Fed Market Reaction: Stock Correlation Weighs More on Bitcoin Than Interest Rates

Bitcoin and equities slightly rally on news that Fed rate hikes may be coming in the coming months

Blockworks exclusive art by Axel Rangel

- Markets marginally rebound on signals that rate hikes may come in March

- If bitcoin’s correlation to equities persists, a greater sell-off might follow a short-term pop

It looks like the easy-money, quantitative-easing days of the Federal Reserve that buttressed crypto markets are winding down.

In its two-day policy meeting that concluded Wednesday, the Fed signaled it would likely begin to raise interest rates in March in tandem with cutting down its balance sheet.

“I would say that the committee is of a mind to raise the federal funds rate at the March meeting, assuming that conditions are appropriate for doing so,” Fed Chairman Jerome Powell said following the Federal Open Market Committee (FOMC) meeting.

The Fed elected to keep rates near zero for now, opting to wait for further tapering of asset purchases before raising rates.

“With inflation well above 2 percent and a strong labor market, the committee expects it will soon be appropriate to raise the target range for the federal funds rate,” the FOMC said in the statement.

Inflation, meanwhile, continues to rise. For the first time since 1982, the consumer price index (CPI) jumped 7% year-over-year across the board in December.

“The economy no longer needs to sustain high levels of monetary policy support,” Powell said.

Markets were largely unphased on the news, with bitcoin rallying above $38,000 and the S&P 500 and Dow Jones Industrial Index each rising about 1%.

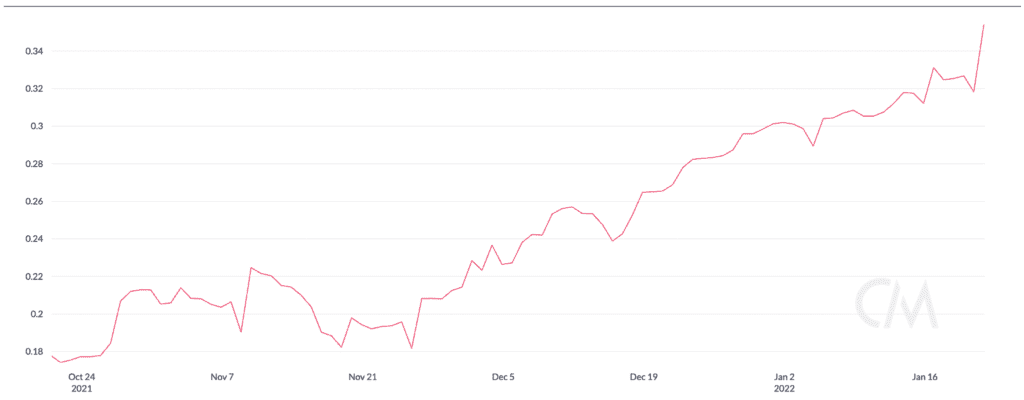

The policy shift comes as the correlation between cryptocurrencies and equities continues to tighten.

“So long as the strong correlation with traditional finance and risk-on assets persists, bitcoin may experience a bullish relief rally in the near-term after the dovish Fed announcements today,” said Josh Olszewicz, head of research at Valkyrie Funds. “When the Fed does raise rates later this year, should the correlations with risk-on assets persist, Bitcoin may also experience bearish price pressures.”

Any rate hike would be the first since 2018. After March, it’s not clear whether additional rate hikes could be in store this year.

“It is not possible to predict with much confidence exactly what path for our policy is going to prove appropriate,” Powell said.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.