California Governor Newsom Vetoes Crypto Bill

The governor said the bill would have cost California “tens of millions” of dollars and the state would wait for federal policymakers to reach their own conclusions on crypto

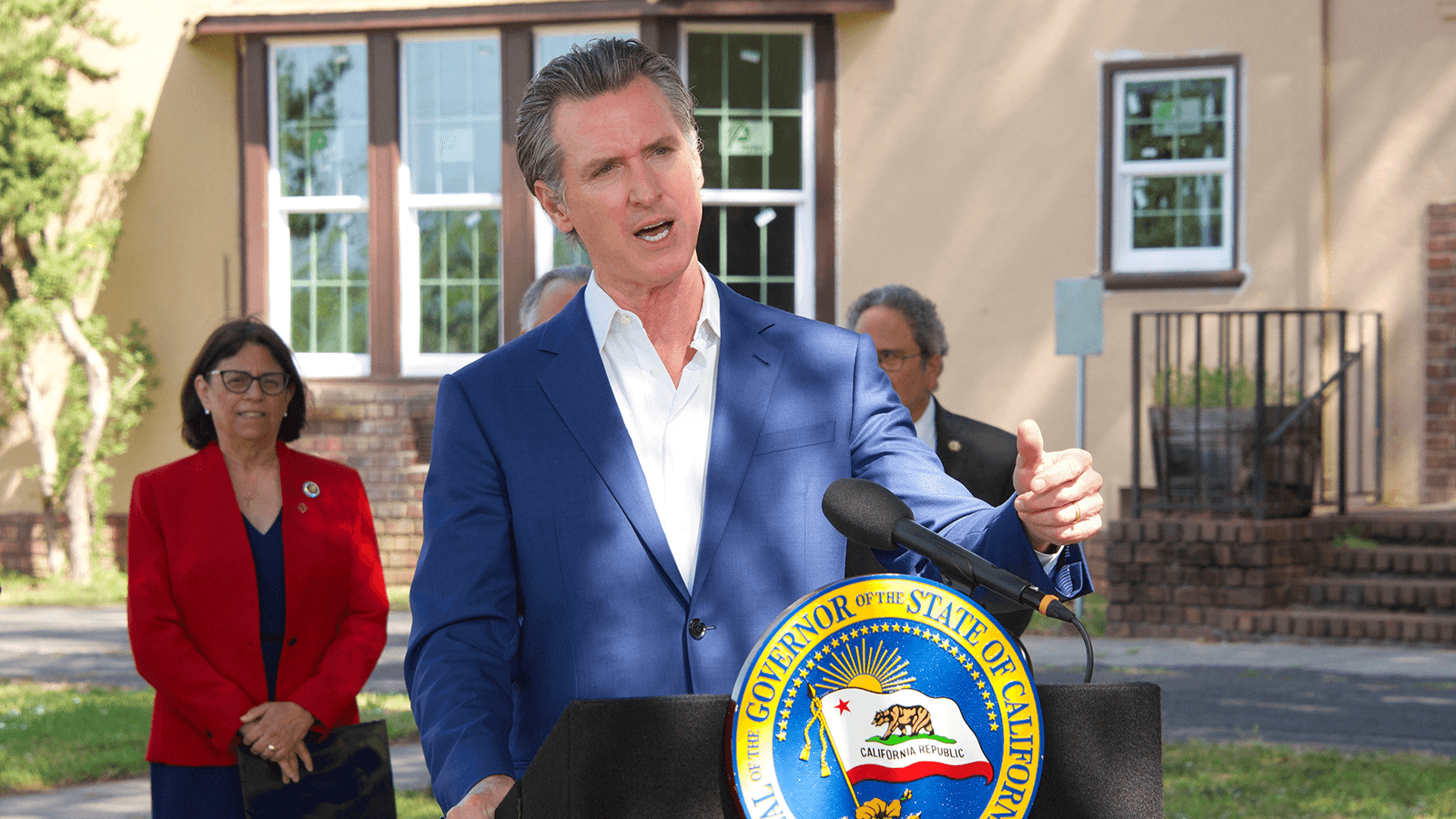

Gavin Newsom; Source: Shutterstock

- California’s governor has refused to sign a digital assets bill that sought greater regulatory clarity

- Initially decreed by the governor via executive order, the bill would have established a licensing regime similar to those overseas

California’s governor has vetoed a bill — born out of an executive order he issued in May — that sought to establish a licensing and regulatory framework for digital assets.

The bill would have tasked crypto companies with seeking a license to offer their services or digital assets to the state’s residents.

It would have also formally adopted new rules governing stablecoins, including requirements that licensed companies only engage with bank-issued stablecoins, which must remain 100% backed by reserves.

Governor Gavin Newsom said his reasoning was due to the bill’s “premature” nature to lock in a licensing regime under Assembly Bill 2269 without first considering prior research and forthcoming federal actions.

At least four US watchdogs — the Secretary of the Treasury, the Secretary of State, the Secretary of Commerce and the Agency for International Development — as well as “other relevant agencies” participated in one of many reports on digital asset regulation in July.

The report included the usual well-worn arguments from government officials, including the need to regulate stablecoins following Terra’s collapse, as well as the potential for criminal use and financial instability resulting from the new asset class.

“A more flexible approach is needed to ensure regulatory oversight can keep up with rapidly evolving technology and use cases and is tailored with the proper tools to address trends and mitigate consumer harm,” the governor said in a statement addressed to members of the California State Assembly.

Newsom also said that presenting a new regulatory program was a costly undertaking which, as the governor stated, would require a loan from the state’s general fund exceeding tens of millions of dollars during the bill’s initial implementation.

“Such a significant commitment of general fund resources should be considered and accounted for in the annual budget process,” the governor said.

Crypto proponents across California and the US have been asking for clearer guidelines on digital assets since at least 2015 shortly following the birth of Ethereum. Several boom and bust cycles throughout crypto’s short history have also prompted regulators to act.

The governor said that while he had refused to sign the bill into law, he would work “collaboratively” with California’s legislature to achieve regulatory clarity only after federal regulators had metered out their own stance toward the new asset class.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.