Latest in Crypto Hiring: Crypto Firm Taps TradFi Vets For Asset Management Business

Blockchain privacy startup adds former director of Ecuador’s central bank as an advisor

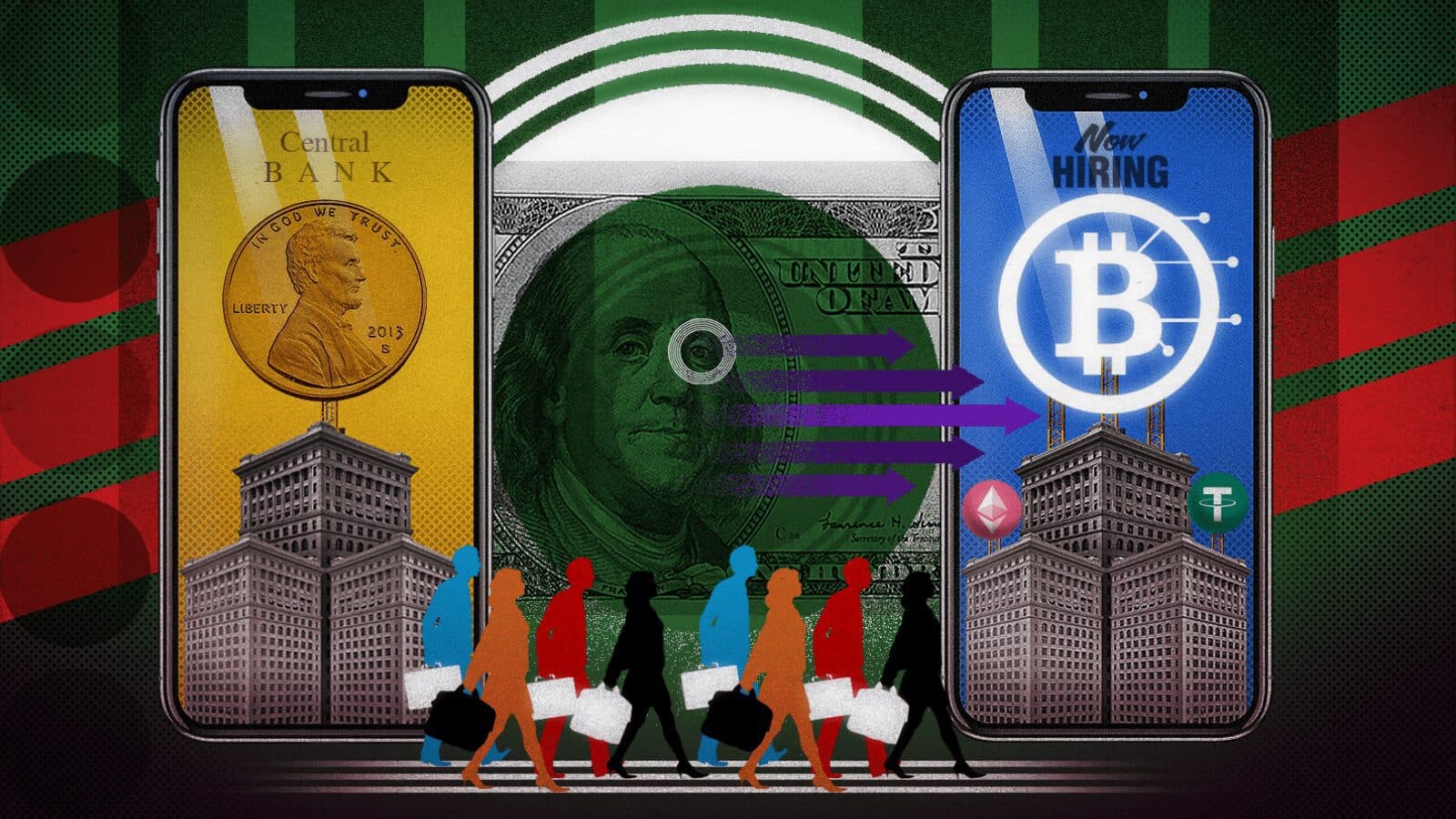

blockworks exclusive art by axel rangel

- Law firm Brown Rudnick adds four partners for its digital commerce practice

- Crypto exchange Rain Financial and social media company Snap reveal layoffs

Crypto-focused financial services firm EQONEX appointed a chief investment officer and head of investment research with extensive traditional finance backgrounds.

CIO Simon Goodman most recently co-founded crypto investment firm PSG Digital and blockchain digital asset allocator Peregrine. Earlier in his career, the executive spent more than 15 years building out hedge fund Marshall Wace’s presence in Asia.

Investment Research Head Benjamin Nudel previously spent nine years in investment banking at HSBC, Société Générale and BNP Paribas.

The hires to boost the company’s asset management business come after EQONEX revealed last month that it would close its crypto exchange to focus more on its asset management and cryptocurrency custody business lines.

Blockchain privacy startup Nym named Andrés Arauz, a former director of Ecuador’s central bank and 2021 presidential candidate, as an advisor.

Nym is a decentralized platform that protects privacy at the network level of any application, wallet or digital service — including against traffic pattern analysis and metadata surveillance.

While leading the Central Bank of Ecuador, Arauz in 2011 headed the first pilot of a central bank digital currency, which was fully deployed in 2014.

“For too long, countries across the world have been subjected to cybercolonialism and mass surveillance of their financial transactions,” Nym Technologies CEO Harry Halpin said in a statement. “While El Salvador’s adoption of Bitcoin as legal tender is an interesting initial experiment, we’re happy Arauz has joined Nym to help develop an even more ambitious plan for financial freedom and privacy across Latin America.”

Galaxy Digital has hired Andrew Lace as a vice president of institutional sales within its trading division, a company spokesperson confirmed.

Lace joins the company from Elwood Technologies, where he was a sales director since July 2021. He has also previously worked at London Stock Exchange Group, Refinitiv and Thomson Reuters.

Galaxy CEO Mike Novogratz said during the company’s earnings call last month that there was “selective shrinking” of the Galaxy team during a second quarter, in which it suffered a $555 million net loss. Still, he added at the time that Galaxy intends to increase its headcount from 375 to more than 400 staffers by the end of the year.

Law firm Brown Rudnick has added Stephen Palley, Matthew Richardson, Preston Byrne and Hailey Lennon as partners in its digital commerce practice. They are joined by associate Jeff Karas.

The four new partners join from law firm Anderson Kill. Palley, who was founder and chair of the technology, media and distributed systems group there, is set to co-chair Brown Rudnick’s digital commerce practice with Clara Krivoy.

“Our clients are increasingly in the digital asset space as founders, investors, or traditional corporate entities looking to use technologies such as blockchain and cryptocurrencies as part of their business,” Brown Rudnick CEO Vince Guglielmotti said in a statement. “This team of supremely talented lawyers brings the type of insights and skills that will benefit our clients by enhancing our ability to offer an end-to-end experience, particularly for those in the technology space.”

Rain Financial, a crypto exchange in the Middle East, has cut staff to reflect “operational needs and market conditions,” Bloomberg reported Thursday.

The company raised $110 million in January from Paradigm, Kleiner Perkins, Coinbase Ventures and other investors. It did not reveal the number of workers it slashed.

In case you missed it, Snap revealed this week it would be cutting about 20% of its workers as it seeks to restructure the company to reduce costs. Some of those staff were focused on the social media company’s Web3 initiatives.

Most recently working as a research and development program manager for Snap, Jake Sheinman said in a tweet Wednesday that the company decided to “sunset” the Web3 team he co-founded last year.

Though augmented reality is one of three strategic priorities for Snap going forward, sources familiar with the company’s efforts told Blockworks that early Web3-related projects didn’t contribute to that focus. Only a few people were involved in exploring Web3 at Snap, the sources added.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.