Axie Infinity Rolls Out Staking Program, Shakes Up Gaming Business Model

Axie Infinity’s Andrew Campbell thinks NFT-based games are “the first novel application of what we can do with NFTs.”

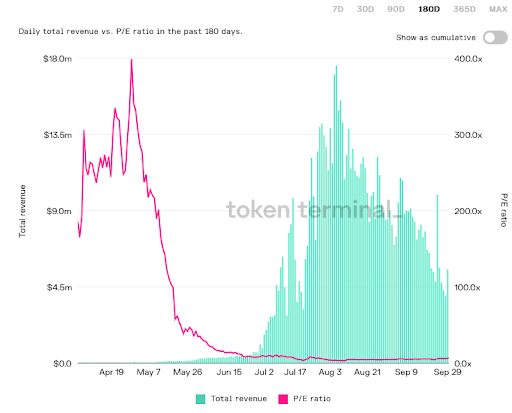

- Play-to-Earn (P2E) game Axie Infinity is on track to generate $2.7 billion in annualized revenue, according to data from Token Terminal

- Axie Infinity said that it airdropped $60 million worth of its tokens to early users of the game on Thursday

Axie Infinity, a popular blockchain-based video game, announced the launch of a staking program for its governance token on Thursday, according to the platform’s substack.

Founded in 2018, Axie Infinity is a play-to-earn (P2E) game where users can earn crypto rewards that can later be sold on exchanges. Specifically, players can trade, battle and breed non-fungible token (NFT) creatures called Axies — a Pokémon-style investment opportunity.

Source: Axie Infinity

Source: Axie Infinity“Bitcoin was kind of like the first novel application of what we can do with blockchain. I think GameFi [or play-to-earn gaming] is the first novel application of what we can do with NFTs,” Andrew Campbell, a content creator and program lead at Axie Infinity, told Blockworks.

“From a conventional investment perspective, it’s not a bad value proposition [either]. You’re getting paid to play a game, and in theory the game is fun, strategic and high-level.”

Accruing earnings from Axie Infinity

There are two tokens within the Axie Infinity economy, Axie Infinity Shards (AXS) and Smooth Love Potion (SLP). SLP is what players earn through playing the game. AXS is the governance token, most comparable to holding shares of a company. Holders of these tokens can vote and create proposals on anything related to Axie Infinity’s platform.

But staking introduces a new component to Axie Infinity. AXS holders can now opt to lock their tokens for an allotted period of time, and in the process, earn rewards. These will unlock over roughly 5.5 years, with the intention of attracting AXS holders who share a similar long-term vision.

Staking will also provide AXS holders the opportunity to vote on the use of the community treasury, where all protocol earnings are currently being stored.

“Staking is a way for us to reward our community members for having a long-term mindset and locking up their AXS tokens,” Axie Infinity’s announcement said, which also revealed that the platform would airdrop $60 million worth of its tokens (at that time) to early users of the game.

Gaming and NFTs

In the future, the studio behind Axie Infinity, Sky Mavis, aims to phase out control over the game and hand governance to the community, according to their white paper. The team, which makes decisions behind the game’s development and direction, currently own 21% of the AXS supply with a vesting schedule that unlocks over 4.5 years.

OpenSea co-founder Devin Finzer cited Axie Infinity as one of the flourishing use cases for gaming in the NFT space during a recent panel at the Messari Mainnet conference.

Despite the billowing demand in art and collectibles on the NFT marketplace he helped to create, Finzer predicts gaming could be the “next frontier” for NFTs.

“I didn’t expect art and collectibles to have such [enormous] value over time. I really thought it would be primarily from legitimate games using NFTs,” Finzer said.

“I think this opens up so many doors. There’s so many people in my generation, and in Gen Z, who love to play [games], but now we want to get rewarded for [it].” Jae Chung, Founder of Jenny DAO, said about P2E games at Mainnet. “I just don’t see that going away.”

It is uncertain if AXS and SLP will be classified as securities and subject to regulation by the US Securities and Exchange Commission, but earning revenue from staking AXS is almost a textbook definition of the Howey Test: an “investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.”

Aside from securities regulations, questions have arisen whether earnings from P2E games and staking rewards should be taxed — including within the Philippines, where many of the game’s players reside.

Play-to-earn economy

Axie Infinity is not the first NFT-based game, but its popularity has led some critics to question the traditional business model of gaming.

“When you look at traditional games, it’s completely centralized. If you think about the governance model, it’s closer to a dictatorship than anything else. The person that owns the [intellectual property] gets to own the entire ecosystem,” Campbell, who has worked in the gaming industry for nearly a decade, said.

Compare Axie Infinity to publicly-traded video game holding companies like Activision Blizzard: In Call of Duty: Black Ops 3, an Activision Blizzard game, players can purchase the game and make in-game purchases for additional content. All revenues go back to the studio because it is a closed-looped system. Players are rewarded for their time by their enjoyment, but not monetarily.

Meanwhile, Axie Infinity has an open system where game items can be transferred between users outside the game. In addition to AXS token-holders revenue from staking, players are also rewarded for their time in-game via SLP tokens.

Campbell added that digital goods available in traditional gaming such as skins have inherently less utility than GameFi items.

“You can’t do anything with those, they’re locked to your account, you can’t sell them on a marketplace, you can’t transfer them to other games, they’re only usable when you’re in that game’s blackbox.”

According to Campbell, Axie Infinity’s business model, whereby developers take less than 10% of revenues, is a “fundamental shift” compared to traditional games.

“When you put that money back into the ecosystem, it starts to unlock more potential for the play-to-earn [model],” Campbell said.

Earning from play

In 2020, Activision Blizzard (ATVI) reported over $8 billion in revenue with $2.2 billion in earnings, according to a recent annual filing. Axie Infinity is on track to make $2.7 billion in annualized revenue, per Token Terminal. All of this revenue is sent to the community treasury, eventually to be managed by AXS stakers.

The current market capitalization of ATVI and the AXS governance token are $60 billion and $5.7 billion, respectively, although fully diluted to the AXS token’s eventual total supply, the latter’s market cap jumps to $23.2 billion. (Only 60 million of the total 270 million supply are in circulation today.)

Axie Infinity revenue growth decline (red) compared to user growth (green); Source: Token Terminal

Axie Infinity revenue growth decline (red) compared to user growth (green); Source: Token TerminalAs of Monday, Axie Infinity has 1.85 million daily active users (DAUs), up 4,768% since April. However, revenue has been declining over the past few months, potentially due to steadier user growth and a change in the cost to breed the in-game NFT characters.

AXS is trading at $97.41, up 31.6%, as of press time.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.