Gemini lawsuit is filled with ‘misrepresentations,’ DCG claims in motion to dismiss

The Gemini suit is pointing fingers at the wrong defendants, DCG claims in motion to dismiss

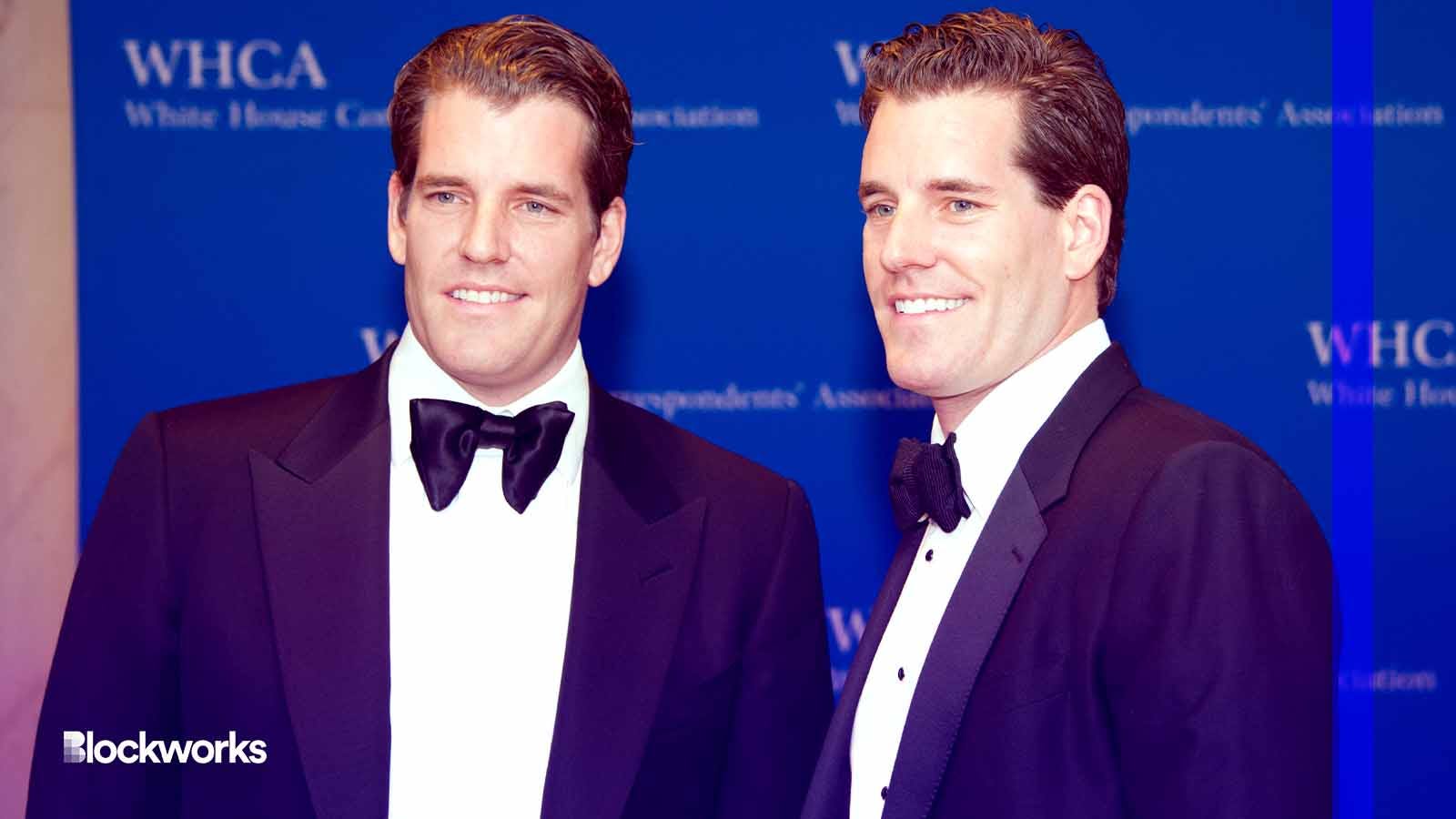

Gemini Founders Cameron & Tyler Winklevoss | Rena Schild/Shutterstock modified by Blockworks

Digital Currency Group filed a motion to dismiss Gemini’s lawsuit on Thursday.

The filing claims that the lawsuit is a misdirection led by Gemini and its founders, Cameron and Tyler Winklevoss, to redirect “irate customers.”

Lawyers representing defendants Digital Currency Group and CEO Barry Silbert claimed that the Winklevoss twins “began an effort to deflect blame by contriving a public, Twitter-based character assassination campaign against Defendants DCG (Genesis’s indirect parent) and Silbert (DCG’s founder)—neither of whom operated or oversaw the Gemini Earn program.”

However, Genesis — which is not listed as a defendant in the suit — coordinated the Gemini Earn Program with Gemini. It goes on to say that the named defendants — Silbert and DCG — “had virtually nothing to do” with the Gemini Earn Program.

DCG attempts to further clarify that the two are “separate companies” and that Genesis has its own executive and management teams.

Outside of the “misrepresentations” of claims made by Gemini, DCG and Silbert claim that Gemini did not “adequately and particularly” allege fraud, meaning that the suit should be dismissed because it lacks the necessary claims for it to move forward.

“Taken down to its actual substance, the Complaint identifies just one allegedly false representation by Defendants to Gemini— Silbert’s statements at the October 2022 lunch with Winklevoss,” the suit said.

Gemini itself, according to the motion, admitted that other events led to the injuries it claims which include the collapse of FTX, the “alleged misrepresentations by Genesis” and the decision “by third parties to file suit with Gemini.”

Gemini and the Winklevoss twins filed their complaint on July 7, alleging — as stated above —that DCG “aided and abetted Genesis in making fraudulent misrepresentations to Gemini with respect to Genesis’s financial condition and the support it received from DCG.”

At the time, DCG said that the complaint was a “publicity stunt.”

On Thursday, the firm referred to the lawsuit as “ridiculous” and added, in a tweet, that it wished to “continue working towards our mission of accelerating the development of a better financial system” if the lawsuit is dismissed.

Prior to the suit, the Winklevosses attempted to claw back $1.2 billion from DCG and Silbert, which it claims was owed to its Earn program because of the Genesis ties.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.