Market Recap: Bitcoin’s Make-or-break Moment

Bitcoin has consolidated between $40,000 and $44,500 leaving crypto investors waiting for a volatile move in either direction.

An illustration of Satoshi Nakamoto. Blockworks exclusive art by Axel Rangel

- Bitcoin continues on an increasingly tighter range waiting for a break up above $44,200 or down below $40,500

- While negative sentiment in the market remains, bitcoin has managed to reach new all-time high hash rates showing continued faith among miners and network participants

Bitcoin has been stuck in a range between $40,500 and about $44,500 waiting for bulls or bears to push it above or below support or resistance.

Investors seem to be ditching risker assets, like tech equities and cryptocurrency, in favor of less volatile ones like cash and index ETFs.

The psychology within the marketplace has become fearful and uncertain while blockchain networks continue to grow in hash rate and other metrics.

Over half a billion dollars have flowed out of cryptocurrency funds in the last five weeks showing a decrease in institutional support.

Make-or-break moment

Over the course of January, bitcoin has consolidated between the price of $40,500 and $44,200. As this range becomes tighter, a volatile move to the upside or downside becomes more and more likely. This consolidation has pushed bitcoin into a make-or-break moment and created a fight between bulls and bears over which direction the market goes.

Bitcoin consolidation range (1/7/2022 - 1/19/2022). Source: Tradingview.com

Bitcoin consolidation range (1/7/2022 - 1/19/2022). Source: Tradingview.com

Bitcoin has already had a quick dip down past the $40,000 range, as is circled above, and it is unclear if investors and traders will be able to push back should it break through support again.

Current overall sentiment suggests a downward trend may be more likely as investors move out of riskier assets, such as tech stocks and cryptocurrency and back to cash. Uncertainty may be creeping back in with coming interest rate hikes from the Federal Reserve which have historically correlated with down markets. If enough leveraged long positions are stacked near $40,500 and bitcoin breaks below that level, it could trigger a series of stop-loss orders which could then trigger a cascading price event and deeper liquidations.

On the other hand, should bulls hold the line on $40,500 a volatile swing to the upside could occur forcing short positions to buy.

Tech ETFs and cryptocurrency performance relative to major indices. Source: https://www.tradingview.com/

Tech ETFs and cryptocurrency performance relative to major indices. Source: https://www.tradingview.com/A crypto analysis Twitter account by the name of TheRealPlanC noted how cryptocurrency has entered the third phase of a trading roller coaster and that it should regain strength as long as it can remain above $40,000.

Market psychology diverges from network support

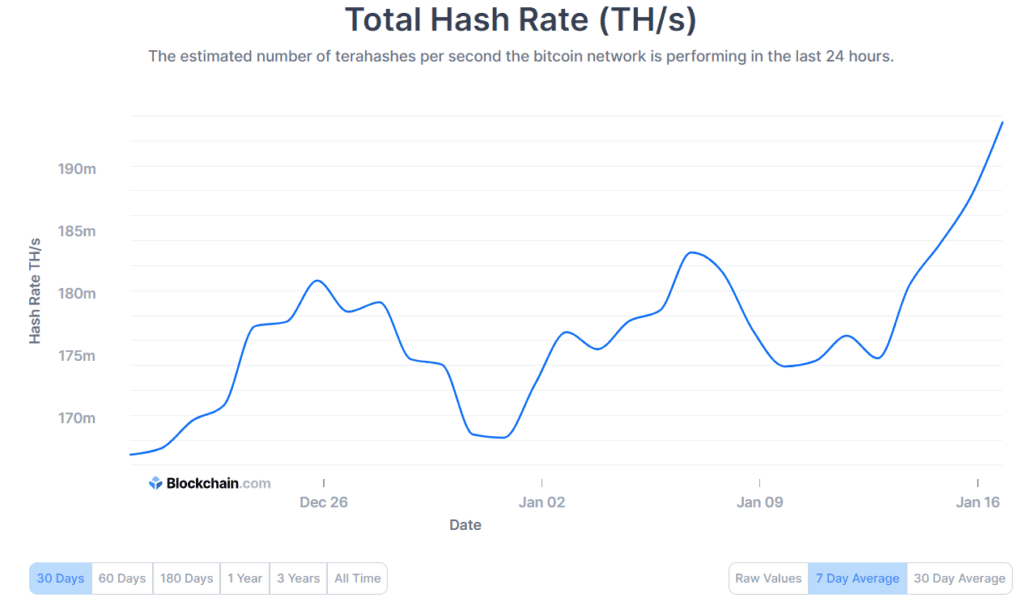

The correlation between crypto markets and equity markets has increased as of late showing that the two have become aligned in terms of trading and investing mindsets. But the current market psychology seems to have diverged from what is actually happening on major blockchains.

Right now, the overall market sentiment of both cryptocurrency and equities sways toward the negative, largely due to the uncertainty of how the Federal Reserve's rate changes could affect the economy as well as how the Covid-19 Omicron variant could stifle job growth.

Bitcoin has been continuously falling from its all-time high on Nov. 10, 2021, due to a series of concerns starting with environmental impact and now its use as an inflation hedge as the Fed looks to decrease inflation. Similarly, the S&P 500 has fallen over 3% in the last week, likely a result of the market's reaction to the Fed and Omicron as well.

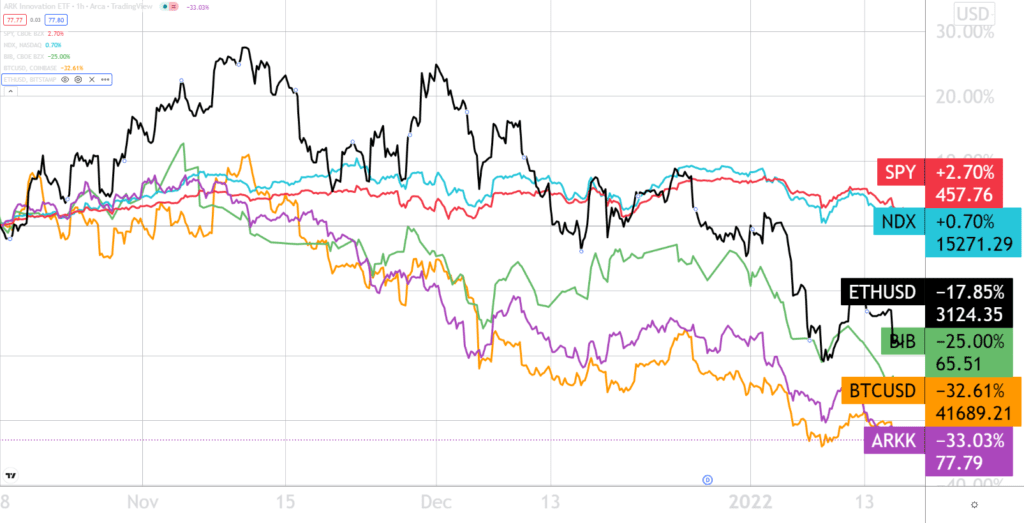

Heading in the opposite direction of their respective prices are Bitcoin and Ethereum's hashrates, or quantity of computing power securing their networks. In the last 30 days, Bitcoin's hashrate has increased from 166.84 million terahashes per second to nearly 194 million terahashes per second, reaching a new all-time high.

In the same time frame, Ethereum's hashrate has increased by 37,463 gigahashes per second. Increased hashrates indicate further investment into mining equipment and infrastructure which also signals faith in future price appreciation.

Bitcoin's hashrate in the last 30 days. Source: https://www.blockchain.com/charts/hash-rate

Bitcoin's hashrate in the last 30 days. Source: https://www.blockchain.com/charts/hash-rateWill Clemente, a popular crypto analyst and the lead insights analyst at the bitcoin mining company Blockwareteam, said on Twitter, "After the China mining ban over summer, Bitcoin hash rate has recovered to new all-time highs. This means the Bitcoin network is currently more secure than ever before."

The divergence of price and hashrates shows that market participants are showing fear while miners and those participating directly with the network are showing faith by becoming even more involved. Other Bitcoin network statistics, like unique addresses and output value per day, show positive trends. Though some on-chain metrics seem positive, market psychology and sentiment tend to be more powerful in swaying markets.

Fund outflows

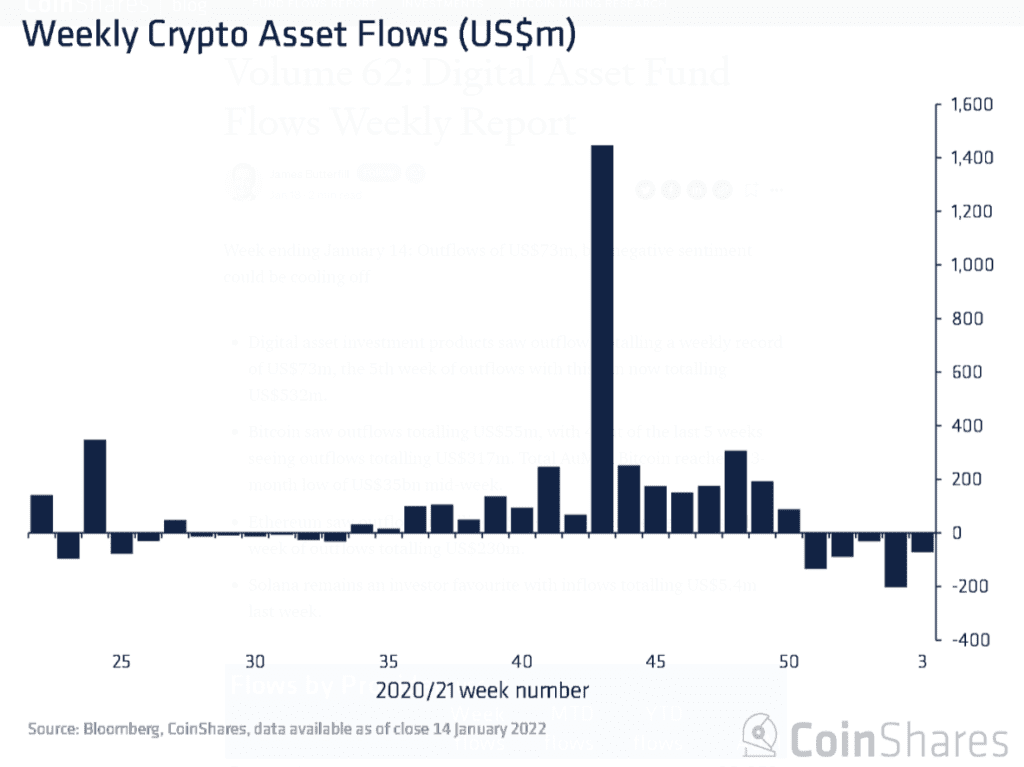

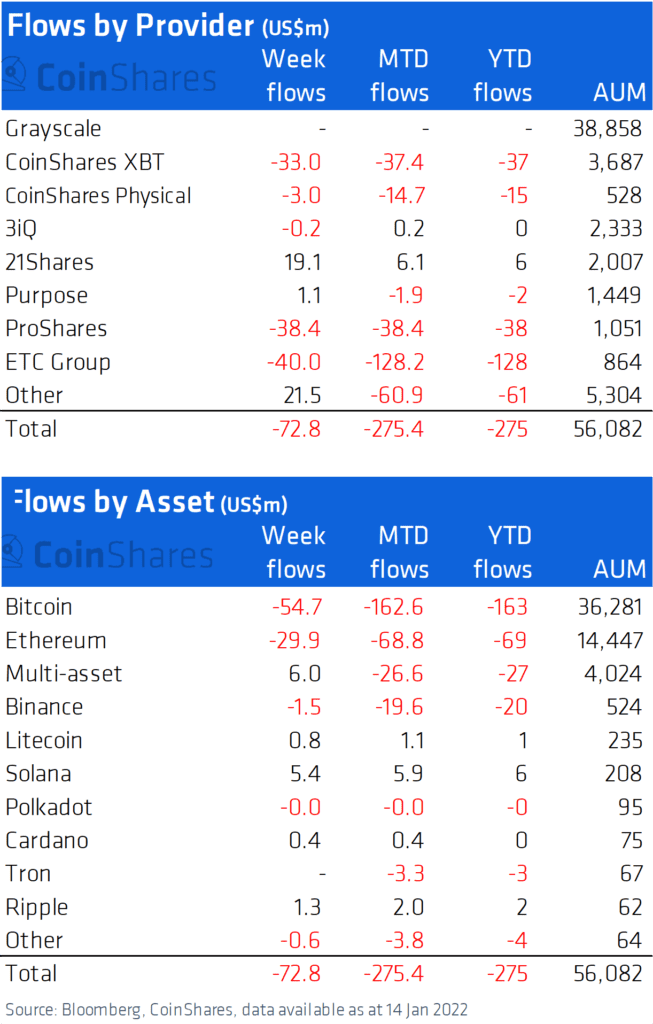

Another metric that aligns with the negative market sentiment is the outflow of cryptocurrency from funds. Outflows from crypto funds over the last five weeks total more than half a billion dollars, according to a report from CoinShares, a provider of digital asset solutions for institutional investors.

The report shows that in just this last week $73 million was removed from crypto funds, showing the reduction of exposure to digital assets among institutional investors.

Cryptocurrency fund asset flows. Source: https://bit.ly/3Kjncoi

Cryptocurrency fund asset flows. Source: https://bit.ly/3KjncoiBitcoin took the majority of the hit with it making up $53 million of the $73 million of outflows this week and $317 million of $532 million in the last five weeks. Ethereum made up much of the remaining outflows with the removal of $50 million in the last week and $230 million in the last five weeks.

Major fund cryptocurrency outflows. Source: https://bit.ly/3Kjncoi

Major fund cryptocurrency outflows. Source: https://bit.ly/3Kjncoi Tomorrow

Investors should expect bitcoin to remain in a tight range and to continue testing the $40,000 support and $44,500 resistance levels until broader markets pressures occur. By extension, ether and other altcoins trading at more volatile percentages in line with bitcoin's movements should be expected. Thursday's initial jobless claims report may be the catalyst to push bitcoin below support or past resistance.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.