‘Deposit Tokens’ Could Trade On DeFi Like Stablecoins: JPMorgan

JPMorgan reckons tokenizing fiat deposits for use across major blockchains might be more acceptable than traditional stablecoins

Exclusive art by Axel Rangel, modified by Blockworks

Bank-issued deposit tokens are much safer than stablecoins for major institutions looking to transfer value across chains, JPMorgan says.

Surging interest and continued advancements in blockchain underscore the necessity for blockchain-based “cash equivalents,” the bank said alongside consulting firm Oliver Wyman in a recent joint study.

To date, stablecoins have predominantly fulfilled this demand. But JPMorgan and Oliver Wyman believe stablecoins — while having previously proved successful — would fall short of meeting serious (regulated) banking needs.

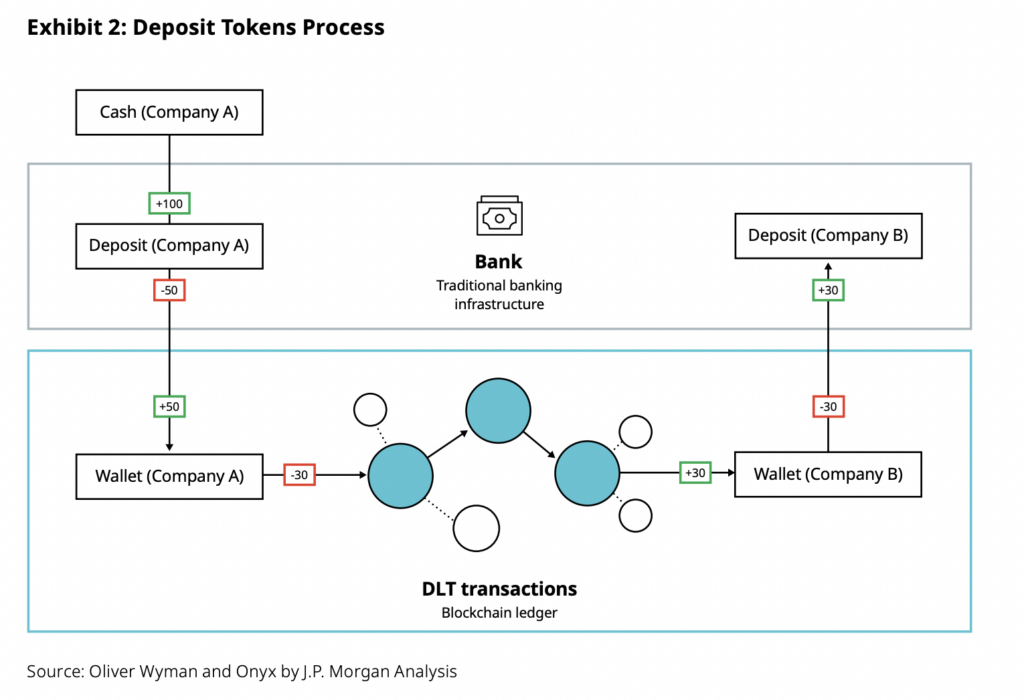

Enter “deposit tokens,” a separate concept from central bank digital currencies (CBDCs). These function similarly to traditional deposits held by licensed financial institutions such as commercial banks, except they exist and operate on-chain.

Last November, JPMorgan traded tokenized Singaporean dollars for tokenized Japanese yen as part of Singapore’s Project Guardian, with help from DBS Bank and SBI Digital Asset. The banks used a permissioned smart contract protocol, a fork of Aave Arc, powered by Polygon for the on-chain trade.

It’s those kinds of tokenized fiat currencies which JPMorgan refers to as “deposit tokens.”

They’re seen by traditional types as a secure and “stable form of money” that can operate on a large scale, says the report.

Deposit tokens would be supported by the issuer’s regulatory framework, capital and liquidity requirements, contingency funding access as well as “robust” consumer protection policies.

From the perspective of the issuing bank, the tokens simply represent a reorganization of the bank’s deposit liabilities on its balance sheet, without altering the bank’s asset composition.

As blockchain-based, tokenized assets thread deeper into payments infrastructure and other intricate commercial dealings, institutional-level participation means determining the most appropriate digital currencies, the pair said.

JPMorgan sees deposit tokens going DeFi

The rise of decentralized finance (DeFi) protocols may also result in the creation of liquidity pools for deposit tokens, according to the report.

These pools would be established by token holders who supply their deposits as liquidity on decentralized exchanges.

If the pools persist and serve a practical purpose, such as fostering market-based fungibility between deposit tokens, then tokenization should not cause a pricing disparity commonly seen in today’s stablecoin liquidity pools, the bank said.

Rather, the liquidity pools should reflect the deposit tokens’ fungibility as financial assets.

JPMorgan, one of the largest investment banks in the world, has been actively involved in blockchain development and implementation for at least six years.

It has previously toyed with blockchain-based solutions for various use cases including as supply chain management, trade finance, and digital identity verification.

In 2016, the bank spun up Quorum, an enterprise-focused version of the Ethereum blockchain to explore blockchain in financial services. JPMorgan sold Quorum to Ethereum powerhouse ConsenSys in 2020 for an undisclosed sum.

JPMorgan is now focused on tokenization platform Onyx, a permissioned interbank protocol for transferring value, settled in its USD-backed stablecoin JPM Coin.

David Canellis contributed reporting.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.