Lawsuit Likens Voyager to Ponzi, Sues Mark Cuban For Promotion

Voyager CEO Stephen Ehrlich and the Dallas Mavericks, the NBA team owned by Mark Cuban, were also named in the class-action lawsuit

Rob Gronkowski, Tampa Bay Buccaneers. Source: Voyager Digital

- A team of Voyager investors allege Mark Cuban helped dupe millions of Americans into investing in a “massive Ponzi scheme”

- Voyager targeted amateur investors through youth-forward marketing, according to the lawsuit

Recent court documents have detailed allegations against billionaire “Shark Tank” investor Mark Cuban over his relationship with bankrupt crypto lender Voyager Digital.

Investors claim Cuban and Voyager CEO Steve Ehrlich were key players who personally reached out to potential Voyager customers and convinced them to put money into the “deceptive” platform.

Cuban’s NBA team, the Dallas Mavericks, was also been named as a defendant in the lawsuit, a securities class-action complaint filed on Wednesday showed.

The pair “went to great lengths to use their experience as investors to dupe millions of Americans into investing,” the 92-page-long complaint reads.

Moskowitz Law Firm lodged a similar class-action in December, which was updated with additional allegations in April. That complaint has since been stayed as a result of Voyager’s bankruptcy, leading to a fresh filing.

The claimants have attempted to document both Cuban’s endorsements of Voyager Digital alongside his million-dollar losses associated with failed stablecoin project Iron Finance, which he publicly endorsed just before it crashed entirely.

Voyager filed for bankruptcy in New York on July 5, days after freezing withdrawals on its platform over liquidity issues.

The Toronto Stock Exchange suspended Voyager shares the next day and now face total delisting, but they’re still available on US-based OTC Markets.

Voyager’s share price — which has oddly tripled in the last five days — has collapsed 97% over the past six months, while its native token VGX has tanked more than 80%.

Not just Cuban: Voyager pushed sports marketing at crypto peak

In October last year, as bitcoin hovered around all-time highs, Dallas Mavericks partnered with Voyager to boost brand awareness and drive crypto adoption when enthusiasm around digital assets was already high.

Voyager was on a sports marketing kick at the time, as were many other crypto firms. Voyager had struck a promotional deal with NFL star Rob Gronkowski one month earlier, which would see the four-time Superbowl champion “become a brand ambassador, Voyager shareholder and holder” of Voyager’s token VGX.

Another advertising agreement with NASCAR driver Landon Cassill, from December, was pegged to pay out in various cryptocurrencies, including VGX.

Claimants in the class-action describe Voyager as a “massive Ponzi scheme” that relied on support from Cuban and Dallas Mavericks.

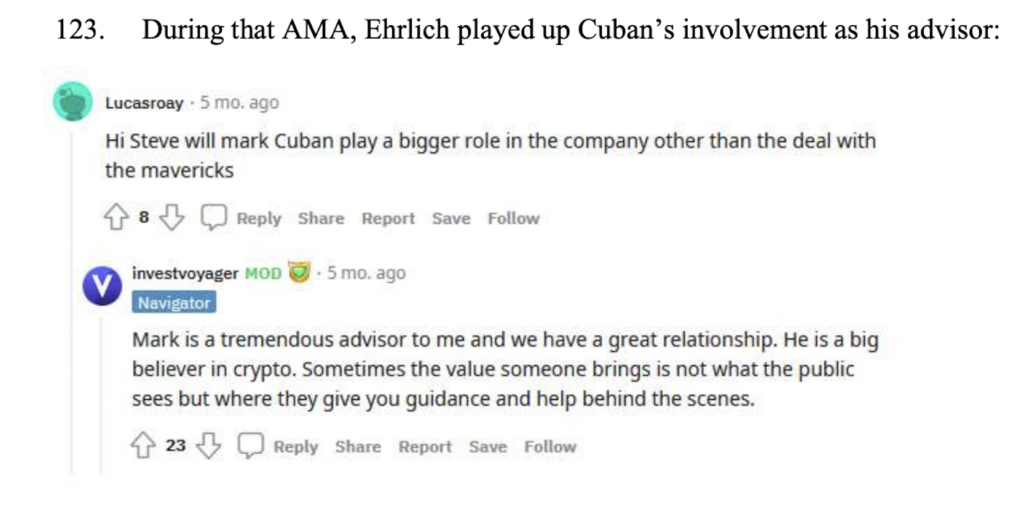

Investors cite a Reddit thread in which Erlich “played up” Cuban’s relationship with Voyager Digital.

Investors cite a Reddit thread in which Erlich “played up” Cuban’s relationship with Voyager Digital.

Voyager is estimated to owe $5.7 billion to over 100,000 parties.

“The very public support from the Dallas Mavericks and their owner, Mark Cuban, including their recent massive investment in the Deceptive Voyager Platform, gives a great illustration of how the Voyager Defendants are targeting unsophisticated investors with false and misleading promises of reaping large profits in the cryptocurrency market,” they wrote.

The plaintiffs also allege that Voyager targeted young, inexperienced investors through youth-forward marketing, promises of interest payments on crypto holdings and assurances that customers would receive the best price on trades.

Cuban and a representative for Ehrlich didn’t return Blockworks’ request for comment by press time.

This article was updated at 7:46 am ET with additional context.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.