If Ether’s Status Is Unclear After This Article, It’s Clearly A You Problem

Gary Gensler refuses to answer the question, so we’ve gathered all the clarity in one easy-to-read article

Planet Crypto for Blockworks

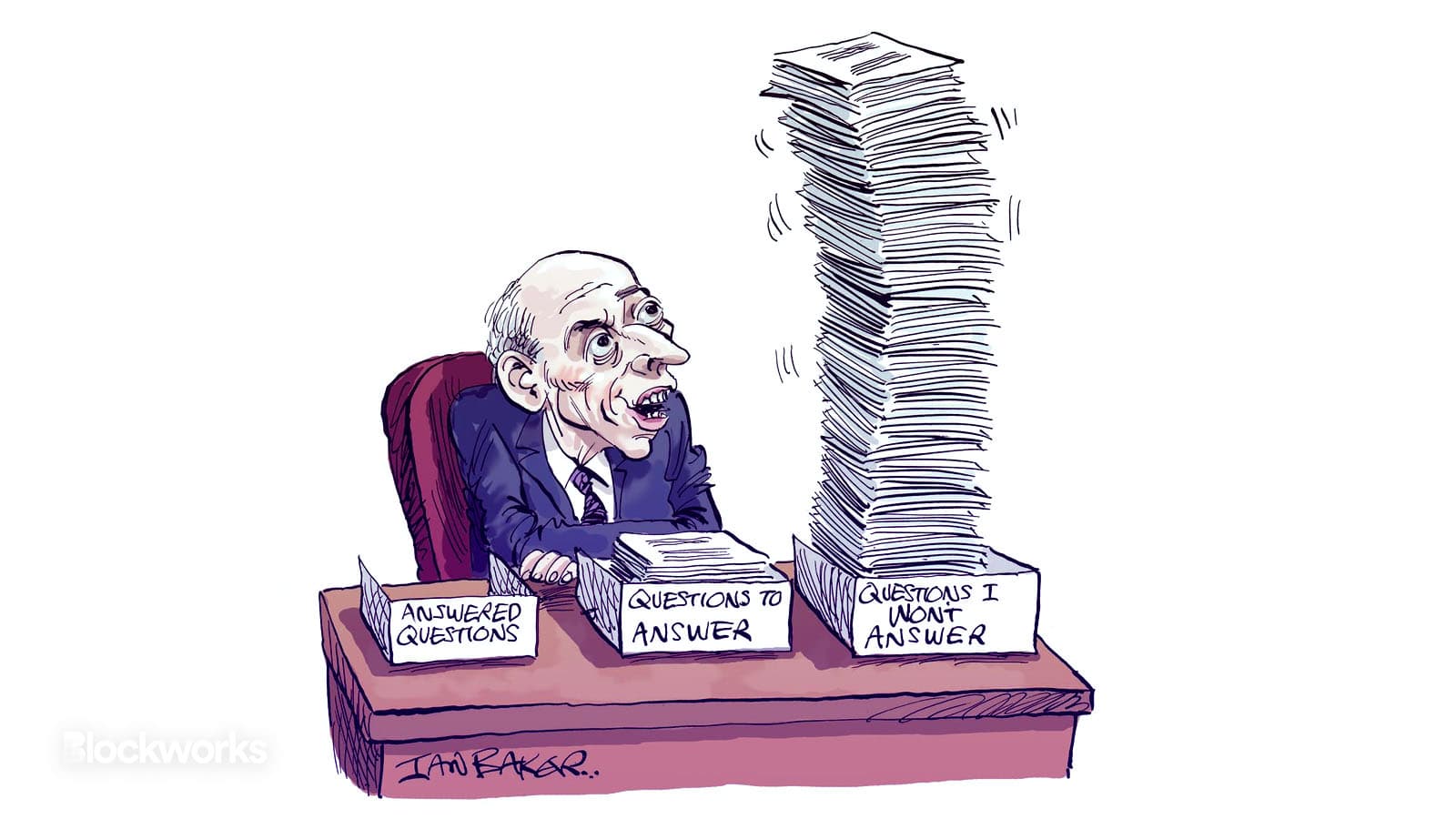

Ether, the native token of the Ethereum blockchain, has been the subject of much discussion recently. While its status appeared to be settled by the SEC’s staff some time ago, the recent transition to a proof-of-stake consensus mechanism has apparently given the current SEC Chair, Gary Gensler, an opportunity to re-examine the token.

Gensler is adamant that the crypto industry has been given perfect clarity on such matters, and has repeatedly declared that the rules for what constitutes a security are absolutely clear, transparent, and not open to interpretation.

So, is Ether, or ETH, a security, a commodity, or something else?

Luckily we have gathered together all the experts who’ve clearly answered this thorny question, in Blockworks’ Ultimate Guide to Regulatory Clarity.™

William Hinman, Director of the Division of Corporate Finance at the SEC, June 2018:

“Based on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions.”

Letitia James, New York Attorney General, March 2023:

“The Tokens [including ETH] are securities because they each involve investments of money into a common enterprise with the expectation of profits due to the managerial efforts of the Tokens’ respective founders, developers, and management teams.”

Also Letitia James, New York Attorney General, March 2023:

“Under both state and federal authority, ETH, LUNA, and UST are commodities.”

Jay Clayton, Chair of the SEC, March 2019 (reinforcing Hinman, above):

“A digital asset may be offered and sold initially as a security because it meets the definition of an investment contract, but that designation may change over time if the digital asset later is offered and sold in such a way that it will no longer meet that definition.”

Rostin Behnam, Chair of the CFTC, May 2022:

“I can say for sure Bitcoin, which is the largest of the coins and has always been the largest regardless of the total market cap of the entire digital asset market capitalization, is a commodity. Ether as well. I have argued this before, my predecessors as well said it is a commodity.”

Gary Gensler, Chair of the SEC, April 2023 (refusing to answer the actual question):

“Ummm, I… I… it’s… actually all securities are commodities under the Commodity and Exchange Act, it’s that we’re excluded commodities, but I would agree that a security cannot also be an excluded commodity and an included commodity.”

Now it’s time for your multiple choice test. Based on the statements above, select one answer.

- Ether is not a security

- Ether is a security

- Ether is both a security and a commodity

- Ether was a security, but now it isn’t

- Ether is a commodity

- Gary Gensler is making it up as he goes along

- All of the above

Clear enough for you?

Thanks to Planet Crypto for this week’s illustration.

A version of this op-ed first appeared in Blockworks’ newsletter: Subscribe below.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.