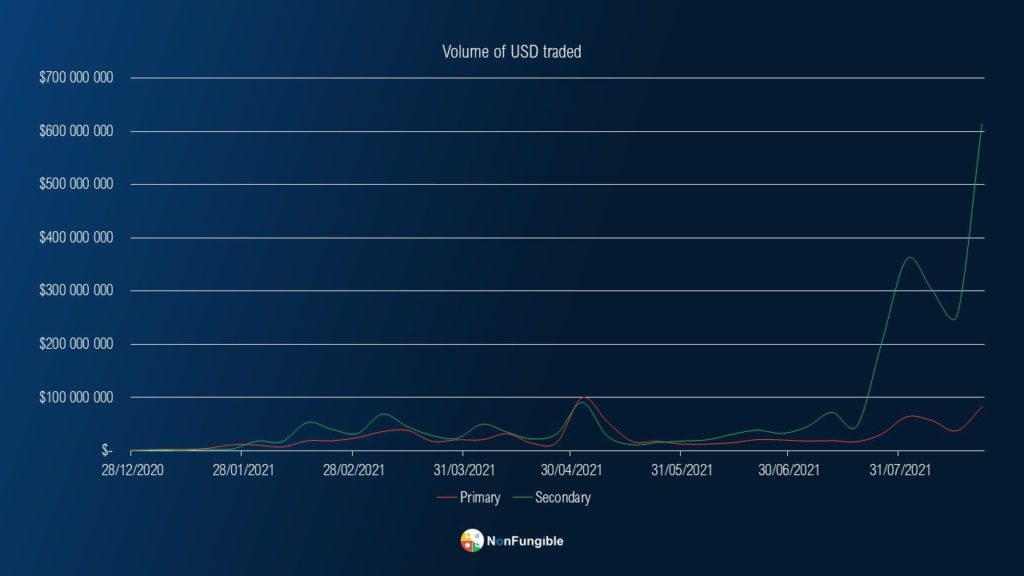

Despite the many questions surrounding the NFT market like provenance of the art and rightsholding, there’s a vibrant secondary market in play which has surpassed the primary market in number of buyers and volume of USD traded according to data from NonFungible.

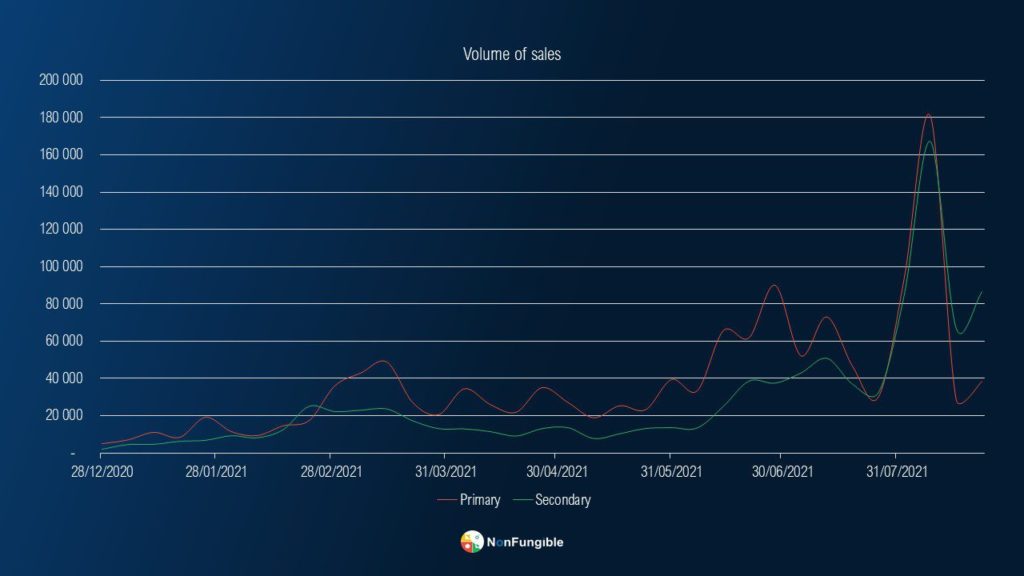

While NonFungible’s data shows that the volume of sales is still higher in the primary market rather than the secondary market, the volume of USD traded is far greater in the secondary market as are the number of buyers.

The data

For example, NonFungible’s data shows 40,000 buyers in the secondary market versus around 25,000 in the primary market.

NFT buyers; Source: NonFungible

NFT buyers; Source: NonFungibleAccording to NonFungible data, the volume of NFT sales is higher in the primary market than the secondary market.

NFT sales volume; Source: NonFungible

NFT sales volume; Source: NonFungible

However, the volume of USD traded is far greater in the secondary market as are the number of buyers as evidenced by the chart below.

Volume of USD traded in NFT community: Source NonFungible

Volume of USD traded in NFT community: Source NonFungible

All told, the above charts suggest that there’s an active trading community around NFTs, and some are being fractionalized.

Whales, according to NonFungible’s data, likely buy up the first round before trying to flip the NFTs on the secondary market where the dollar volume picks up.

Enter the metaverse

Initially, when NFTs first entered the public consciousness, many suggested that there was not a liquid secondary market. What secondary market did exist was centered around brand name artists like Beeple. But for every Beeple, there were thousands of other artists that watched their NFTs stay static on markets and not move into wallets.

Jenna Pilgrim, co-founder of Streambed, a blockchain-powered rights management platform for NFT holders, attributes part of this growth story on the retail side to the mainstreaming of the ‘metaverse’ — a virtual world where NFTs become virtual real-world property.

“The emergence of and rise in popularity of metaverse worlds and new forms of investing in them should drive more organic investment that will trickle down to the average consumer,” she told Blockworks, arguing that the only thing holding back the metaverse from expanding is the clunky UI/UX on most platforms.

Institutional investors?

The next question is, how much of this volume is being driven by institutional investors?

Not so much, according to Valkyrie Investments. Valkyrie’s head of research, Sean Rooney, suggests that institutional interest is only on the infrastructure side for now and the Visa purchase of a CryptoPunk would be considered a “notable exception” and a one-off purchase.

“The bulk of people buying NFTs appear to be crypto whales looking to diversify out of long-term holdings like Solana and ETH, especially if they can buy them using those tokens, or others they have that underpin the blockchains where these assets are being sold and auctioned,” adds Valkyrie’s Chief Investment Officer Steven Mc Clurg, arguing that there’s too many concerns around taxation and custody as well as a lack of guidance on taxation for institutional dollars to flow in.

Streambed’s Pilgrim adds that if institutional investors want exposure to NFTs, they would simply invest in venture funds that are deploying capital to NFT infrastructure and companies rather than buying the NFTs themselves.

With eye-catching sales NFT sales like ‘Charlie Bit my Finger’, which went for nearly $700,000, USD, or a copy of the first DOGE photo selling for nearly $4 million, FOMO is going to be a huge driver says Pilgrim — but she’s concerned that people don’t know what they are buying given the uncertainty of law around rightsholding.

“This unfortunately leads undereducated buyers to buy an NFT with the hope of it appreciating in value, and then being unable to sell it,” she said.

Pilgrim hopes that more people will buy the NFTs for the sake of the art rather than a speculative investment.

“You have to really like the artwork itself, because you may be holding on to it for a while,” she said.

Are you a UK or EU reader that cant get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.