AAVE, COMP MKR Battle for Market Share; BTC ETFs Fuel Leverage: Markets Wrap

Increased CME volume may be contributing to BTC volatility; COMP, AAVE, and MKR battle it out for marketshare in DeFi.

Source: SHUTTERSTOCK

- Bitcoin experienced intense volatility that coincided with the closing of CME futures markets

- AAVE, MKR and COMP battle it out for DeFi marketshare

Bitcoin (BTC) experienced a mini flash crash around 2:15 PM ET today but quickly recovered.

Perpetual funding rates remain an important metric to keep an eye on.

Some industry experts believe that the volatility can be attributed to the recently approved BTC ETF.

The borrowing and lending space in DeFi may be large enough for AAVE, COMP and MKR to all thrive.

Despite recent turbulence in the NFT space, there remains a lot of catalysts for price appreciation.

Latest in Macro:

- S&P 500: 4,596, +.98%

- NASDAQ: 15,448, +1.39%

- Gold: $1,799, +.03%

- WTI Crude Oil: $83.06, +.48%

- 10-Year Treasury: 1.578%, +.049%

Latest in Crypto:

- BTC: $60,972, +3.40%

- ETH: $4,264, +6.38%

- ETH/BTC: .0700, +4.31%

- BTC.D: 44.65%, -.84%

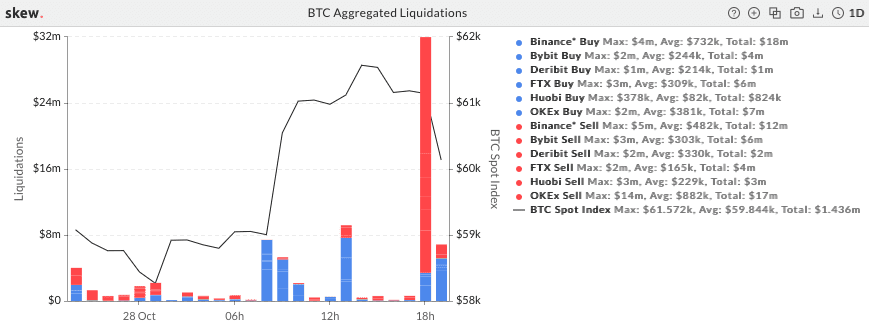

BTC liquidation cascade

Bitcoin experienced an intense period of volatility today around 2:15 PM ET, with the BTC price falling as low as $57,653 before quickly recovering. There was a strong rally in the middle of last night from $58,000 up to nearly $62,000 right before the sell-off.

It appears speculators got too excited too quickly, as perpetual funding rates were racing higher as the price action traded in a range right before the sell-off.

“The funding rate is derived from the difference between the market price of perpetuals and the spot index it’s anchored to. Excessive buying of perps increases the spread between perp price and the spot index, causing funding to go up. Conversely, negative funding is incited by an influx of perp shorting, forcing the contract’s price to fall lower than spot prices,” wrote Ashwath Balakrishnan of Delphi Digital.

He continued, “For funding to fall lower, one of two things needs to happen: either existing longs get shaken out and are forced to cover, or there’s an increase in bearish sentiment prompting traders to go net short. Either way, it’s unclear whether we’ve found a local bottom yet.”

As seen in the following chart, open interest weighted funding rates raced higher prior to the dip in price. Unfortunately, traders began getting aggressive quickly after the correction which signals additional caution may be appropriate.

Source: Laevitas.ch

Source: Laevitas.ch

According to Skew, roughly $32 million worth of futures positions were liquidated in just a 10-minute window.

Source: Skew.com

Source: Skew.com

Are BTC ETFs to blame?

Some industry experts believe that the volatility can be attributed to the recently approved BTC ETF, which is backed by leveraged positions in the form of cash-settled futures contracts.

Caitlin Long, 22-year Wall Street Veteran and founder of Avanti, took to Twitter to share her thoughts:

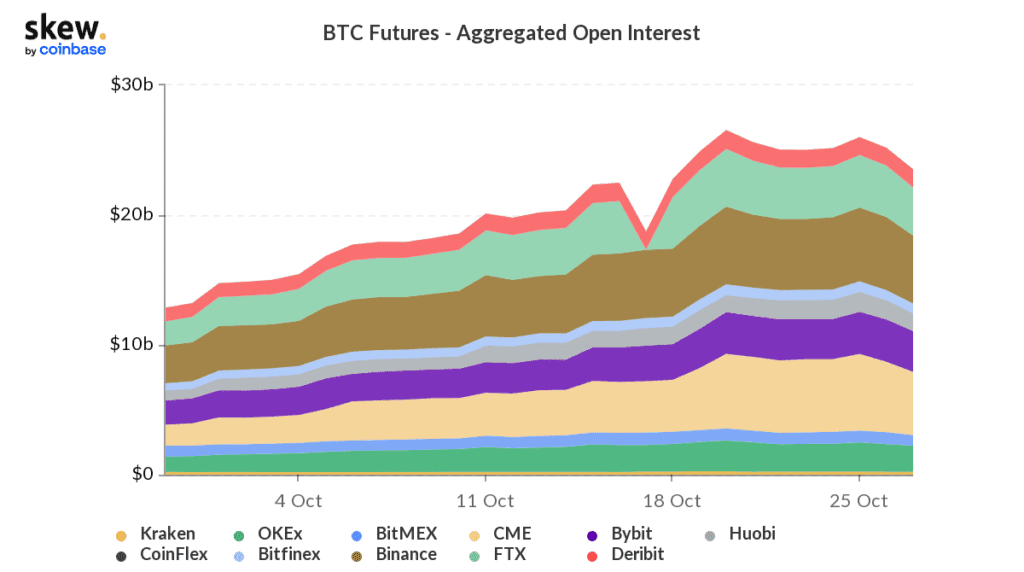

It is unclear if the added leverage via ETF approvals to the BTC ecosystem is to blame for the volatility in price.

It is worth noting, however, that the CME only accounts for roughly 20% of aggregated futures open interest albeit a growing portion. This is significant to add because the CME is where all of the futures are being traded that back the aforementioned ETFs.

Source: Skew.com

Source: Skew.com

Aave, Compound and MakerDAO battle it out for marketshare

Aave (AAVE) and Compound (COMP) facilitate peer-to-peer borrowing and lending. Liquidity providers (LPs/lenders) earn interest for their services, while borrowers pay interest on top of their loans to pay the LPs.

MakerDAO (MKR) allows users to take out loans by locking up digital assets as collateral in return for a decentralized stablecoin, DAI. However, borrowers need to be attentive to their loan-to-collateral ratio as asset prices fluctuate in order to avoid having their collateral liquidated.

AAVE, COMP and MKR all compete for users’ appetites to take on leverage via borrowing. However, when it comes to lending it is really just AAVE and COMP battling for market share because they have peer-to-peer ecosystems versus MKR’s collateralized debt position (CDP) model.

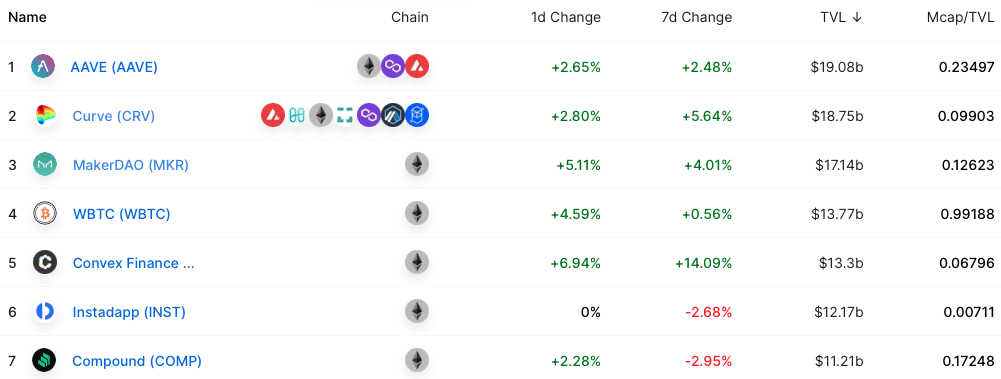

AAVE currently leads based on total valued locked (TVL) in its platform, followed by MKR at third and COMP at seventh:

Source: DefiLlama

Source: DefiLlama

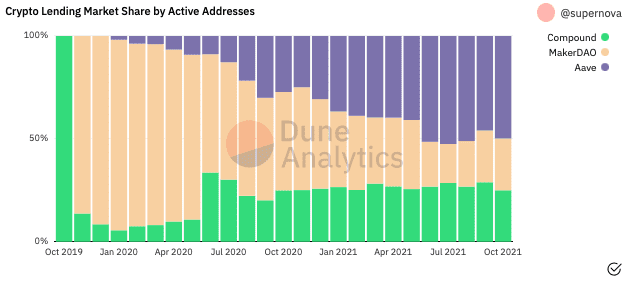

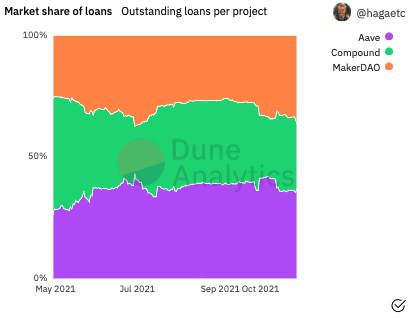

According to the following Dune Analytics dashboard, the percentage of market participants interacting with COMP has remained consistent since mid-2020, whereas AAVE has stolen a lot of marketshare away from MKR.

COMP and MKR each hold a 25% market share of active addresses versus AAVE with 50%.

However, the picture looks a lot different when looking at the market share of loans outstanding per project. AAVE leads with a 35.7% market share, with MKR in 2nd with 34.5%, and COMP in last with 29.9%.

This implies that while there are fewer active addresses on MKR taking out loans, they are players with very big pockets and trust the stablecoin, Dai, is a pristine asset.

With roughly $80 billion of loans outstanding between the three protocols and only 3.5 million DeFi users, the total addressable market and growth run way is extremely large. Only time will tell if all three protocols can thrive side by side.

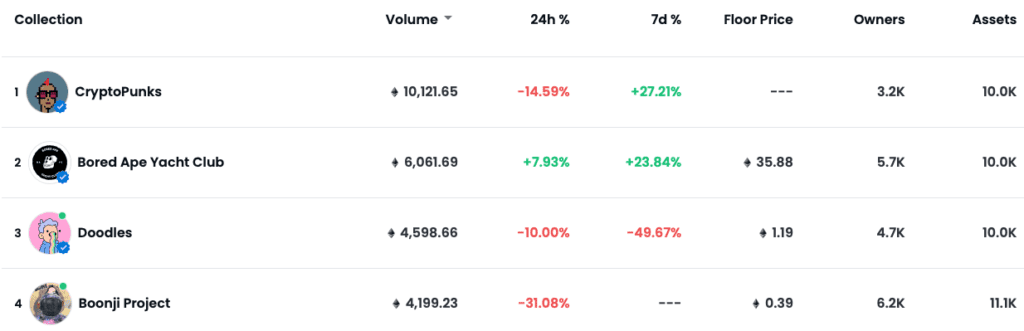

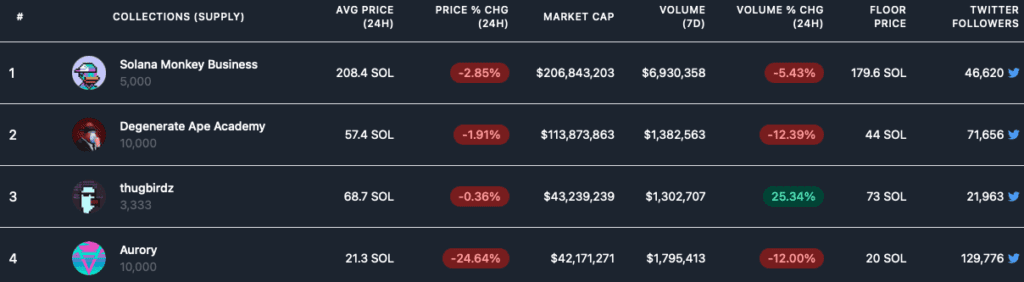

Non-Fungible Tokens (NFTs)

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found in the photos below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! Looking forward to catching up tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.