Empire Newsletter: There’s a whole wide world outside of US ETFs

Just over half of the crypto tokens held by investment products have beaten the S&P 500 over the past year

Tada Images/Shutterstock modified by Blockworks

Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Just like us

US-listed ETFs tend to get a lot of attention. And rightly so — nothing says “crypto is eating finance” more than Wall Street funds scooping up tokens for their shareholders.

But there’s a whole world outside of ETFs and even the US.

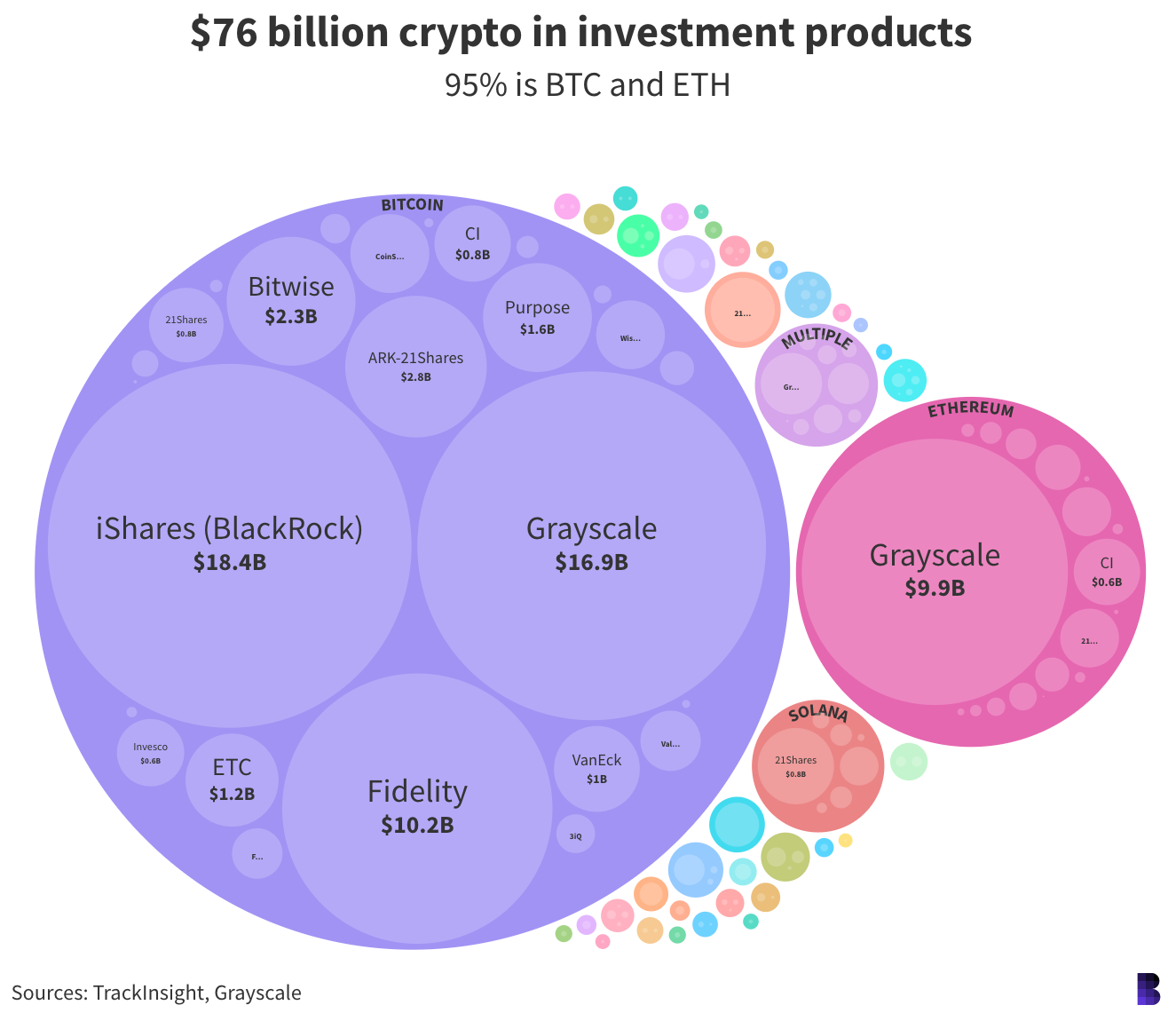

For sure, an overwhelming majority of assets under management (AUM) by crypto investment products are tied up in bitcoin and ether.

The circles represent different products holding different cryptocurrencies.

The circles represent different products holding different cryptocurrencies.

As the US waits for the SEC to formally approve the ether ETF registration statements (and for any decision on the solana ETFs) there are already a number of ETPs, ETNs and ETCs listed in the US and Europe backed by those cryptocurrencies.

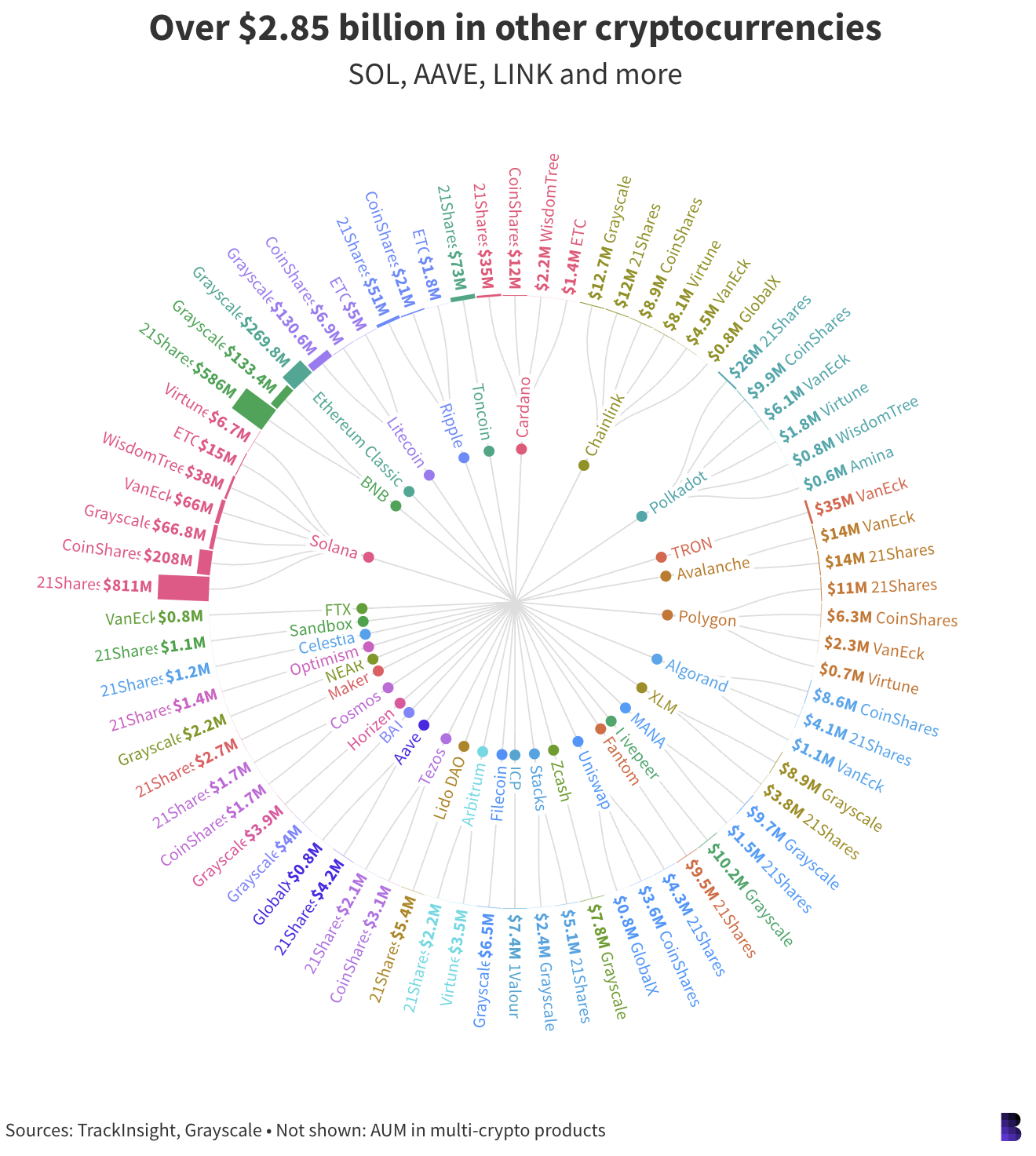

There are even more products with direct exposure to 33 additional tokens including celestia, optimism, fantom, uniswap and stacks.

Solana is so far the number-three pick from traditional finance types, with $1.22 billion split between funds from 21Shares, CoinShares, Grayscale, VanEck, WisdomTree, ETC and Virtune.

BNB, ethereum classic and litecoin are next in line, ranging from cumulative AUM of $719.4 million for the former and $142.5 million for the latter.

Yes, a Grayscale trust still holds hundreds of millions of dollars in ethereum classic, thanks to its closed-ended nature.

Yes, a Grayscale trust still holds hundreds of millions of dollars in ethereum classic, thanks to its closed-ended nature.

Buying all those cryptocurrencies is one thing, but it’s another to hold the right ones.

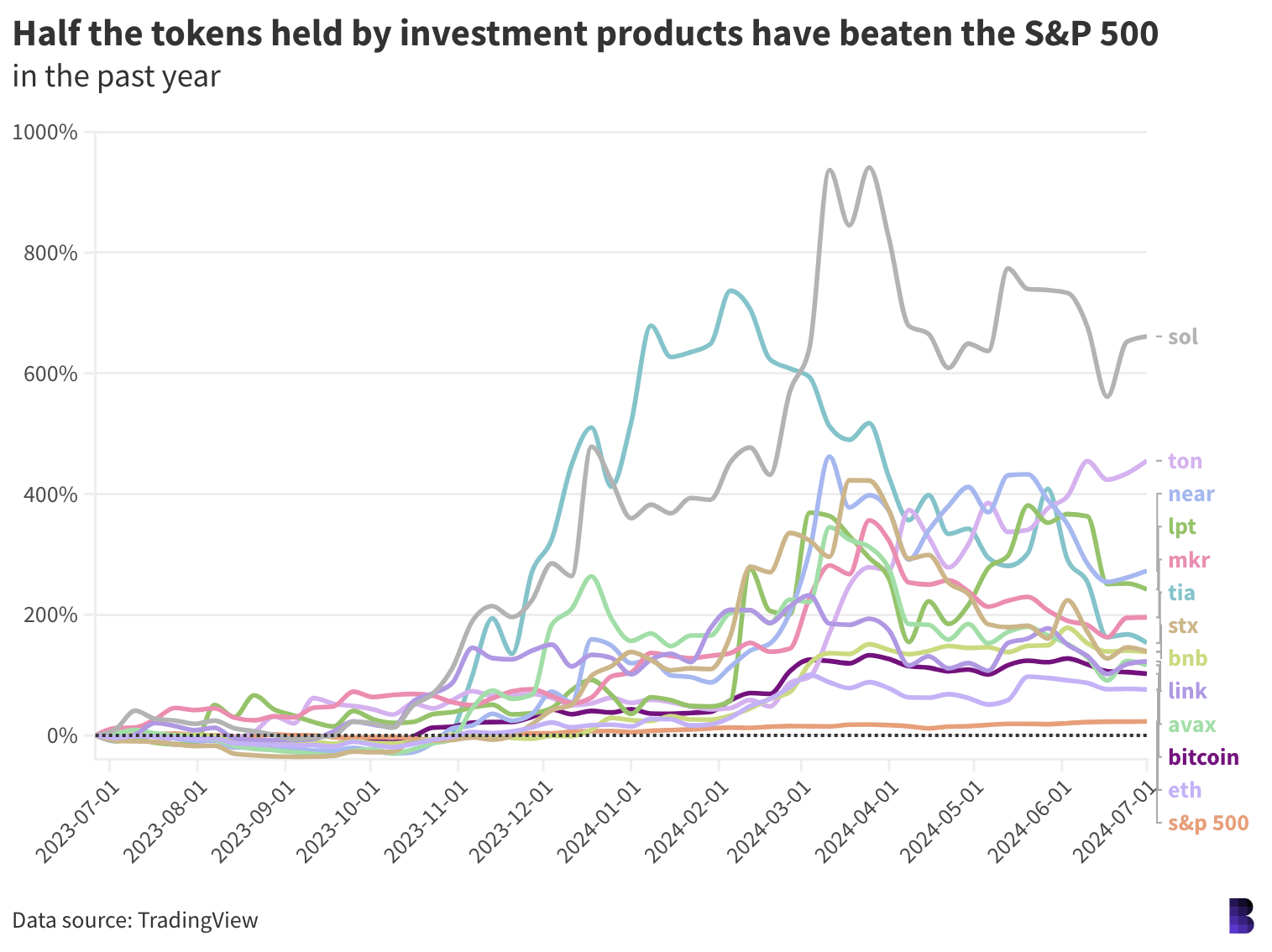

So far so good for most. Just over half of the tokens held by investment products have beaten the S&P 500 over the past year.

Solana, ton, near, livepeer, maker and celestia have led the pack, all posting more than 200% returns since this time last year as of earlier this week.

Bitcoin and ether were up 102% and 76% respectively.

The S&P 500 has meanwhile gained about 23% over the same period.

The S&P 500 has meanwhile gained about 23% over the same period.

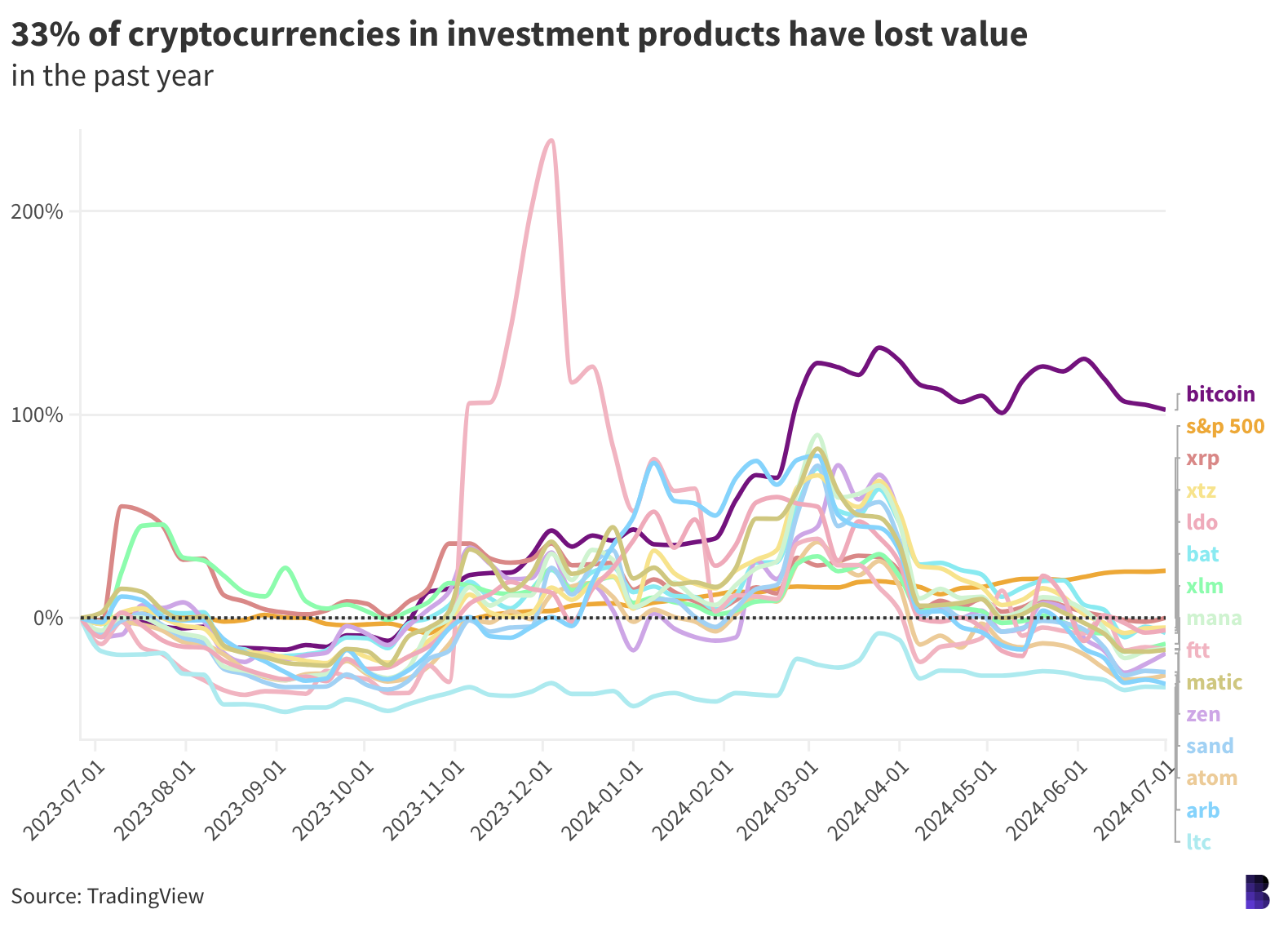

There are, however, some laggards. One-third of the cryptocurrencies held by the analyzed products are in the red this past year.

Litecoin, arbitrum, cosmos and the sandbox are the worst off, down between 34% and 26%.

Litecoin, arbitrum, cosmos and the sandbox are the worst off, down between 34% and 26%.

So, while it’s heartening to know that some percentage of token supplies might be gobbled up by traditional investment products — it can still go wrong for those buyers.

The products themselves can diverge from the underlying cryptocurrencies, especially with closed-ended funds like Grayscale’s, but the performance of the tokens alone shows the strike rate isn’t bad at all.

— David Canellis

P.S. Katherine and I need your help. Fill out this survey and help us produce journalism tailored to you and your interests.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.