Swipe Left To Short, Right To Long: Tinder for NFT Leverage Goes Live

Blockworks exclusive: SynFutures launches alpha for Tinder-style NFT trading app, allowing up to 3x leverage by swiping left and right.

Shutterstock.com/r.classen, modified by Blockworks

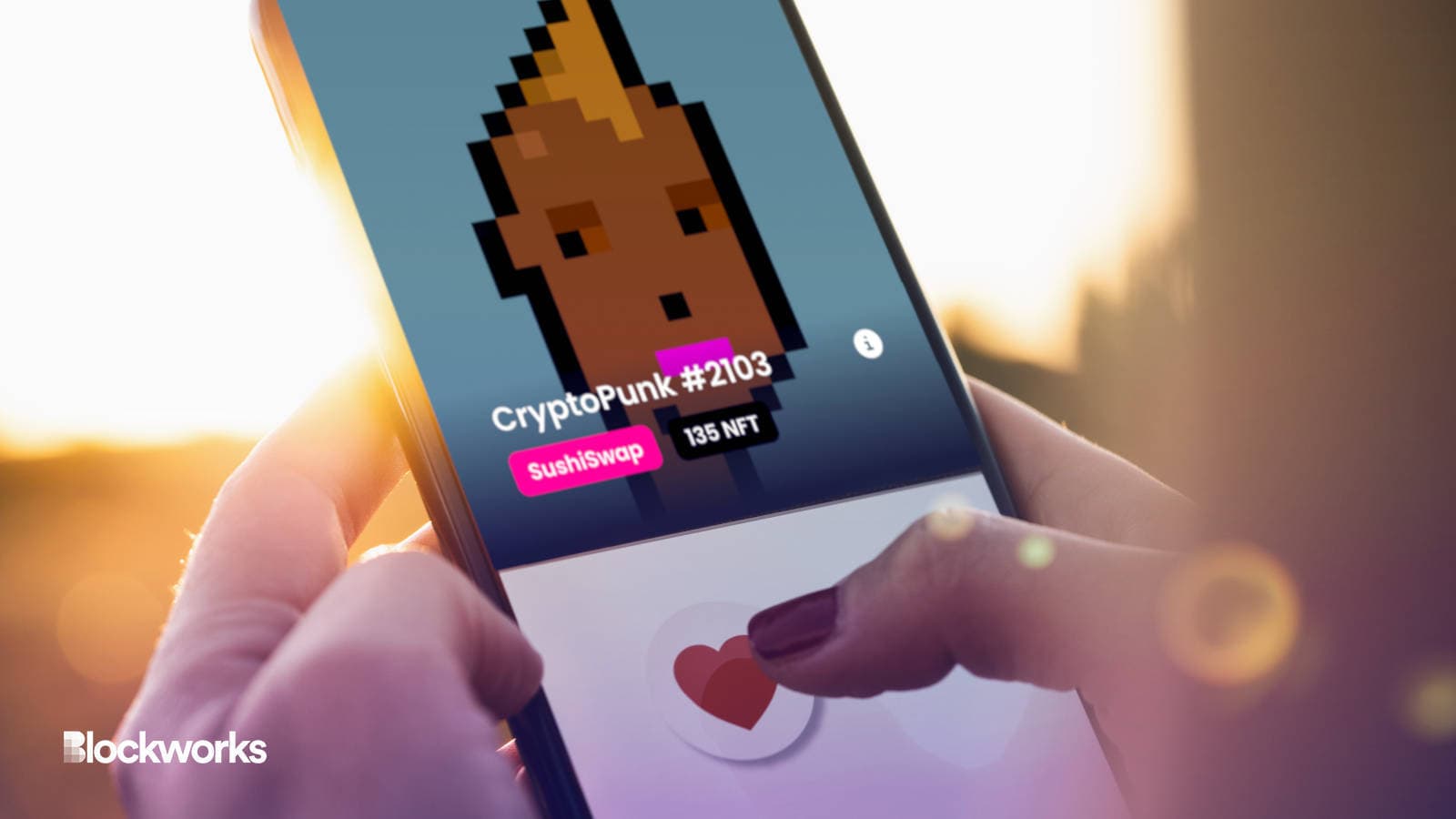

On the romance front, SynFutures’ new NFT trading app, NFTures, probably can’t help. But its interface is no doubt familiar to anyone who’s been unlucky enough to use dating apps like Tinder and Hinge.

Swipe left to short the CryptoPunk. Swipe right to go long — with up to three times leverage either way.

It’s a hilariously degenerate way to think about NFTs. But it moves to reinforce personal taste at a time when NFT marketplaces are catering to high-volume traders.

Instead of gamifying speculation with impersonal aggregators, low fees and zero royalties, NFTures places the actual imagery tied to NFTs front and center.

Just like how potential dates instantly determine date-ability with one glance at a profile picture, traders can immediately wager whether a blue-chip profile picture NFT is overvalued or undervalued, with all bets collateralized and settled in ether (ETH), all on-chain via browser wallet MetaMask, among others.

NFTures (a portmanteau of “NFT” and “futures”) is currently in alpha, and went live this morning for a portion of SynFutures’ waiting list. The list has so far garnered around 14,000 signups, chief marketing officer Mark Lee told Blockworks, with a few thousand now able to start swiping.

Users won’t be longing or shorting fully-fledged NFTs, which in the case of Bored Apes and CryptoPunks cost upwards of 58 ETH ($100,000). NFTures instead offers exposure to a basket of floor price CryptoPunks via a SushiSwap price oracle.

Are you into this CryptoPunk? Click the heart to go long | Source: SynFutures

Are you into this CryptoPunk? Click the heart to go long | Source: SynFuturesThe basket of CryptoPunks is an NFTX treasury filled with 135 NFTs, all equally valued. The treasury is effectively a floor-price CryptoPunk index fund.

Users deposit their NFTs in return for an ERC-20 vToken, PUNK, which represents claim on a random NFT contained within the treasury. Those tokens can then freely be exchanged, or even used to access a special Curve pool for further leverage.

By indexing those CryptoPunks, NFTX offers an alternative to floor prices (the lowest-valued NFT in a collection). Floor prices can be easily gamed: wash trading far below the lowest going price can immediately tank them, opening up all sorts of concerns for leveraged positions.

PUNK, on the other hand, trades on decentralized exchanges SushiSwap and Uniswap, allowing better price discovery on that particular collection. SynFutures new app offers exposure to that spot price, rather than transacting any individual CryptoPunks.

SynFutures plans to add more NFTs treasuries in the future, with Bored Apes and Pudgy Penguins and other top-10 collections floated as potential candidates.

Ethereum for NFT derivatives, Polygon for crypto

Another advantage of offering exposure on an index, rather than actual NFTs, is that it opens markets up for smaller bids. Trading CryptoPunks directly demands six-figure capital, but NFTures allows much smaller positions to be taken.

There are other concerns. Positions are all settled on Ethereum, which has recently experienced an uptick in usage, translating to increased transaction fees.

Trades on the app cost around $10 in gas fees right now and, to begin with, the app only allows users to take a fully-collateralized position worth up to 0.1 ETH ($168), eating into potential upside.

“It’s important for us to increase the position size. If the position size is too small, there’s just not enough financial incentive for someone to pay these fees,” SynFutures’ Lee said.

Liquidity can also be a problem on DEXs, especially for more exotic derivatives like these, resulting in unavailable trades and slippage.

Similar to SynFutures’ primary protocol, which supports futures trading for certain cryptocurrencies, NFTures is bootstrapped by capital provided by some of SynFutures’ strategic partners. The two platforms are completely separate, with separate liquidity pools, but NFTures does use SynFutures’ trading infrastructure.

“It all comes down to demand, which is why we’re doing it in phases. If we opened it up for everyone and there wasn’t enough liquidity, that would be an issue,” Lee said. “So we just want to make sure we monitor our liquidity, make sure it’s able to support the demand that comes in.”

Lee noted that as more demand comes into the app, the firm will expand liquidity either internally or through some of its external partners. SynFutures will continue to open access every week.

SynFutures opted for Ethereum rather than its native Polygon to power its NFT app, despite the fees, as it doesn’t anticipate people coming in and out of positions too much, unlike actual crypto derivatives, which demand higher volume.

“All of the popular NFT collections — the major ones that actually have enough liquidity and market depth — also happen to be on Ethereum,” Lee said.

Tinder for NFT leverage, a gateway to DeFi

Lee expressed that NFT trading isn’t meant to be like crypto derivatives trading, which at the top end is typically earmarked by high volume.

By creating a trading platform in the style of modern dating apps, SynFutures hopes to attract a wider audience than only seasoned NFT traders (SynFutures’ terms prohibit a number of jurisdictions, though, including the US and UK).

“NFT prices don’t change that much anyway, so this is really more a mid-term bet that you’re making. You’re saying: ‘Okay, I think in the next month or two, I see CryptoPunks dropping, so I’ll open a position here,” Lee said.

Other startups are building NFT derivatives products, too. NFTPerps is currently in private beta on Ethereum Layer-2 network Arbitrum, for one, but that’s pitched towards more crypto native speculators.

Lee sees NFTures serving a different purpose: introducing the broader NFT collector audience to the idea of DeFi. That means making them comfortable with the idea of speculating on NFTs in other ways than by simply buying and holding them.

“If you’re holding a piece and you don’t necessarily want to get rid of it, you could open a short position to cover some of your downside risk,” Lee said. “We call NFTs a gateway into crypto, we want this product to be a gateway into DeFi.”

Then again, some NFT collectors are in love with their JPEGs. Shorting them would just be rude.

Updated Mar. 22, 2023 at 2:21 pm ET: Added terms and conditions.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.