Meta’s Metaverse Play Ridiculed Online

CEO Mark Zuckerberg is taking flack over ‘Horizon Worlds’ progress, dimming company’s prospects

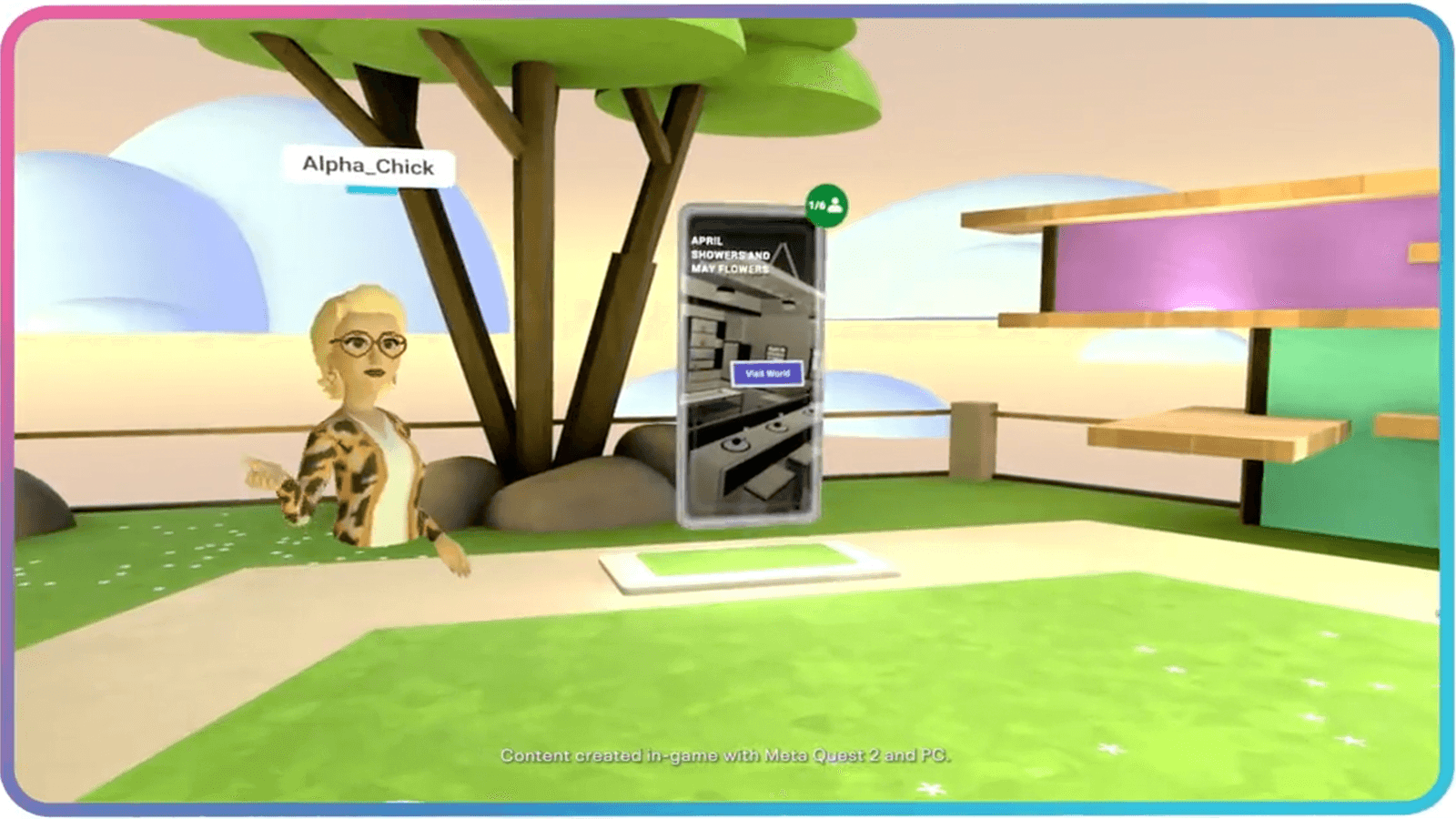

Source: Twitter.com/HorizonWorlds

- A mocked Facebook post features Zuckerberg’s avatar standing in front of miniature models of the Eiffel Tower and the Tibidabo Cathedra

- Meta’s metaverse division, Reality Labs, is losing billions of dollars a year

Meta appears lost in its vision of what 3D virtual worlds should look like in 2022, according to some. The company’s release of its “Horizon Worlds” in Spain and France this week has been mocked by hundreds online, following CEO Mark Zuckerberg’s announcement post on Facebook.

The post features Zuckerberg’s avatar standing in front of miniature models of the Eiffel Tower and the Tibidabo Cathedral on a bed of grass. The problem? The quality of the graphics appears to be rendered in the previous century.

Formerly known as Facebook Horizon, Horizon Worlds is a virtual reality online metaverse game designed for “everybody,” despite being limited to US and Canadian persons over the age of 18.

Its release in two European countries on Monday follows years of development and over $10 billion dollars already spent to get the metaverse title to its current state. Meta announced its game towards the end of September 2019, two years before the company changed its name from Facebook.

Zuckerberg has been mocked online before for his company’s pursuits of virtual worlds. Late last year, 3-D animation studio Surreal Entertainment spun up a viral parody video, based loosely on a demo announcement from Meta.

Reality hitting Reality Labs

Meta is determined to see its metaverse bet through, despite burning substantial cash reserves in the process. Late last month, the company reported quarterly losses in the billions over slumping sales stemming from its metaverse unit, Reality Labs.

Reality cost Meta more than $5 billion in missed sales for the second quarter of this year, adding more than $10 billion in losses to its previous yearly earnings. Its metaverse arm has now racked up more than $16 billion in losses over the past 18 months.

Meta’s metaverse play could prove to be a risky bet in an already crowded games market dominated by the likes of Activision Blizzard and Riot Games.

While those studios have yet to formally announce a title related to the metaverse, questions remain over how Meta intends to steal market share or attract gamers away from the titles designed by the incumbent leaders.

Gamers, already exhausted by the concept of non-fungible tokens and metaverse concepts, could hardly be expected to engage in a virtual world that sit on par with Runescape-level graphics, critics say.

And while blocky world-building game Minecraft is much beloved, Horizon Worlds is yet to offer up a substantial level of user engagement and functionality to compete.

Still, Meta is defiantly plowing ahead.

According to research conducted by crypto asset manager Grayscale, the metaverse is tipped to be a trillion-dollar yearly revenue opportunity across advertising, social commerce, digital events, hardware and creator monetization.

Epic Games, the company behind one of the world’s most popular games Fortnite, raised an eye-watering $2 billion dollars in April in a bid to accelerate its metaverse ambitions.

Despite substantial funding, questions center on how developers will best attempt to monetize efforts in a world seemingly designed for decentralization and individual ownership of digital assets.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.