Digital Asset Investment Products See First Outflows in 17 Weeks: Markets Wrap

Digital asset investment products saw their first week of outflows in over 4 months

- Digital asset investment products saw first week of outflows in over 4 months

- Terra becomes the second largest layer-1 chain when measured by TVL

Digital asset investment products saw first week of outflows in over four months, according to a CoinShares report.

Terra becomes the second largest layer-1 chain when measured by TVL, according to DeFi Llama.

Margined open interest on BTC is more heavily weighted towards stablecoin margined open interest, implying a healthier market structure.

Latest in Macro:

- S&P 500: 4,568, -1.14%

- NASDAQ: 14,980, -1.24%

- Gold: $1,789, -0.60%

- WTI Crude Oil: $68.66, -3.10%

- 10-Year Treasury: 1.429%, +0.027%

Latest in Crypto:

- BTC: $47,291, +0.91%

- ETH: $3,943, +0.14%

- ETH/BTC: 0.0833, -0.98%

- BTC.D: 40.57%, +0.49%

Crypto investment products see outflows

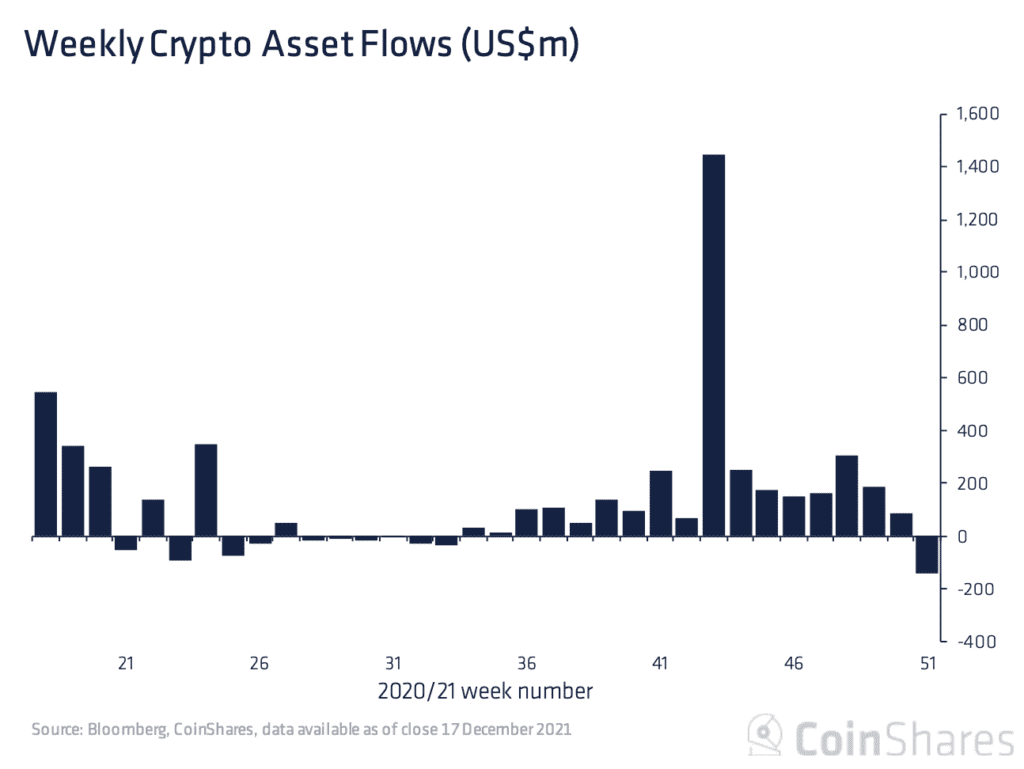

Digital asset investment products saw outflows totaling US$142m for the week ending on December 17th, the first outflow following a 17 week run of inflows, according to CoinShares latest fund flows report. The largest previous outflow took place in June of 2021 where weekly outflows totaled $97 million.

Source: CoinShares

Source: CoinSharesThe report notes that while the outflows appear alarming at first glance, there are a few key factors to consider for better context:

- The outflows come at a time when the Federal Reserve has signaled increased tapering of asset purchases and rate hikes in 2022, which has spurred outflows across all risk-on assets

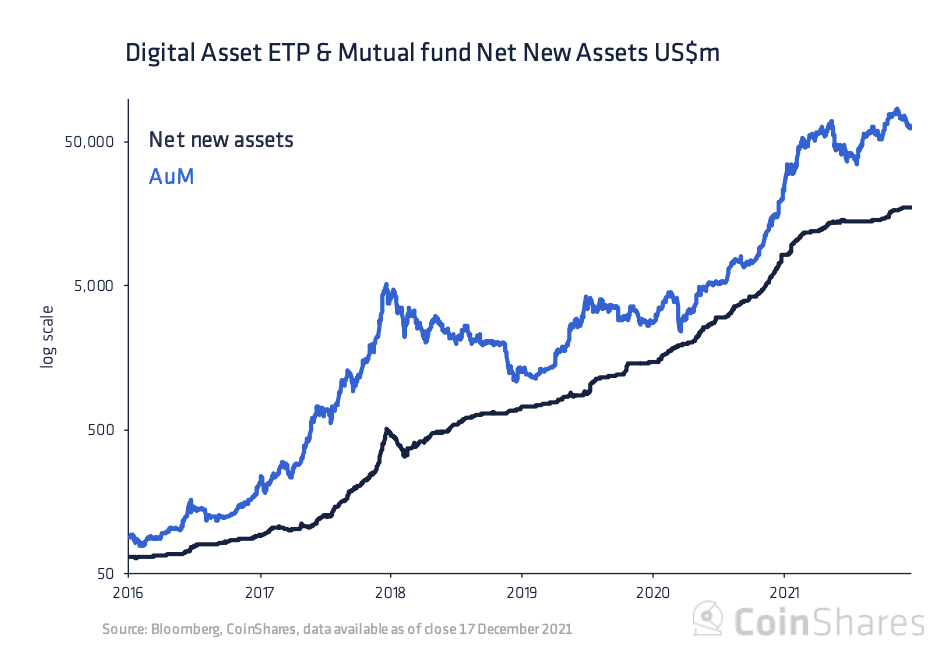

- Outflows only represent 0.23% of the total assets under management (AUM) versus the outflows seen in early 2018 at the start of the bear market, which were equal to 1.60% of AUM at the time.

- Inflows peaked at $9.5 billion for 2021 versus the total inflows of $6.7 billion seen in 2020, marking a record year of inflows for digital asset investment products.

Source: CoinShares

Source: CoinShares

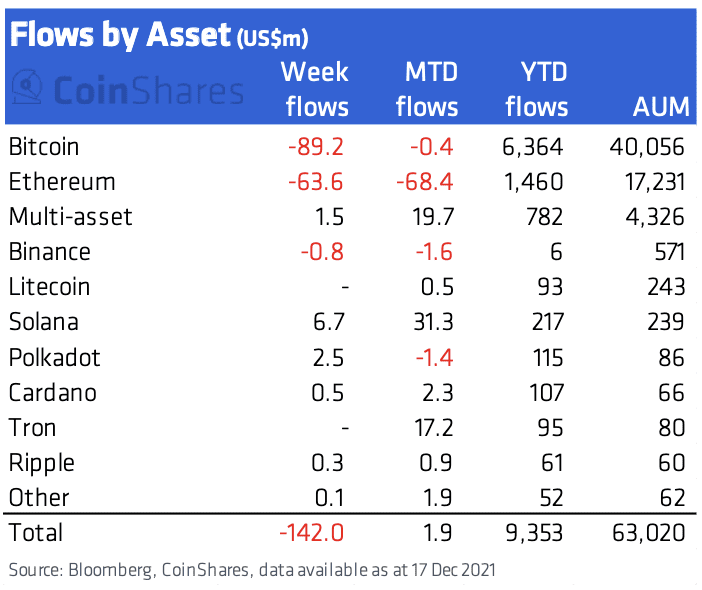

Bitcoin products saw outflows equal to $89.2 million, which was enough to push month-to-date flows into negative territory.

Ethereum investment products saw record outflows last week, totaling $64 million according to the CoinShares report.

While the two blue-chip digital assets saw outflows from investment vehicles, Solana, Polkadot, Cardano, Ripple and others saw net inflows despite the volatility seen in the digital assets market over the past few weeks.

Source: CoinShares

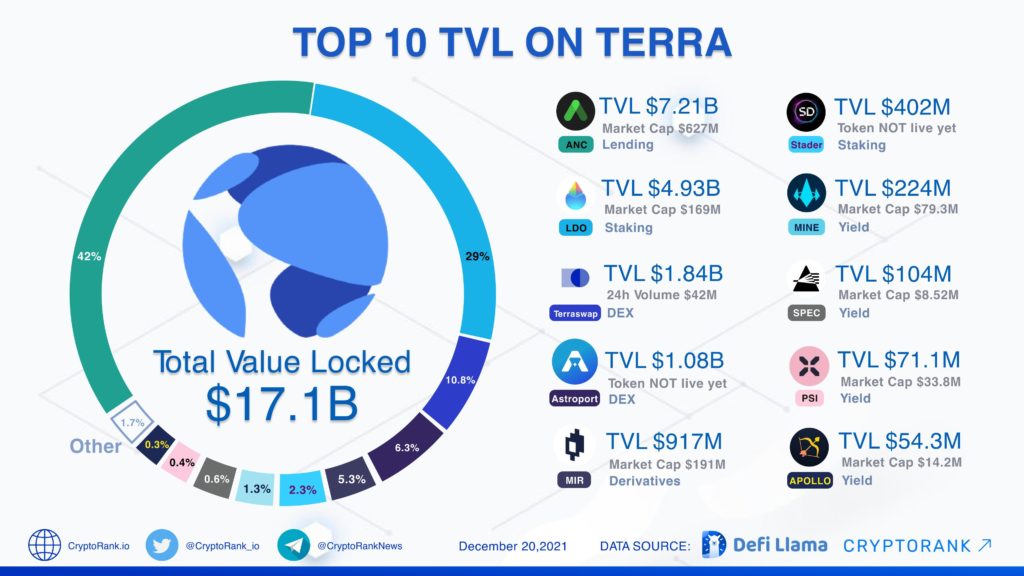

Source: CoinSharesTerra (LUNA) climbs to number 2 chain by TVL

Terra (LUNA) ousted Binance Smart Chain (BSC) and Avalanche (AVAX) over the weekend to become the second largest layer-1 chain when measured by total value locked (TVL). Terra currently boasts $17.66 billion of TVL according to data from DeFi Llama. The large increase in TVL can be attributed to the liquidity bootstrapping phase for a new DEX on Terra, Astroport, that concluded over the weekend.

Source: DeFi Llama

Source: DeFi LlamaBTC note

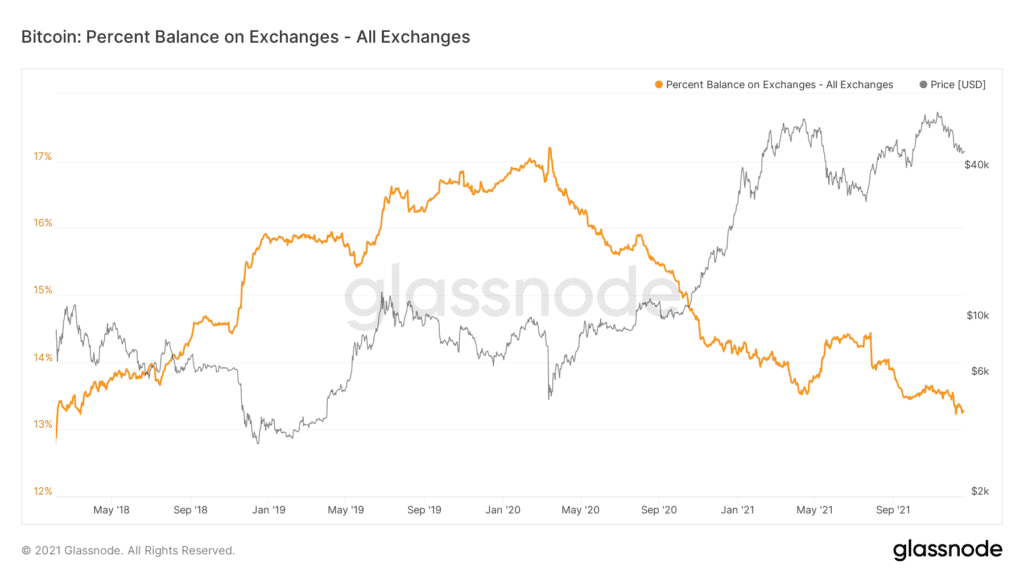

The percentage of BTC supply held of centralized exchanges is hovering near 3-year lows, according to data from Glassnode.

Source: Glassnode

Source: Glassnode

“There are two types of BTC derivatives: BTC/crypto margined and stablecoin/USD margined,” wrote on-chain analyst, Dylan LeClair. “BTC margined longs are unfavorable versus stablecoins during a market downturn because as asset prices fall traders using BTC as collateral are liquidated.”

As seen in the below chart, stablecoin margined open interest is outpacing BTC/crypto margined open interest which is seen as a healthier market structure.

Source: @DylanLeClair_

Source: @DylanLeClair_Non-Fungible Tokens (NFTs)

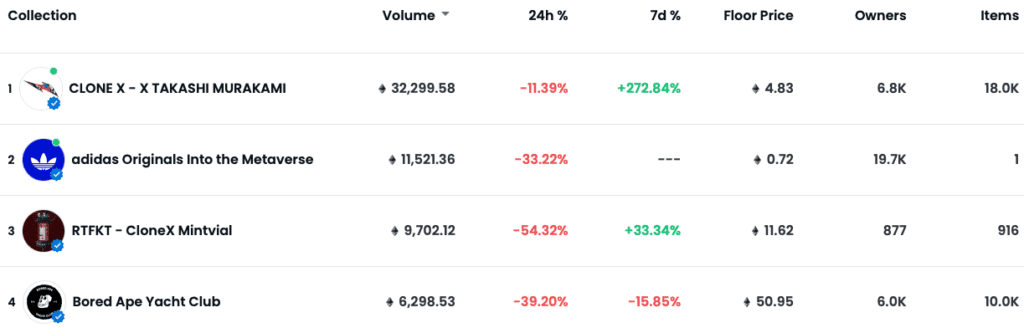

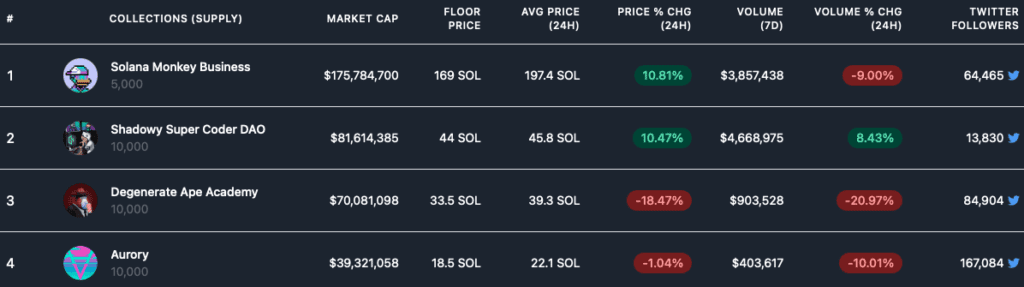

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.