Crypto Venture Firm Dragonfly Acquires Hedge Fund Backed By A16z, Sequoia

Dragonfly buys early Ethereum, Algorand investor

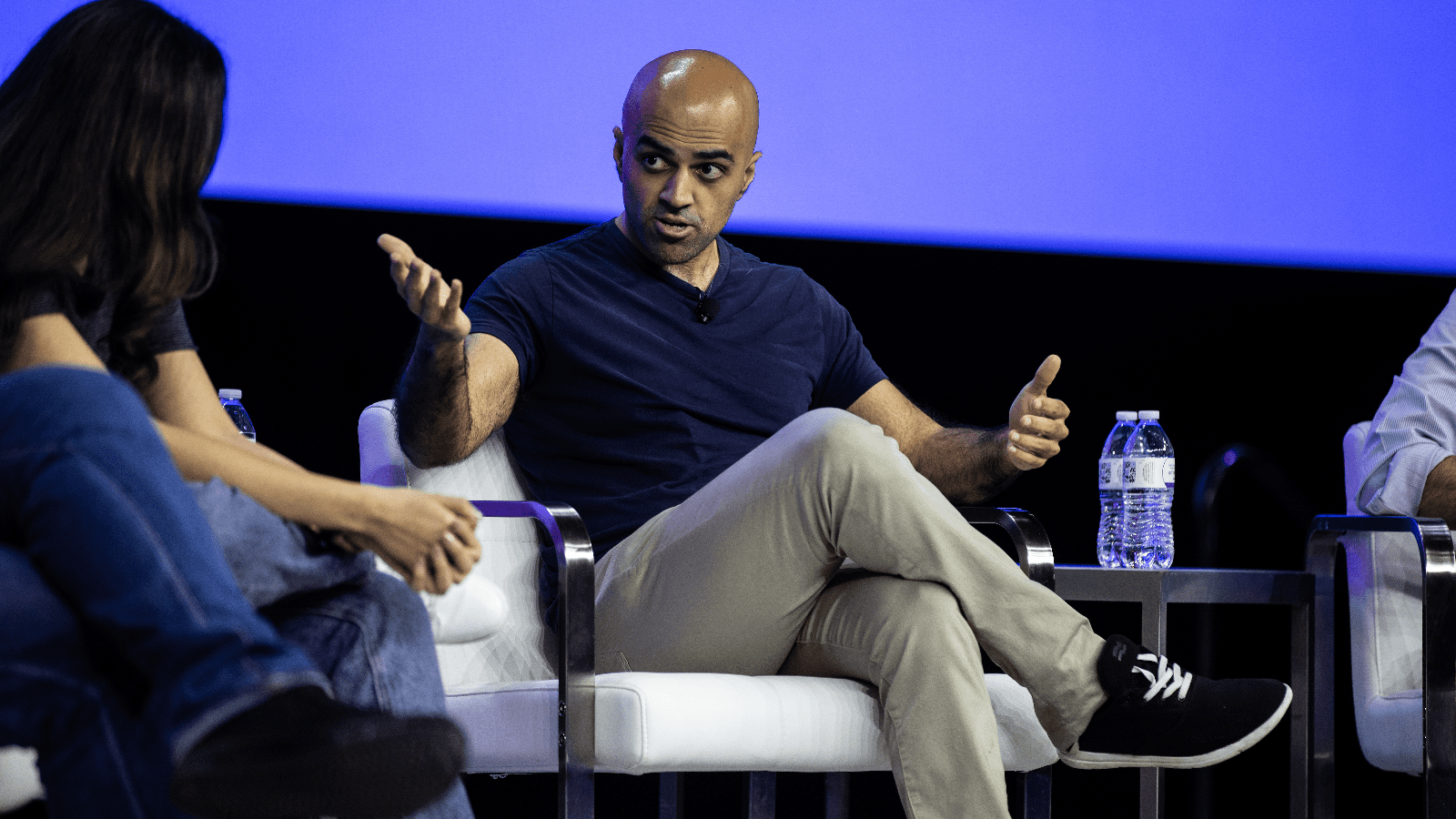

Dragonfly Capital Managing Partner Haseeb Qureshi | Photo by Lauren Sopourn

key takeaways

- Dragonfly purchases early Ethereum investor in undisclosed deal

- Dragonfly managing partner Haseeb Qureshi formerly worked as a partner at the hedge fund firm

Cryptocurrency-focused venture capitalist Dragonfly has purchased its first digital assets hedge fund firm backed by Sequoia and a16z.

The acquisition, MetaStable, founded in 2014, is one of the oldest and highest-performing crypto hedge funds. MetaStable was an early investor in Ethereum, Filecoin and Algorand — at one point raking in a return in excess of 500%.

More recently, the fund has invested in trading platform Floating Point Group and layer-1 protocol Iron Fish.

Dragonfly managing partner Haseeb Qureshi, who formerly worked as a partner at MetaStable, in a blog post Monday said the firm is now “more expansive than it’s ever been.”

The news comes months after Dragonfly, based in San Francisco, CA, closed its third crypto venture fund at an oversubscribed $650 million. Its second fund, closed in 2021, cleared $250 million. The company remains interested in native protocols, Web3 initiatives and tokens that aim to create new digital economies, General Partner Tom Schmidt said in May.

Dragonfly will also soon be the new owner of 10 million LDO tokens — equal to 1% of the total supply — after the Lido DAO approved the sale earlier this month. Lido is a liquidity platform where traders can earn yields on staked assets. LDO token holders came to an agreement after floating different versions of the proposal.

Dragonfly committed to buying the LDO tokens at $1.45 apiece, or at the two-week average price as of the vote plus a 5% premium, whichever is higher. There is a one-year lockup period.

As part of a brand overhaul, also announced Monday, the firm has dropped “Capital” from its name.

The acquisitions and rebranding effort fit into Dragonfly’s broader goal to reintegrate itself as a crypto-native brand. Its new look is affectionately inspired by the “hacker” and “weirdo” culture often displayed throughout the space, according to Qureshi.

“It’s time for a refresh,” Qureshi said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- 0xResearch: Alpha directly in your inbox.

- Lightspeed: All things Solana.

- The Drop: Apps, games, memes and more.

- Supply Shock: Bitcoin, bitcoin, bitcoin.