BUSD

Buried inside Binance’s proof of reserves is proof of diamond hands among its users

Paxos is getting off scot-free after the SEC said it wouldn’t pursue legal action against the company

Binance is preparing to phase out BUSD, but the replacement is struggling to gain on-chain adoption

What do you mean, you’ve never bet money on a cuddly rodent via Binance Smart Chain?

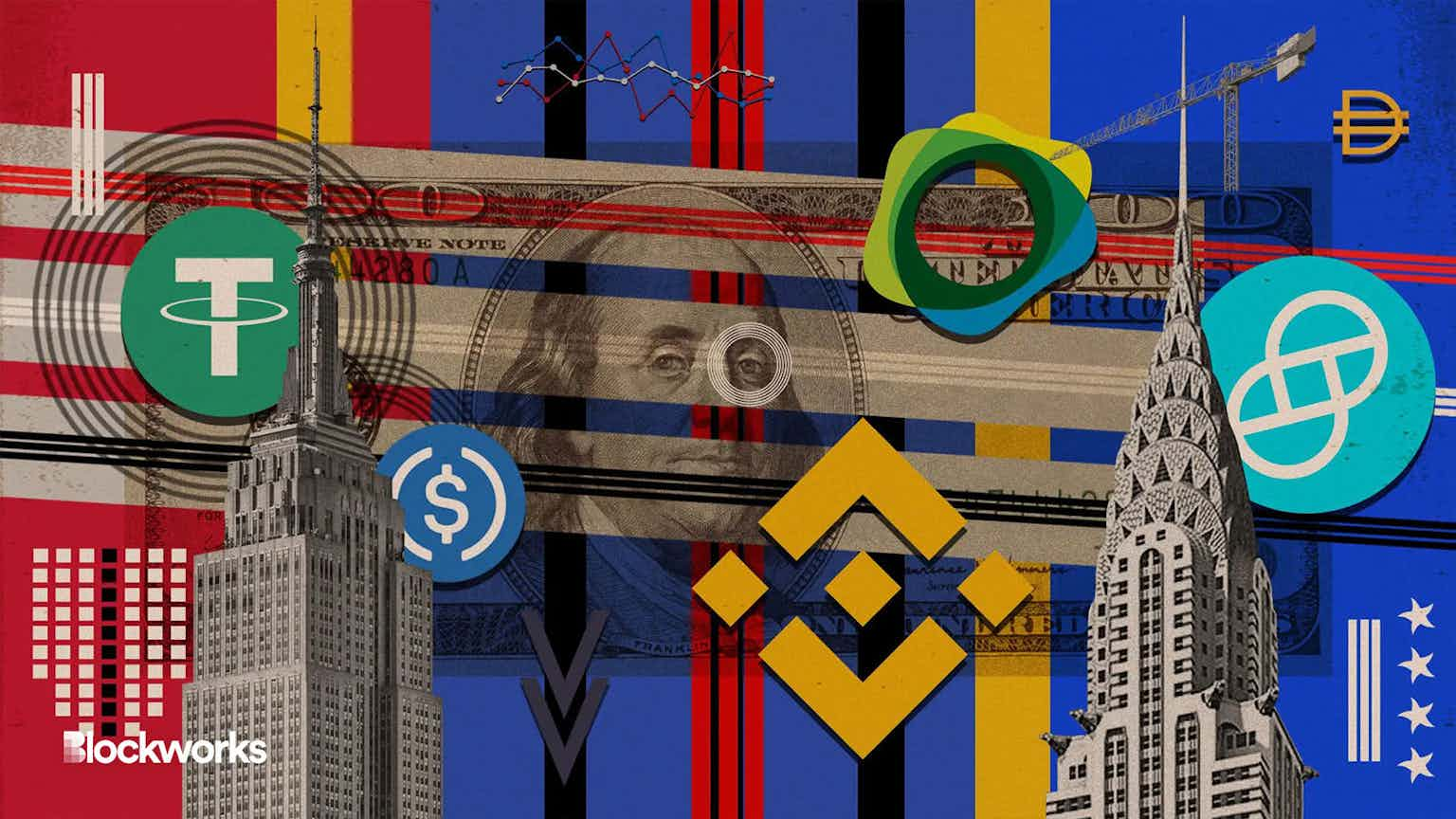

The percentage of stablecoins in the total crypto market capitalization has seen a sharp rise in the past two months

USDT’s dominance is likely the result of headwinds faced by its rivals, USDC and BUSD, in recent weeks, analysts say

After facing regulatory scrutiny in the US, Binance’s BUSD could be heading the way of the dodo, according to on-chain data and analysts

Given the regulatory pressure BUSD is facing, suspending trading is a good opportunity for Coinbase to make a move the SEC will appreciate without much of a downside

US government debt is considered as highly liquid assets leaving little doubt about Paxos’ ability to meet an influx of redemptions on BUSD, analysts say

BUSD’s circulating supply has dipped by 26% since Paxos received a Wells notice from the SEC

Stablecoin dominance is one of the only crypto charts to steadily fall over the past 60 days, per Blockworks Research

After a record year for regulatory action in 2022, the “regulation by enforcement” era has continued into the new year

“The regulator for the capital of capital markets does not need a single company to bring to its attention a widely evidenced and reported situation,” says Circle spokesperson

Paxos deposit addresses saw a huge uptick in deposits, meaning there’s more redemptions/burns to come, a Nansen researcher said

Regulators’ latest actions could mark an expanded interpretation of which stablecoins qualify as securities, one lawyer said — but much is still unknown

More projects may leave the US for jurisdictions that are more open to innovation, Ume CEO Brent Xu told Blockworks

Binance chief says they will continue BUSD support but, “foresee users migrating to other stablecoins over time.”

Analysts say USDT growth resembles similar periods in 2019 and 2020 which coincided with bitcoin bull markets

The largest crypto exchange is back to holding about 80% of market share relative to 11 other centralized exchanges, up from a low of around 67%

Osmosis is set to launch a “version of the Curve 3pool, which includes USDC, Tether, and BUSD,” founder Sunny Aggarwal told Blockworks

Circle currently holds about 31% of the total market share for stablecoins, down from 37% six months ago