Sushi Opens Thursday Up 3% After CTO Resignation

The DAO token of the Sushi decentralized exchange spiked 20% after CTO tweets resignation, then declined as US trading day began

Blockworks exclusive art by Axel Rangel

- The market doesn’t seem to think Joseph Delong’s resignation will have a material impact on SushiSwap’s fortunes

- Open interest remains consistent, suggesting that traders are comfortable with Sushi’s current price

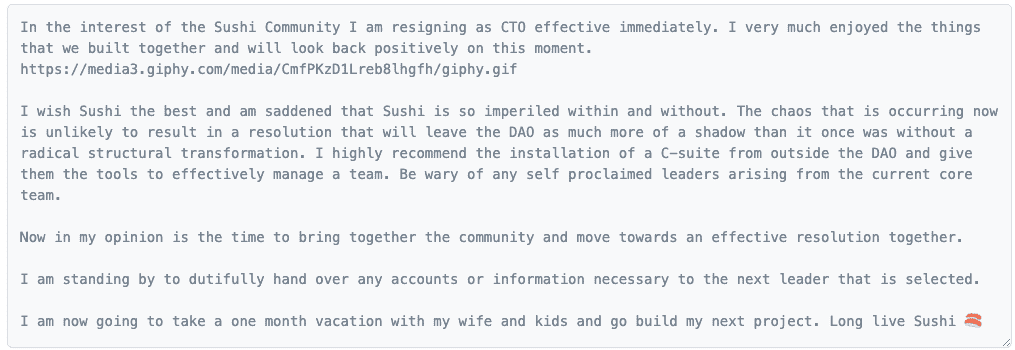

Hope of a price recovery among Sushi governance token holders after the protocol’s CTO, Joseph Delong, resigned was shattered early Thursday as SUSHI had gained 20% on word of his resignation but subsequently dropped back down to Earth.

The token is up about 3% in the last 24 hours, according to CoinGecko, and started the US trading day at around $6. Initially, when Delong tweeted his resignation, the token spiked to $6.90 — up approximately 20%.

Delong sent a message embedded in an Ethereum transaction using his private key which must be read as UTF-8 data to decode

Delong sent a message embedded in an Ethereum transaction using his private key which must be read as UTF-8 data to decode

SushiSwap’s token is down about 50% in the past month.

Open interest data is flat, consolidating around the $2.19 million mark, showing that investors are satisfied at the token’s current pricing.

At the core of the token’s decline is the market’s lack of confidence in the DEX’s future, amidst infighting between Delong and a clique of executives and the rest of the DAO community.

“Sushi is currently demonstrating the perils of DAO governance for all to see, with token holders now turning on the core team in a vicious public battle,” Will Harborne, CEO of DEX DeversiFi told Blockworks via Telegram.

“With Delong having been leading the development of Sushi’s next generation AMM Trident, hoped by many to be the key to challenging Uniswap V3, this will leave the community governed project even more leaderless,” he said.

While there have been proposals to reform the DEX’s governance by investors like Arca, which would make it more in line with a hierarchical corporation, no action has yet been taken to seriously consider its implementation.

“DAOs aren’t a silver bullet solution and need leadership and good governance just like any other organization. When there is misalignment between leadership and community, the entire DAO will suffer,” Luuk Weber, strategic lead at PrimeDAO told Blockworks in an interview.

“Single token governance, as used in Sushi, allows for wide governance participation, but may also cause tension between token holders and leaders,” said Weber.

In the case of Sushi, 64% of all governance tokens are held by whales, according to IntoTheBlock, while 27% of all governance tokens are held by one sole investor.

“This causes misalignment between leadership and the community which ultimately ends with both sides losing faith in each other; driving down the value of the governance token as it loses its power to coordinate contributors,” added Weber.

Sushi is down from an all-time high of $23, which it hit in mid-March.

“We’ve seen Sushi recover from worse crises in the past and so much hope remains, but it will require the DAO to find strong new leadership and ideas from within the community fast to avoid a death spiral,” concluded Harborne.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.