The crypto investor’s guide to volatility risk management

These are the best tools and practices you can leverage to defend against crypto market volatility

Artwork by Crystal Le

Key Takeaways:

- Diversification, stop-loss orders, and advanced options like Bumper can significantly enhance a trader’s risk management strategy.

- Effective volatility management tools, such as Bollinger Bands, Average True Range, and Chaikin Money Flow offer insights into market dynamics and potential trading opportunities.

Fraught with risks like market volatility, fraud, technical glitches, and cybersecurity failures, the world of cryptocurrency has become infamous as one of the most risky, volatile financial markets in the world. It is highly demanding of participants, requiring they become skilled at risk management best practices, lest they fail to survive for very long.

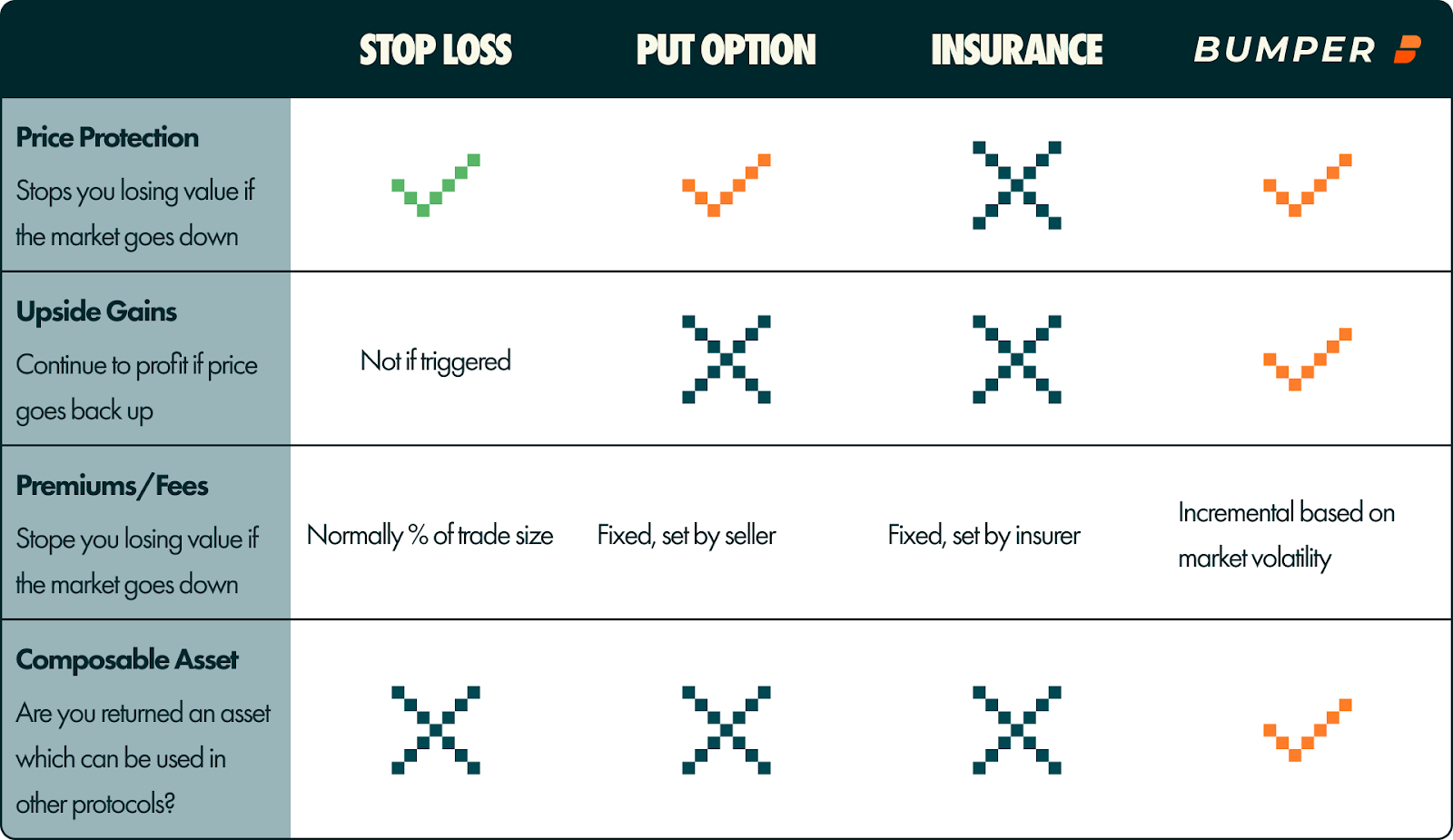

Bumper vs. Alternatives | Source: Bumper

Bumper vs. Alternatives | Source: Bumper

For anyone eager to hone their skills and better navigate crypto markets, this guide is a necessary tool. It provides a comprehensive view of volatility, an overview of available crypto risk management tools to add to your arsenal, and a preview of an advanced new tool that crypto holders can leverage to eliminate many worries of downside risk in the markets.

This is everything you need to know about crypto volatility risk management!

Managing volatility and price protection

To effectively manage volatility, one must first comprehend its multifaceted causes. Crypto asset prices are frequently influenced by market speculation, often driven by both hype and the intertwined elements of fear, uncertainty, and doubt (FUD). This volatility can be further accentuated by limited liquidity, which results in pronounced price changes during significant trading shifts. Additionally, the interplay of regulatory changes, potential cybersecurity breaches targeting crypto exchanges, and the ever-present influence of official announcements, news reports, and prevailing social media sentiment can collectively mold the volatile landscape of the market.

Although volatility’s causes are identifiable, it remains impossible to predict with certainty whether volatility will increase or decrease. However, traders oftentimes look at these types of volatility in an effort to predict how it will change:

- Historical volatility – A statistical measure of past price fluctuations, calculated as the standard deviation of the asset’s price over time. The higher the standard deviation, the greater the volatility of the asset

- Implied volatility – A measure of an asset’s expected future price movement. Commonly used to price options contracts and is derived from the prices of those options.

- Beta – The measure of an asset’s volatility in relation to a benchmark, such as the overall market. A beta greater than 1 indicates higher volatility and a beta less than 1 indicates a lower volatility

Various indicators are designed to help traders understand and leverage volatility before ultimately taking an active position to limit their risk. Here, we’ll explore three: Bollinger Bands, Average True Range, and Chaikin Money Flow.

Bollinger Bands

Bollinger Bands are a popular tool designed around a central moving average with two bands that expand and contract based on market volatility. These bands are excellent for visualizing volatility shifts, helping traders pinpoint promising entry and exit points. When the asset price crosses above the upper band or dips below the lower one, it could suggest overbought or oversold conditions, respectively, hinting at an imminent price reversal.

Bollinger Bands | Source: Bumper

Bollinger Bands | Source: Bumper

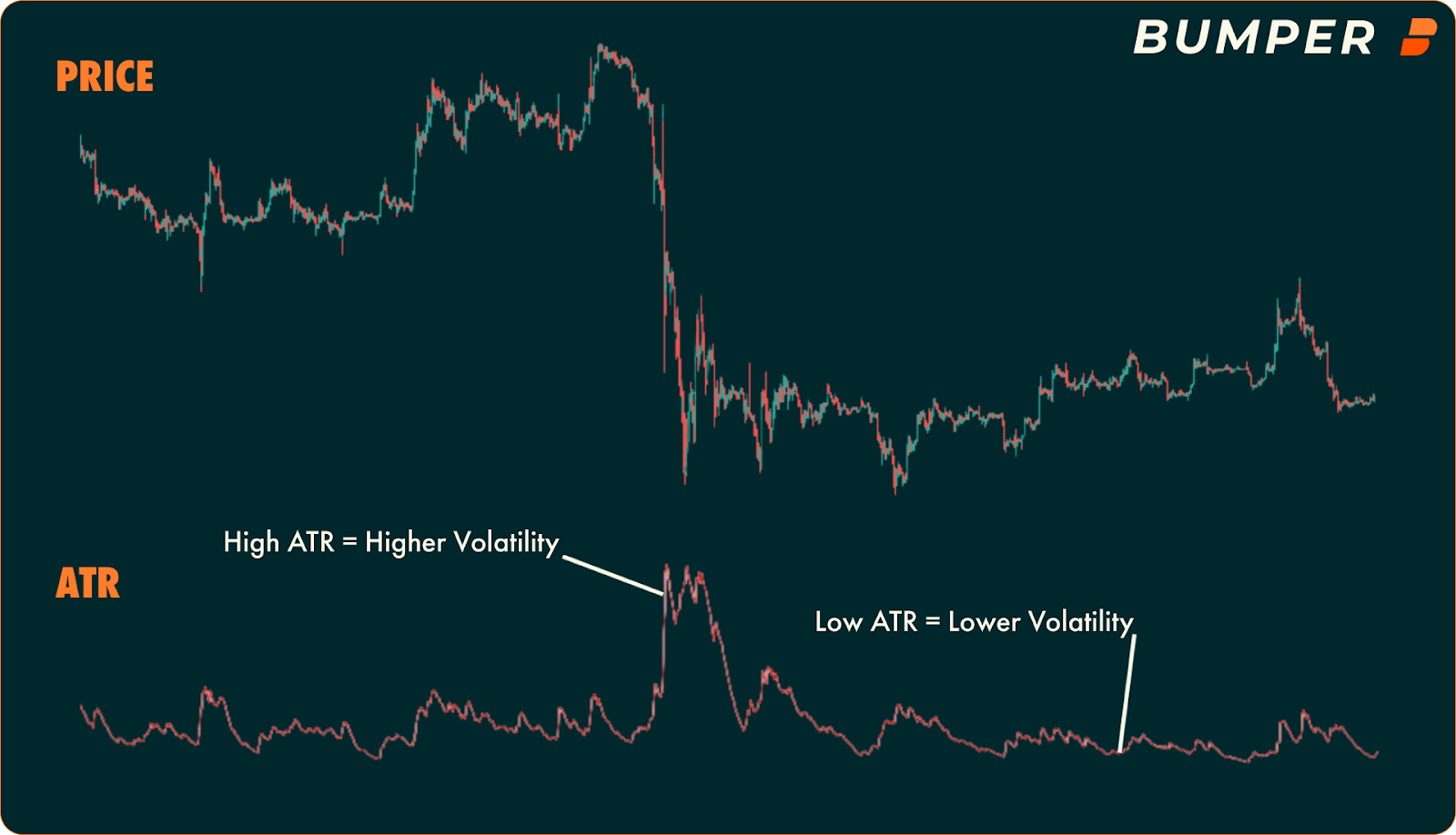

Average True Range

The Average True Range (ATR) offers a snapshot of volatility, displaying the difference between an asset’s high and low prices over a specified period as a singular value. An elevated ATR denotes a surge in volatility, whereas a reduced ATR suggests the opposite. When the ATR climbs, it might signify escalating volatility, potentially signaling an opportune moment for traders to act.

Average True Range | Source: Bumper

Average True Range | Source: Bumper

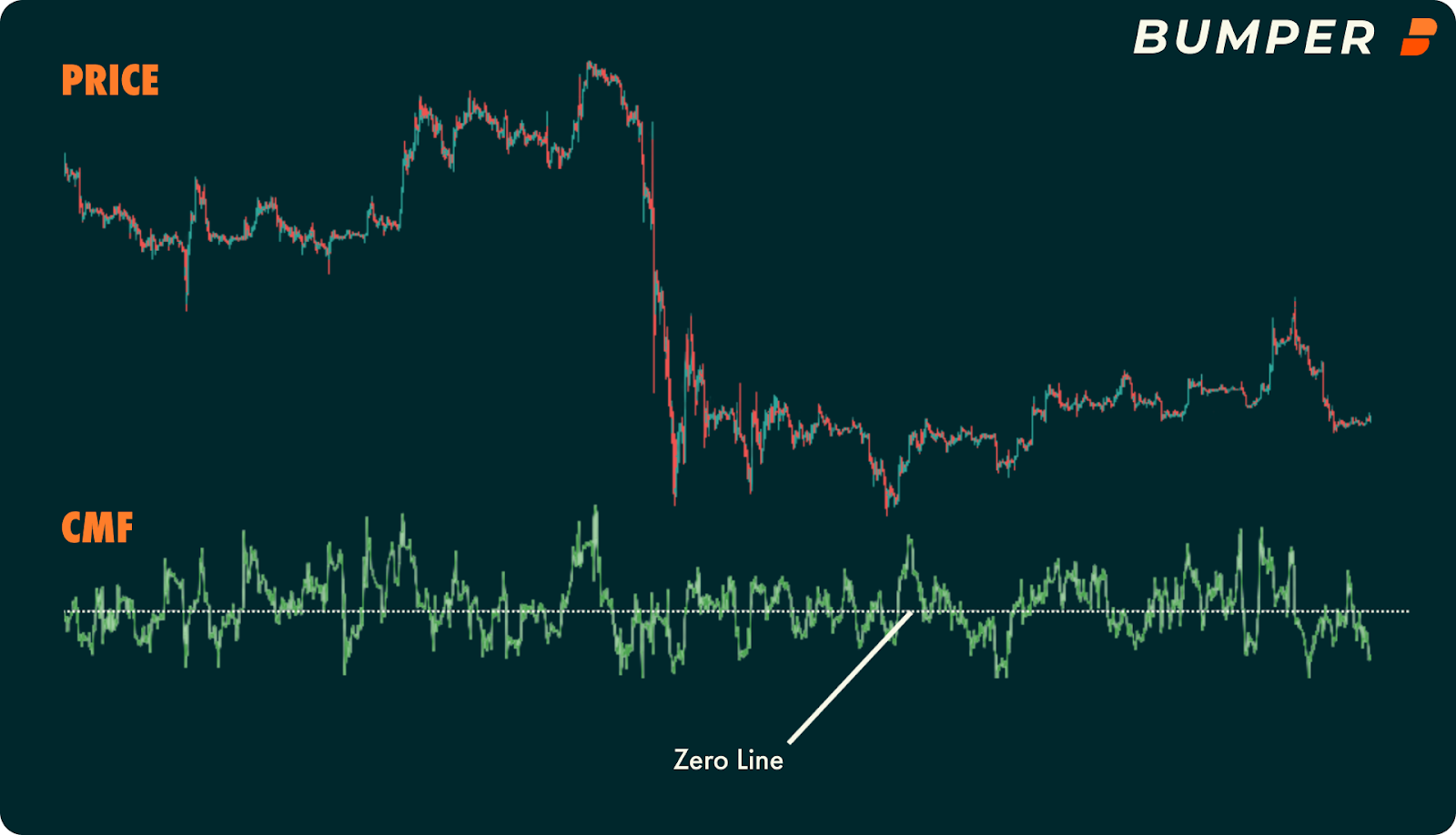

Chaikin Money Flow (CMF)

The CMF gauges the influx and outflow of capital concerning an asset. Generally represented as a line graph alongside the asset’s price chart, a CMF value of 1 indicates an inflow of money, while -1 represents an outflow. If the CMF hovers above the zero mark, it might imply robust buying pressure, suggesting the asset’s price has the potential for further ascent, and the inverse is also true.

Chaikin Money Flow | Source: Bumper

Chaikin Money Flow | Source: Bumper

Crypto Risk Management Tools

To protect their portfolios against market volatility, top traders make use of a wide array of tools, each with its own pros and cons. While each takes time and patience to master, this overview will get you started on the right path.

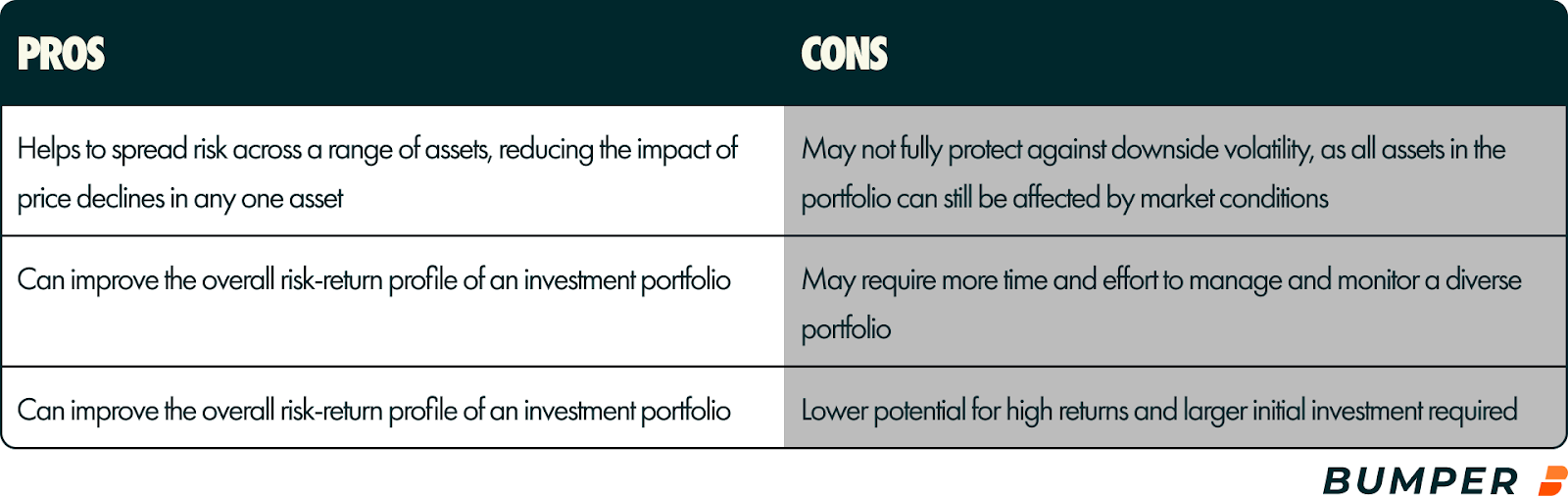

Diversification

Diversification simply involves spreading your investment portfolio across a variety of different investments. This, in turn, spreads risk across assets to minimize the impact of price declines in any one asset on the overall portfolio. Stablecoins are a popular choice when considering diversification options, as their values are pegged to reserve assets to prevent price fluctuations. While volatility does sometimes occur, these assets are far less likely to fluctuate compared to other cryptocurrencies.

Pros & Cons of Portfolio Diversification | Source: Bumper

Pros & Cons of Portfolio Diversification | Source: Bumper

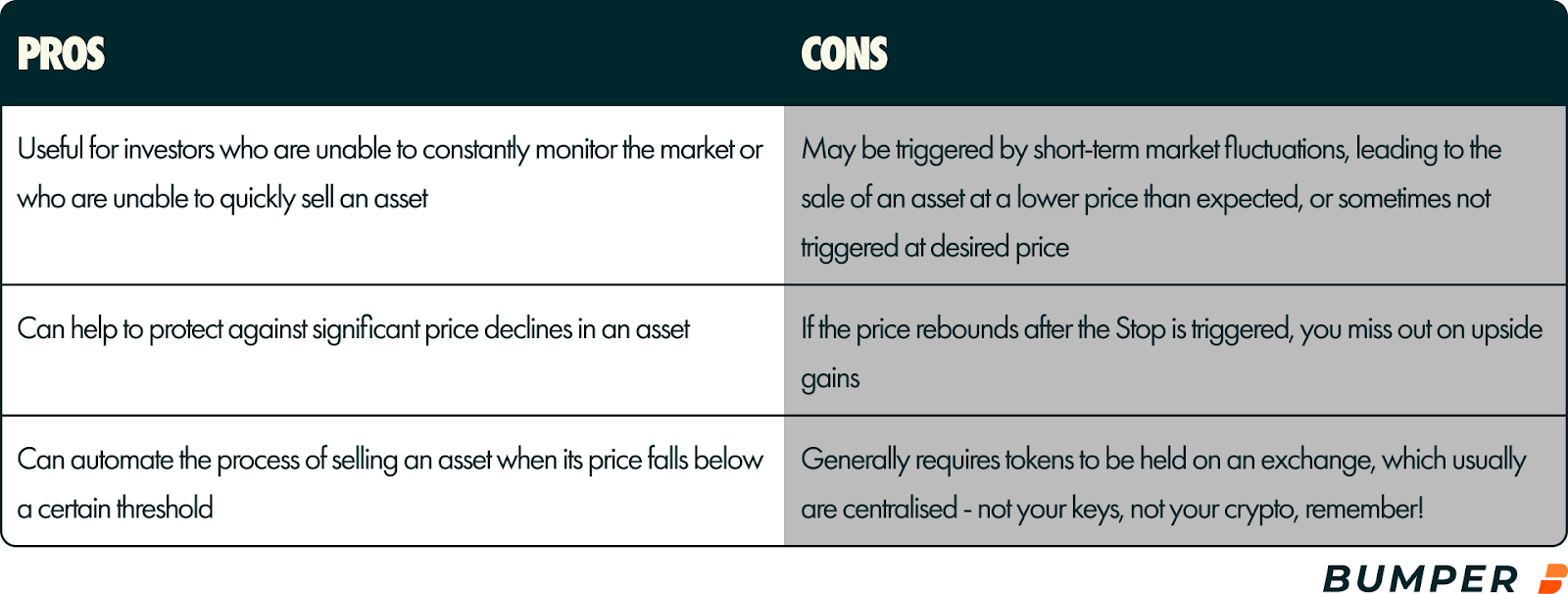

Stop Loss Orders

Stop losses are a common feature on most exchanges that allow users to automatically place an order to sell an asset if its price falls below a certain threshold. There are a variety of different types of stop losses.

Stop quote

A standard stop loss activates when an asset’s price falls below a predetermined point. It then tries to offload the asset right away. Yet, if no one is willing to buy at that rate, it can further depress the execution price, so the final selling price may not match the originally set stop loss price.

Stop limit orders

These activate only when a specific price threshold is reached. The risk is that without a buyer, you might have a sell order set above the current price, which could result in a failure to fill your position. If unchecked, you might see your asset’s value decrease with the market, only to have it sold as it starts to recover.

Trailing stop loss

Traders oftentimes use trailing stop losses to lock in profits as the market rises, automatically moving the stop loss up with the increasing price to maintain a roughly similar gap. While this protects against sudden market downturns, it can also trigger a sell during normal market pullbacks, potentially missing further gains.

Pros & Cons of Stop Loss | Source: Bumper

Pros & Cons of Stop Loss | Source: Bumper

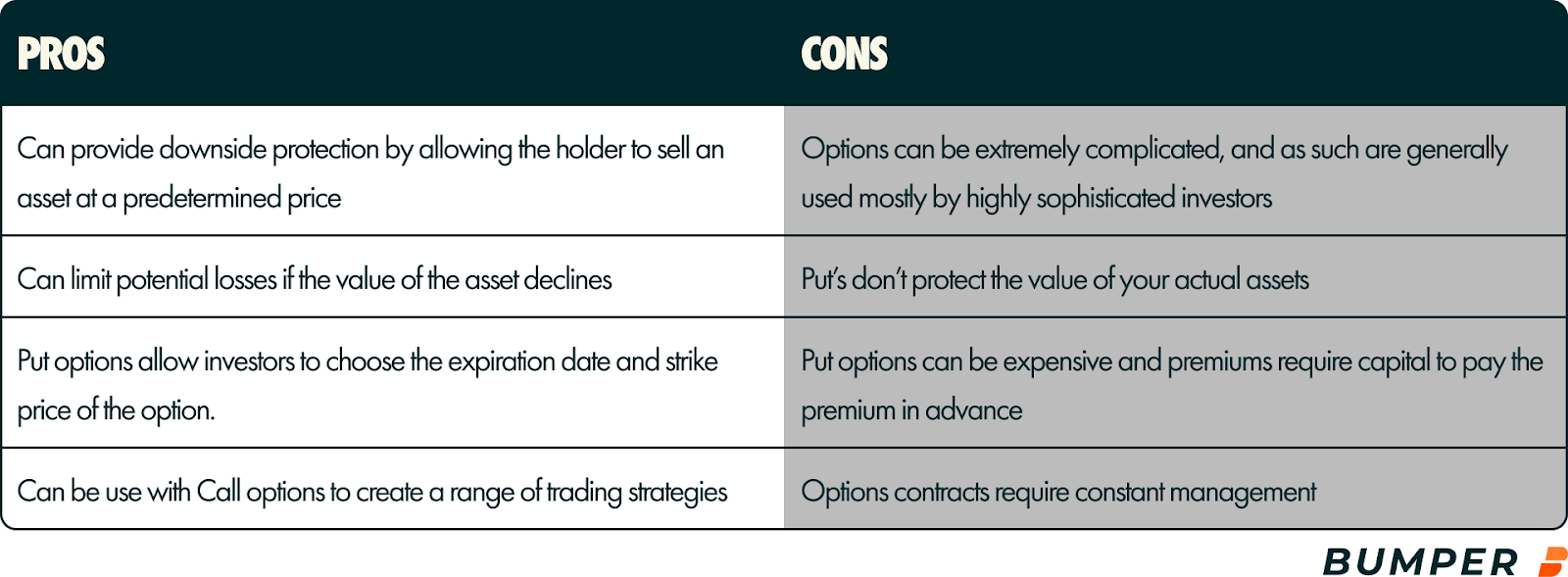

Put Options

A put option allows the holder to sell an asset at a set price (the strike price) on, or before, a specific date. For instance, if an investor has a put option on Bitcoin at $50k and its price drops below that, they can sell it at the $50k price.

Pros & Cons of Put Options | Source: Bumper

Pros & Cons of Put Options | Source: Bumper

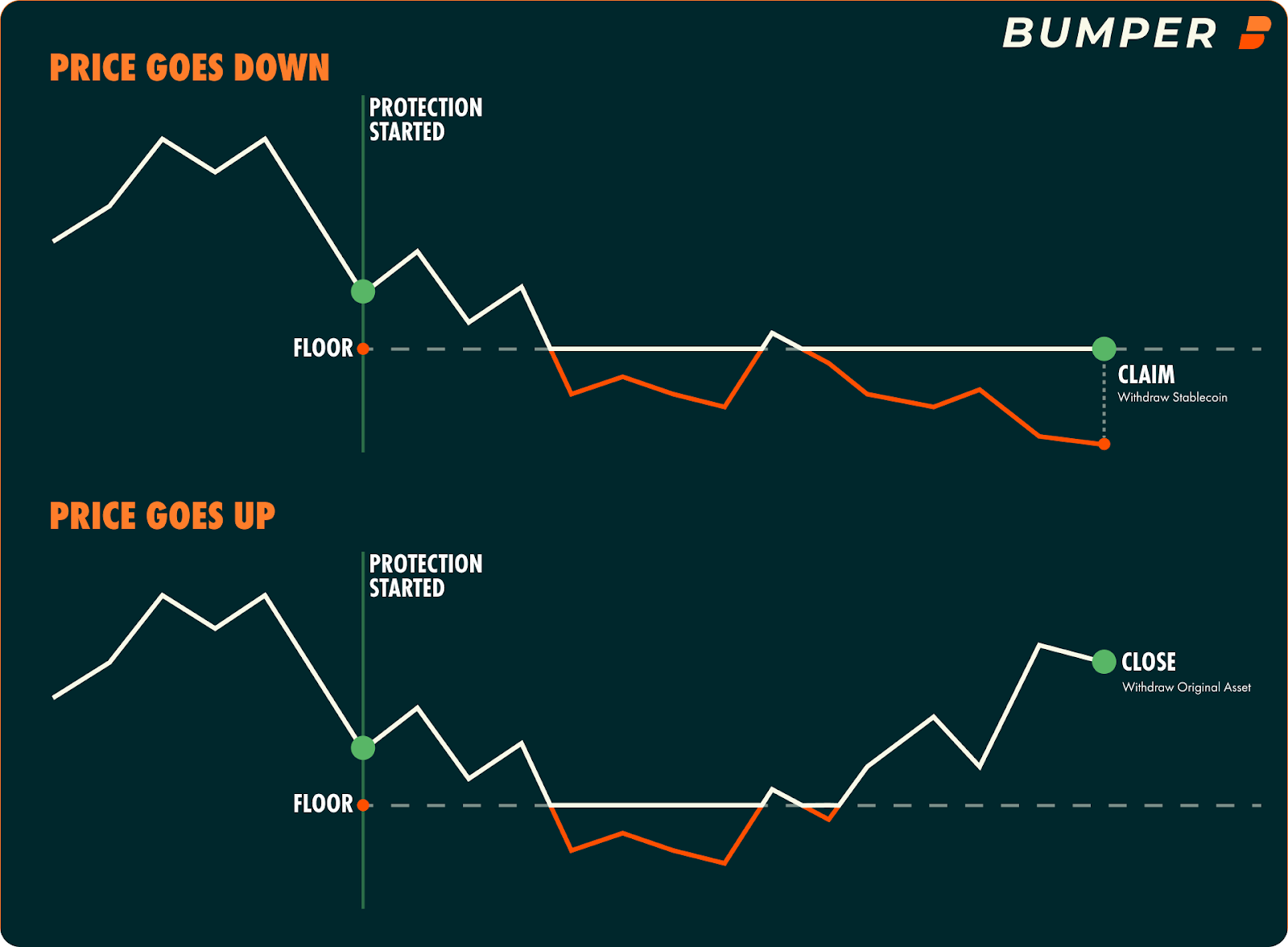

Bumper

Bumper is a newly launched, incredibly easy-to-use DeFi protocol that allows users to purchase protection against potential price declines in their crypto assets. If the value of your protected asset falls below the floor you set, Bumper protects its dollar value from further declines.

Bumper protects from downside volatility | Source: Bumper

Bumper protects from downside volatility | Source: Bumper

Bumper has taken the best components of its alternatives and joined them together within a cohesive offering. Within the system, everything is conducted in a straightforward, provably fair manner that removes counterparty risk. Unlike buying a put option (see Bumper vs. put options) or using a stop-loss order (see Bumper vs. stop loss), Bumper enables users to enjoy the gains when the market rides higher.

“When Fisher Black and Myron Scholes, then just two young university professors at Princeton, published their now-famous Black-Shcoles formula, it was awarded the Nobel prize for economics and kick-started a $13trn Options market. The equation uncovered an undeniable force of nature that governs risk. You can’t beat Black-Scholes. But Bumper can beat the margin that Option desks apply on top of Black-Shcoles. Now this is where it gets weird. Although Bumper takes a radically innovative approach to risk, using different formulas, inputs, and a novel rebalancing mechanism, it is freakily correlated to Black-Scholes. To our knowledge, no one has ever done that in the 50 years since it was published. Most importantly, although correlated, Bumper is on average 30% cheaper than option desks.”

Jonathan DeCarteret, Co-founder and CEO of Bumper

Safeguarding investments in the crypto frontier

In the dynamic world of cryptocurrency, managing volatility is a necessity. From understanding the underpinning factors of market fluctuations to leveraging advanced tools like Bumper, investors have multiple means to shield their assets. The financial landscape is ever-evolving, but with the right tools, knowledge, and strategy, investors can better position themselves to capitalize on the rewards of the crypto market while simultaneously mitigating its inherent risks.

In celebration of their recent protocol launch, Bumper is offering early adopters a share in up to $250,000 worth of BUMP incentives just for protecting and earning crypto through their platform. To stay up to date on all Bumper updates, follow them on their socials and join their Discord community.

This content is sponsored by Bumper.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.