BAYC Flips CryptoPunks as OpenSea Volume Recovers: Markets Wrap

Bored Ape Yacht Club becomes the most expensive NFT community to join after flipping CryptoPunks in floor price

Bored Ape Yacht Club | Source: NTFS.WTF

- Bored Ape Yacht Club flips CryptoPunks in terms of floor price

- Axie Infinity remains the largest NFT collection by trading volume over the past 7 days

Bored Ape Yacht Club flips CryptoPunks in terms of floor price.

Opensea volume has rebounded during the month of December.

Axie Infinity is still the largest non-fungible token collection by trading volume over the past 7 days.

Latest in Macro:

- S&P 500: 4,696, +1.02%

- NASDAQ: 15,521, +1.18%

- Gold: $1,803, +0.76%

- WTI Crude Oil: $72.96, +2.60%

- 10-Year Treasury: 1.453%, -0.034%

Latest in Crypto:

- BTC: $49,214, +0.40%

- ETH: $4,035, -0.10%

- ETH/BTC: 0.0819, -0.17%

- BTC.D: 40.37%, -0.74%

BAYC flips CryptoPunks floor price

Popular NFT art collections Bored Ape Yacht Club (BAYC) and CryptoPunks have seen their floor prices, the lowest priced piece of art in a given collection currently for sale on a secondary market, converge over the past month.

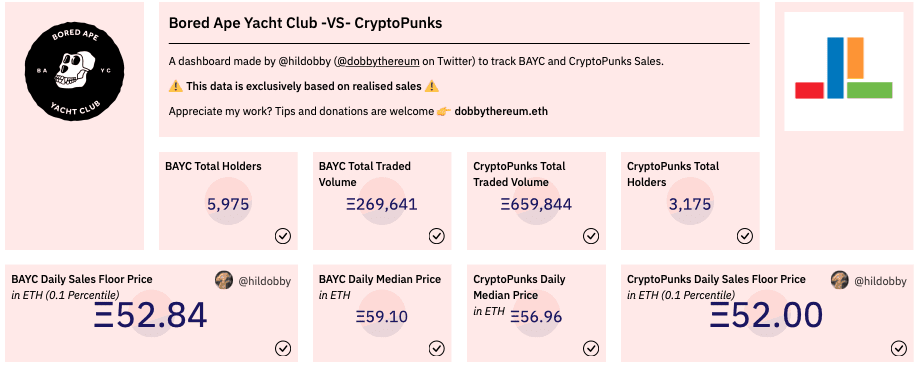

Today the BAYC floor price officially ousted CryptoPunks as the most expensive NFT community to join, with its floor prices sitting at 52.84 ETH and 52 ETH, respectively, according to data from Dune Analytics.

Source: Dune Analytics

Source: Dune AnalyticsThe rise of BAYC can in part be attributed to high-profile celebrities such as Post Malone, Steph Curry and Jimmy Fallon purchasing apes to become part of the community.

“We describe NFTs as stores of culture because they embody a moment in history,” Yat Siu, co-founder and chairman of NFT game developer Animoca Brands, said in a Cointelegraph interview.

Many NFT market participants believe that these profile pictures are representative of their identities online and are not open to selling, even at a price tag equal to over $210,000.

“Heyy are you interested in selling me your pink Bored Ape? I’m absolutely in love with it,” billionaire Kylie Jenner messaged @WillyTheDegen, an anonymous NFT collector, on Twitter.

Willy tweeted in response to her direct message saying, “I hit delete message, by the way. Diamond hands baby,” and proceeded to block her, “for the culture.”

While BAYC floor price has in fact flipped CryptoPunks, it is worth noting that the lifetime trading volume is more than double BAYC’s with nearly 670,000 volume of ETH traded, according to data from Dune Analytics.

BAYC is also planning to launch a token in early 2022, which could be contributing to the price appreciation according to The Block.

Opensea volume rebounds

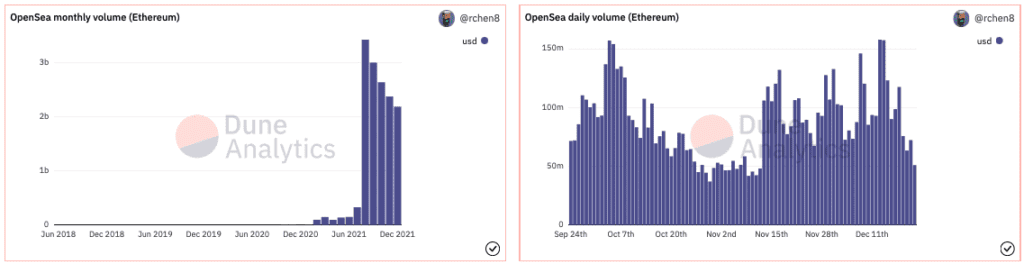

Opensea volume has rebounded during the month of December, on pace to hit roughly $2.82 billion in monthly sales, according to data from Dune Analytics.

If OpenSea’s trading volume maintains its current pace, this would mark the highest number since September. Daily volume has been tapering off over the past few days, but maybe those last-minute Christmas shoppers will push volumes higher.

Source: @bit_hedge

Source: @bit_hedgeNFTs overview

Despite a lot of action going on in the world of NFTs, Axie Infinity was still the top collection by sales according to data collected by the Satoshi Club.

Source: @esatoshiclub

Source: @esatoshiclub

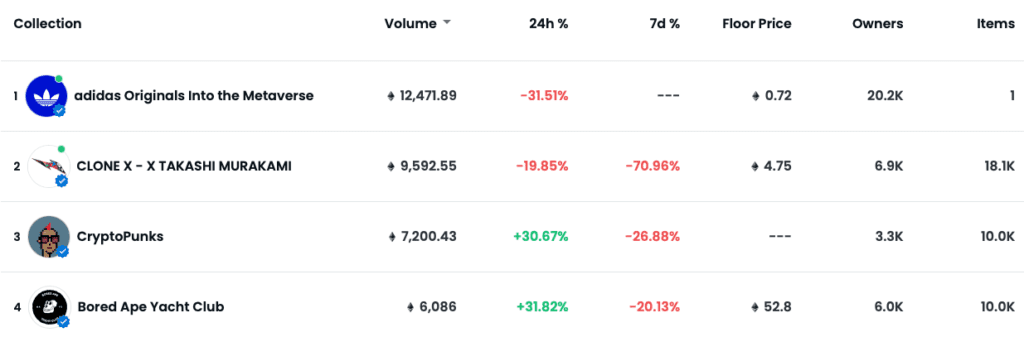

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

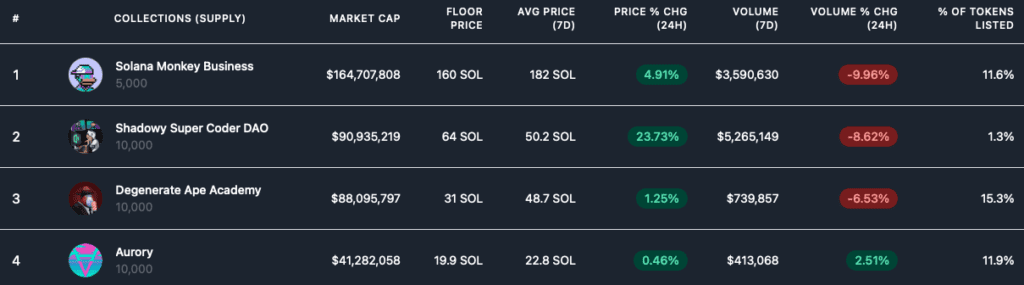

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.