ETH and BTC Cede Market Share to AVAX, SOL, LUNA and BSC: Markets Wrap

BTC has been rangebound this week as market sentiment remains mixed, ETH and BTC continue to cede market dominance to alternative networks.

Blockworks exclusive art by Axel Rangel

- BTC has been rangebound this week as market sentiment remains mixed

- BTC and ETH continue to battle alternative networks for investor mindshare

BTC has been rangebound this week between $56,000 and $59,000, unable to decide which direction to break.

There are strong cases for both bullish and bearish BTC narratives.

With the Fed sticking to its guns on tightening monetary policy, equities may face headwinds in the near-to-medium term.

ETH and BTC continue to lose market share to AVAX, SOL, LUNA and BSC.

Adidas partnered with multiple NFT collections as the company looks to expand into the metaverse.

Latest in Macro:

- S&P 500: 4,577, +1.42%

- NASDAQ: 15,381, +0.83%

- Gold: $1,769, -0.72%

- WTI Crude Oil: $67.19, +2.47%

- 10-Year Treasury: 1.448%, +0.012%

Latest in Crypto:

- BTC: $56,984, +0.52%

- ETH: $4,549, +0.16%

- ETH/BTC: 0.0798, -0.42%

- BTC.D: 41.62%, -0.13%

BTC rangebound

BTC has been rangebound between $56,000 and $59,000 since Sunday, struggling to make a decisive break to the upside or downside. The number one digital currency attempted to break out numerous times this week on positive news, only to get rejected at the upper end of the trading range.

“To understand the recent bump we’re seeing for BTC, we can look at two recent announcements that highlight one of the bullish tailwinds building behind bitcoin,” wrote Noelle Acheson, head of market insights at Genesis, to Blockworks. “One is the announcement from El Salvador just over a week ago that the country would be issuing a $1 billion bond which would be used to buy $500 million-worth of BTC, half of which would be locked for 5 years. The other is the confirmation over the weekend that MicroStrategy added another 7,000 BTC to its already sizable Treasury.”

BTC bull case

On-chain indicators continue to paint a bullish picture for BTC prospects going forward:

- Illiquid supply sits north of 75%, according to data from Glassnode.

- Long-term holder supply has rolled over, which is common at the beginning of bull markets. It remains a high percentage of the circulating supply.

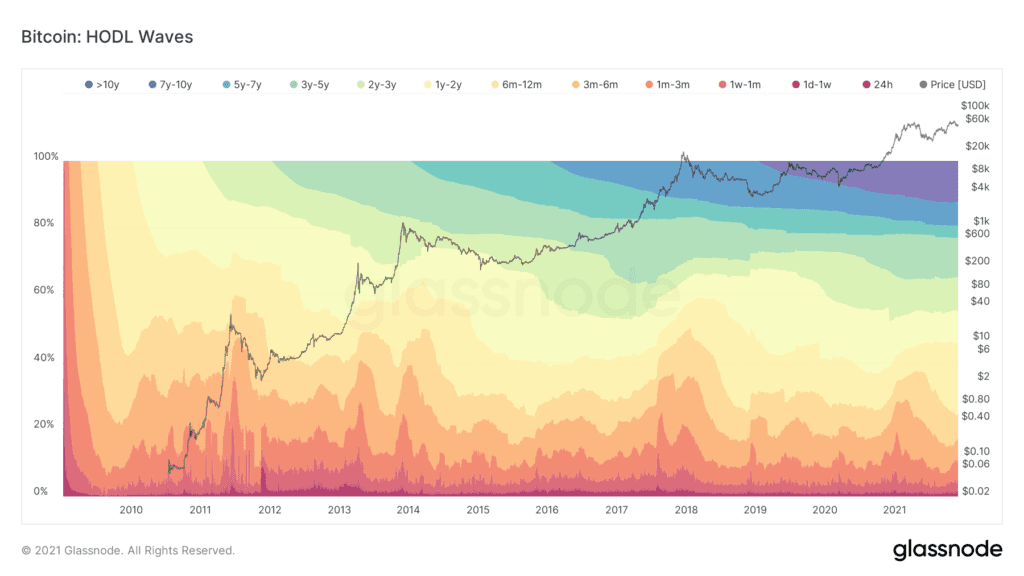

- HODL waves show that while BTC supply held by three- to six-month holders decreased, the six- to 12-month older group actually increased. This is likely new investors who bought at higher prices trying to break even on their purchases by selling into the rally.

- Inflation continues to run hot as the Fed chairman retires the word ‘transitory’ as it relates to inflation.

Source: Glassnode

Source: Glassnode

Over the summer when BTC corrected, a lot of the on-chain metrics displayed bear market bottoming patterns. For example, the Pi Cycle Top Indicator, which tracks the 111-day moving average (DMA) and 2x multiple of the 350 DMA reset since the correction earlier this year. In layman’s terms: when the red line gets close to the green, line caution is warranted.

BTC bear Case

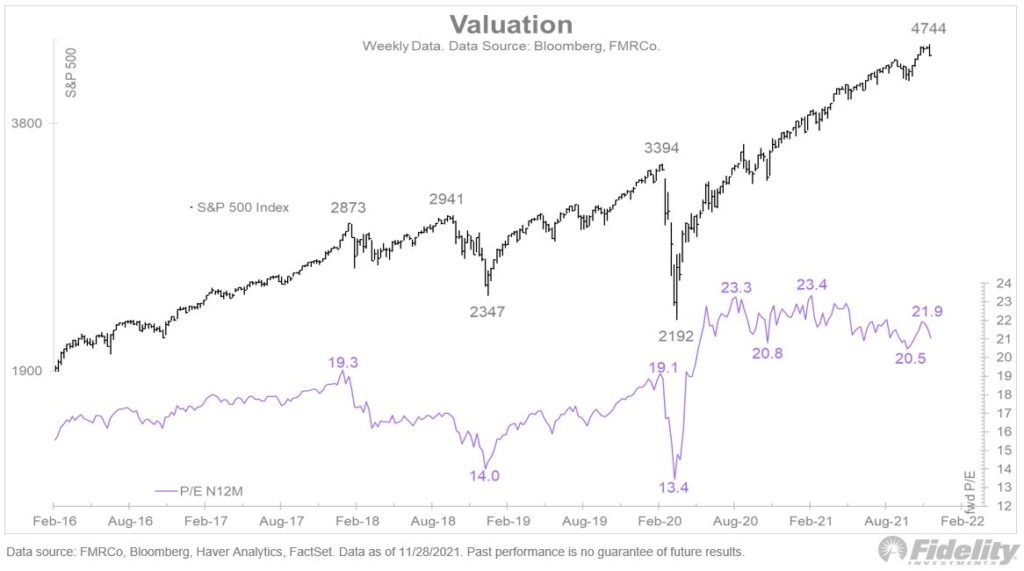

From a macro perspective, there is a lot of uncertainty surrounding markets with the Fed reiterating its plans to tighten monetary policy.

“Is the bull running out of steam?” wrote Jurrien Timmer, director of global macro at fidelity, on Twitter. “Earnings have done all the heavy lifting for more than a year now. The combination of slowing-but-positive earnings growth and a sideways-to-down P/E multiple suggests a flattening out of the bull market’s slope.”

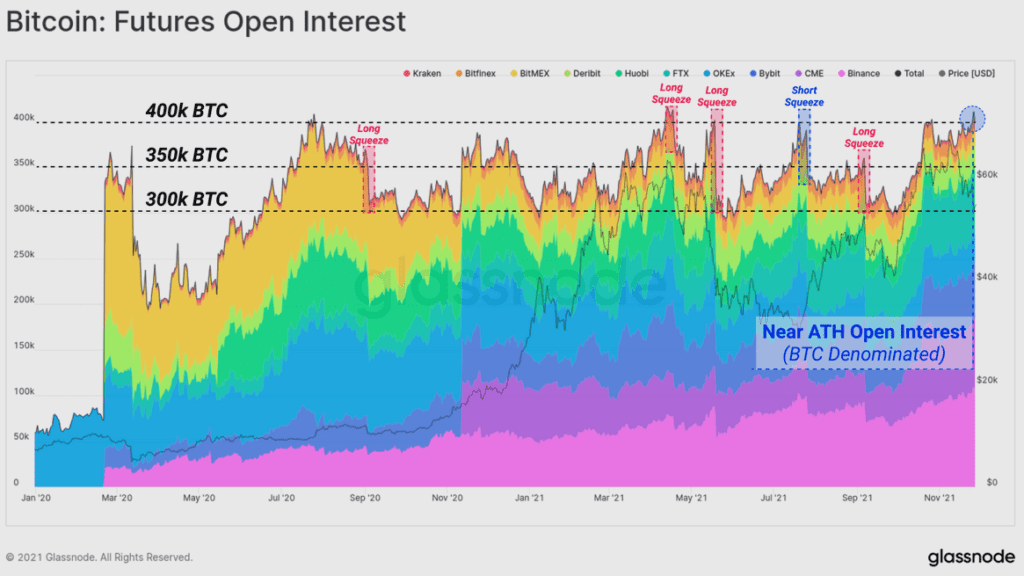

Glassnode notes that futures open interest is just below its all-time high when denominated in BTC. Their report states. “With leverage in futures markets near an ATH, there is a risk that leverage may unwind, as has been demonstrated in almost all prior instances where open interest surpassed 350k BTC in size”.

While funding rates are only showing a slightly positive bias when compared to the end of October run-up, the vast amount of derivatives-based open interest displayed above leaves the door open for a leverage washout of the shorts or the longs. In short, liquidations could spur an explosive upwards or downwards move but only time will tell which way it unfolds.

Increased competition for mindshare

Bitcoin has seen its market cap dominance over the digital asset space fall over the past year from a high of roughly 72.5% in January to a low of roughly 40% in May, according to data taken from Trading View.

Ethereum proponents like to point to the following chart of ETH’s performance denominated in BTC. When the metric is rising, it indicates that ETH is taking market share away from BTC, which has undeniably been occurring. In fact, ETH has outperformed BTC by roughly 230% over the past 12 months. It is worth noting that ETH started with a much lower market cap and thus had more potential upside to begin with.

Source: Trading View

Source: Trading ViewWhat Ethereum proponents aren’t quick to point out is the increased competition for mindshare from decentralized product users and other layer-1 alternatives.

“L1 tokens have been on the rise since EIP-1559 upgrade on ETH in early August. High gas fees on the ETH chain have become a norm now. This has forced participants to move to other L1 chains that provide cheaper and faster transactions over CeFi and DeFi platforms. We expect this trend to continue going forward into the next quarter as well,” Delta Exchange CEO, Pankaj Balani, wrote to Blockworks in an email.

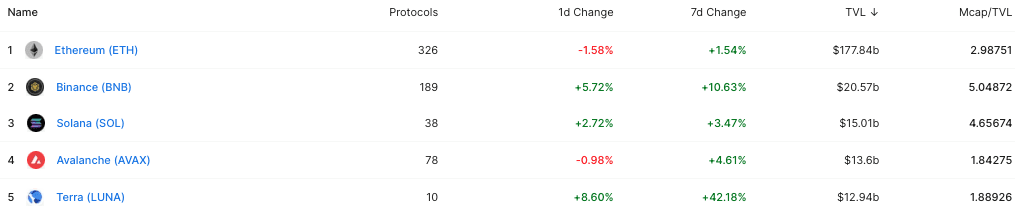

Ethereum’s market share of total value locked (TVL) across all chains was 97.65% on January 1, 2021. Today that number sits at 65.62%, according to data from Defi Llama. The main culprits stealing market share are Binance Smart Chain (BSC), Solana (SOL), Terra (LUNA) and Avalanche (AVAX) as investors seek higher returns from lower market cap assets.

There is no telling if Ethereum will be able to recapture this lost ground as various scaling solutions launch to reduce transaction fees. Incentive programs have also been a large force driving traffic to other chains as users seek higher yields/rewards for their attention. A multi-chain future may be where this is heading.

Source: Defi Llama

Source: Defi LlamaNon-Fungible Tokens (NFTs)

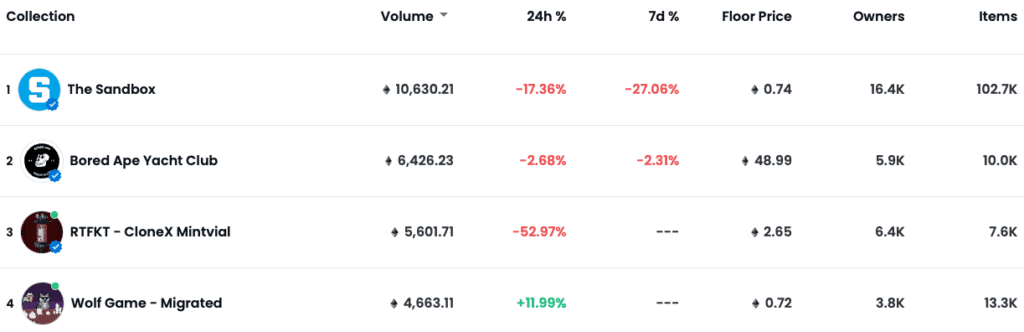

Adidas is launching an NFT product line in collaboration with Bored Ape Yacht Club and Punks Comics, according to a Blockworks article released earlier today.

Sylvia Jablonski, Defiance’s co-founder and chief investment officer, told Blockworks that NFTs will be bigger than the internet.

“NFTs are special; they have created this cultural revolution,” she said. “They are the key to everything that is or will be the metaverse, [and] digital tokens will represent land ownership in the metaverse.”

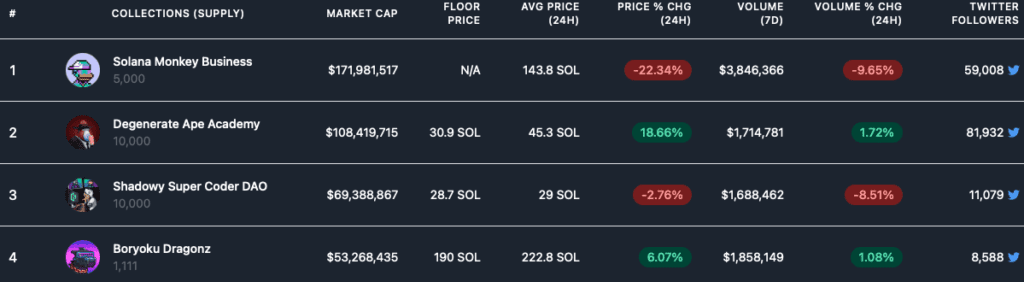

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.