Inscriptions craze proves stark contrast between Ethereum rollups

The thesis that more activity begets lower proving costs passes a real-world test

ymcgraphic/Shutterstock modified by Blockworks

The advent of zero-knowledge proof-based Ethereum rollups represents a significant advance in blockchain scalability and efficiency.

Over the past week, their ability to handle a spike in transaction volumes was put to the test with the fad-like phenomenon of inscriptions hitting various EVM-based networks in sequence.

One aspect unique to zk-rollups, such as zkSync, StarkNet and Polygon’s zkEVM, is their ability to amortize the cost of generating validity proofs across many transactions. Therefore, unlike many blockchains, they actually get cheaper to use as they scale.

Read more: Zero-knowledge rollups get cheaper with scale

Inscriptions refer to various forms of data, typically metadata of tokens or NFTs, written to blockchains in a way which can be more cost-effective than smart contracts, as they require less gas.

Recently, there’s been a surge in the use of inscriptions on a variety of networks — not just Ethereum layer-2s but also Avalanche and Solana — mainly for speculative trading of low-value assets. This trend has led to network congestion and operational disruptions that have kept protocol developers busy finding ways to mitigate their impact.

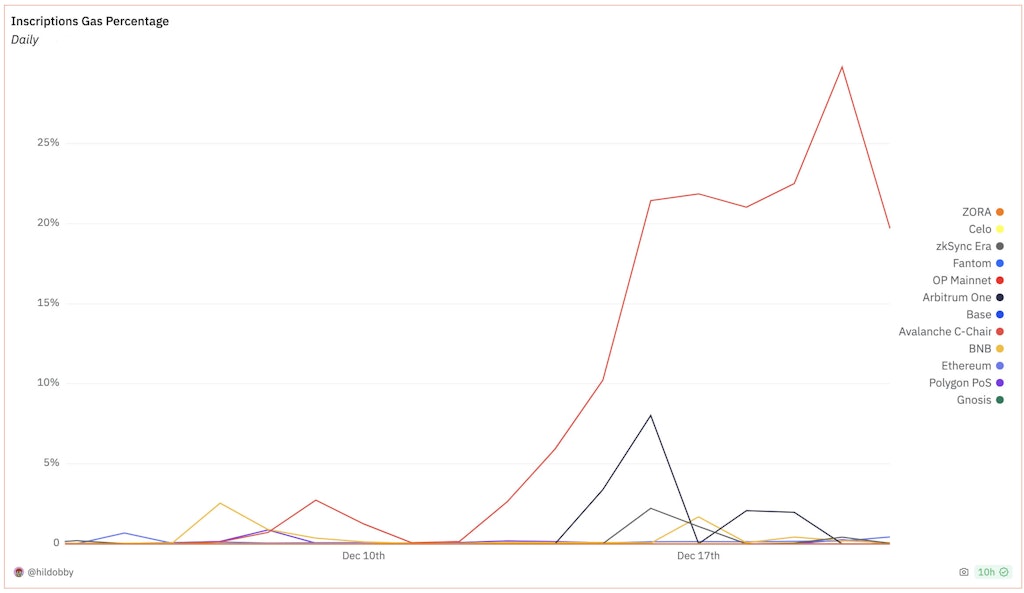

In some cases, those disruptions have been severe — Avalanche’s EVM-compatible C-chain, for instance, saw the cost of transactions spike tenfold, as inscriptions were briefly responsible for over 30% of all gas consumed.

Percentage of gas attributable to inscriptions, Avalanche in red. Source: Hildobby | Dune analytics

Percentage of gas attributable to inscriptions, Avalanche in red. Source: Hildobby | Dune analyticsZK magic

To understand why proving costs on zk-rollups decrease with rising transaction volumes, it’s crucial to delve into the mechanics of zero-knowledge proofs and the architecture of these rollups.

Zk-rollups utilize cryptographic methods, such ZK-STARKs (Zero-Knowledge Scalable Transparent Argument of Knowledge), to validate transactions off-chain before submitting them in batches to the Ethereum mainnet.

This batching reduces the number of transactions that need to be processed on-chain, significantly lowering gas fees. As the number of transactions in a batch increases, the cost per transaction decreases, showcasing economies of scale.

ZkSync Era, currently the largest rollup by total-value locked (TVL), upgraded its original SNARK-based prover to one based on STARK proofs, called Boojum, on Dec. 4. It can theoretically handle 2,000 transactions per second (TPS) — though in practice has yet to see a tenth of that. For reference, Ethereum mainnet averages around 15 TPS.

Optimistic rollup Arbitrum, whose 2021 mainnet launch gave it a first-mover advantage, has by far the most TVL at $2.4 billion.

Both networks were impacted by booming inscriptions activity within a couple days of each other — which accounted for about 60% of all transactions over the past week on the pair.

The phenomenon provided a real-world experiment in Ethereum rollup scaling.

So what happened?

Both suffered downtime, but transaction fees on Arbitrum spiked, while zkSync’s went down.

Transaction fee comparison between zkSync and optimistic rollups. Source: growthepie.xyz

Transaction fee comparison between zkSync and optimistic rollups. Source: growthepie.xyzThe cost of using zkSync has been in a clear downtrend since the Boojum upgrade was completed earlier this month. The network currently has the lowest transactions costs among all layer-2s, competitive with the fees users pay on optimistic rollups.

But the response to a surge in demand underscores the efficacy of zero-knowledge rollups in upscaling Ethereum’s throughput.

By compressing data and processing transactions in batches, many more transactions can fit in a single proof to be verified on the Ethereum mainnet.

A researcher at venture firm 1kx, known as 0xtaetaehoho, noted on X that the network posted 5,566 proofs on Dec. 17, more than double the total pre-Boojum, and did so at a lower cost to the network.

Lessons learned

The traffic did cause problems for zkSync’s RPC services and block explorer, however, prompting Matter Labs to post an extensive thread of lessons learned.

“This weekend served as an important stress-test and a big milestone on the way of bringing Ethereum to the next billion people,” the developers said.

“For nearly 14 hours straight, the network handled ~150 TPS — peaking at 187 TPS — with an average [transaction] cost of ~$0.12.”

Other Ethereum scaling solutions, such as Polygon’s POS chain, also handled the extra traffic well, even with much higher volumes.

According to Polygon founder Sandeep Nailwal, the network notched 18 million transactions per day, while gas fees maxed out at the MATIC equivalent of $0.10, which he called “the result of months of effort on EVM parallelisation (BlockSTM) and multiple other hardforks which resulted in reduced reorgs and better performance.”

Polygon’s zkEVM has yet to see a significant surge in inscriptions-related traffic, but technical lead Jordi Baylina told Blockworks the reduction in proving costs seen in recent months means it’s “not the limiting factor for transactions.”

“If you compare the [proof] cost with data availability cost, for example, or even the cumulative fee for the inclusion of the transaction, it is much, much lower,” he said.

Matter Labs’ head of business development, Marco Cora, sees a future of “a little bit of chaos and disintegration, a lot of experimentation, but one in which the best technical solutions will emerge.

“Everybody is doing fantastic work — all our ‘competitors,’ they are actually super commendable,” Cora told Blockworks. “Eventually we will all figure out what’s the best, and we will all converge there.”

One thing that Cora says is not in doubt is that zero-knowledge tech is the future.

“Pretty much everybody seems to have agreed…Optimism has said it very explicitly, and Arbitrum I think has said it implicitly now that they are looking at it,” he said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.