New NFT Marketplaces Make Grab for OpenSea’s Lead

As OpenSea notches a $13.3 billion post-money valuation, NFT marketplaces are trying to give the crypto start-up a run for its money

Blockworks exclusive art by Axel Rangel

- LooksRare, an NFT marketplace, launched on Monday with a vampire attack on OpenSea as a grab for industry marketshare

- OpenSea announced a fresh funding round of $300 million last week

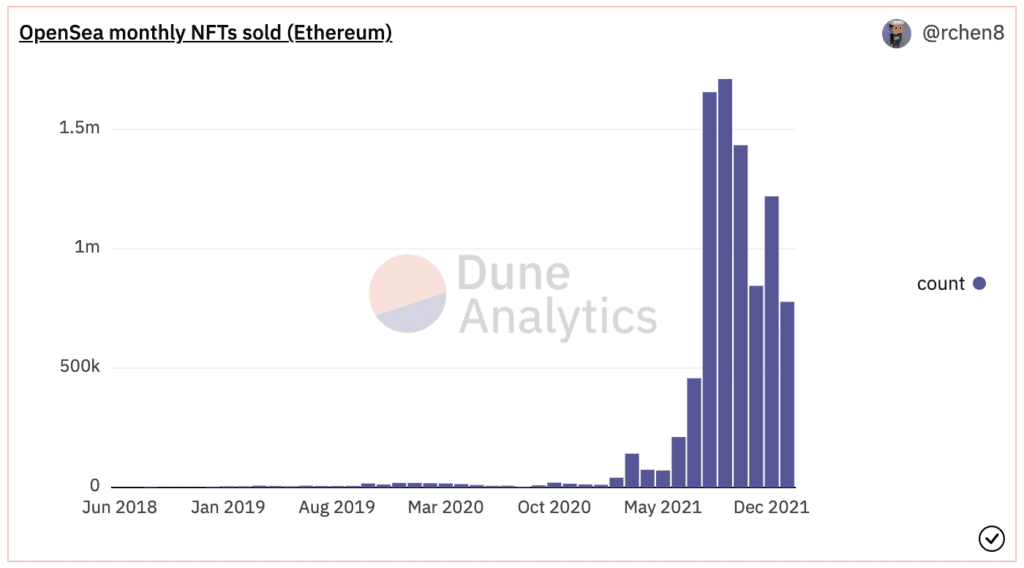

The NFT space saw plenty of action last year, with total trading volumes across 14 major marketplaces accumulating $19.6 billion. However, OpenSea saw blockbuster success as the largest non-fungible token marketplace with monthly trading volume at $3.42 billion alone at its all-time high.

Additionally, OpenSea secured $300 million in Series C funding earlier this month, bringing its post-money valuation to $13.3 billion.

“In 2021, the world woke up to the potential of NFTs to unlock utility and economic empowerment across a vast set of industries, communities and creative categories,” Devin Finzer, CEO of OpenSea, told Blockworks in an email when the company announced the capital raise. “Our vision is to be the destination for these new open digital economies to thrive.”

Competitive threats

However, the industry titan’s capital raise hasn’t stopped other marketplaces from trying to get an edge on the start-up. One marketplace called LooksRare went live on Monday with a vampire attack on OpenSea.

For the uninitiated, a vampire attack occurs when an emerging platform tries to replace an incumbent by offering incentives to investors to move their liquidity to an alternative platform. In this case, LooksRare is deploying an airdrop of the LOOK token. Users must have at least one NFT on LooksRare’s marketplace for sale prior to claiming the reward.

LooksRare aims to bring in big spenders from the NFT kingpin by letting investors claim free tokens if they’ve previously traded over 3 ether (or $9,600 worth of ETH) on OpenSea.

Despite LooksRare’s grab for marketshare, OpenSea still has a “first mover advantage” as one of the oldest NFT marketplaces in the industry, said Martha Reyes, head of research at Bequant.

“OpenSea took off so quickly that it will be hard for other players to catch up. It will take time. [Other platforms] will have to invest in teams [and] in the right technology,” Reyes said. “There’s a brand name attached to it that’s quite strong. They’ve had dominance in this space for quite a while now.”

OpenSea monthly NFTs sold (Ethereum) by @rchen8, Dune Analytics

OpenSea monthly NFTs sold (Ethereum) by @rchen8, Dune AnalyticsSpace to share

Tapping into the surging popularity of crypto collectibles, Coinbase Inc. (COIN) could also topple OpenSea as the industry’s largest marketplace.

The company announced a forthcoming marketplace called Coinbase NFT on Oct. 6. The product offering will allow investors to purchase, mint and showcase various NFTs, according to a blog post from the firm. The waitlist has exceeded 2.6 million as of Dec. 29, which is more than OpenSea’s total active traders. However, the marketplace has not gone live despite the product being slated to launch by Dec. 2021.

“I think there’s plenty of space for OpenSea to continue to grow without anyone coming in to take away market share from them,” Reyes said. “The industry is growing so quickly that there’s space for [everyone.]”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.